Key Takeaways

- XRP’s worth surged 25% amid hypothesis of diminished SEC enforcement post-Gensler.

- Pantera anticipates fewer SEC lawsuits and potential dismissals after Gensler’s departure.

Share this text

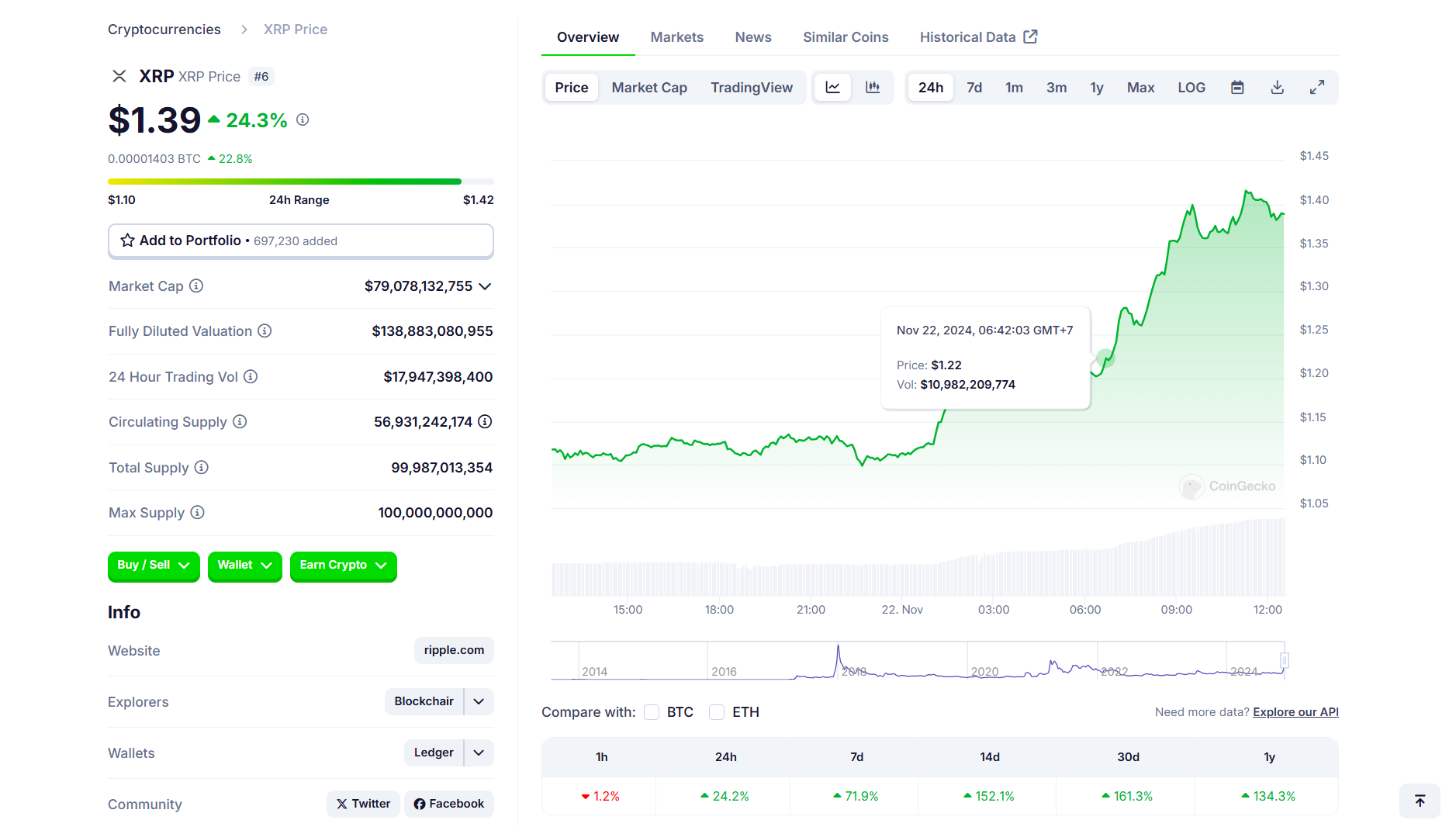

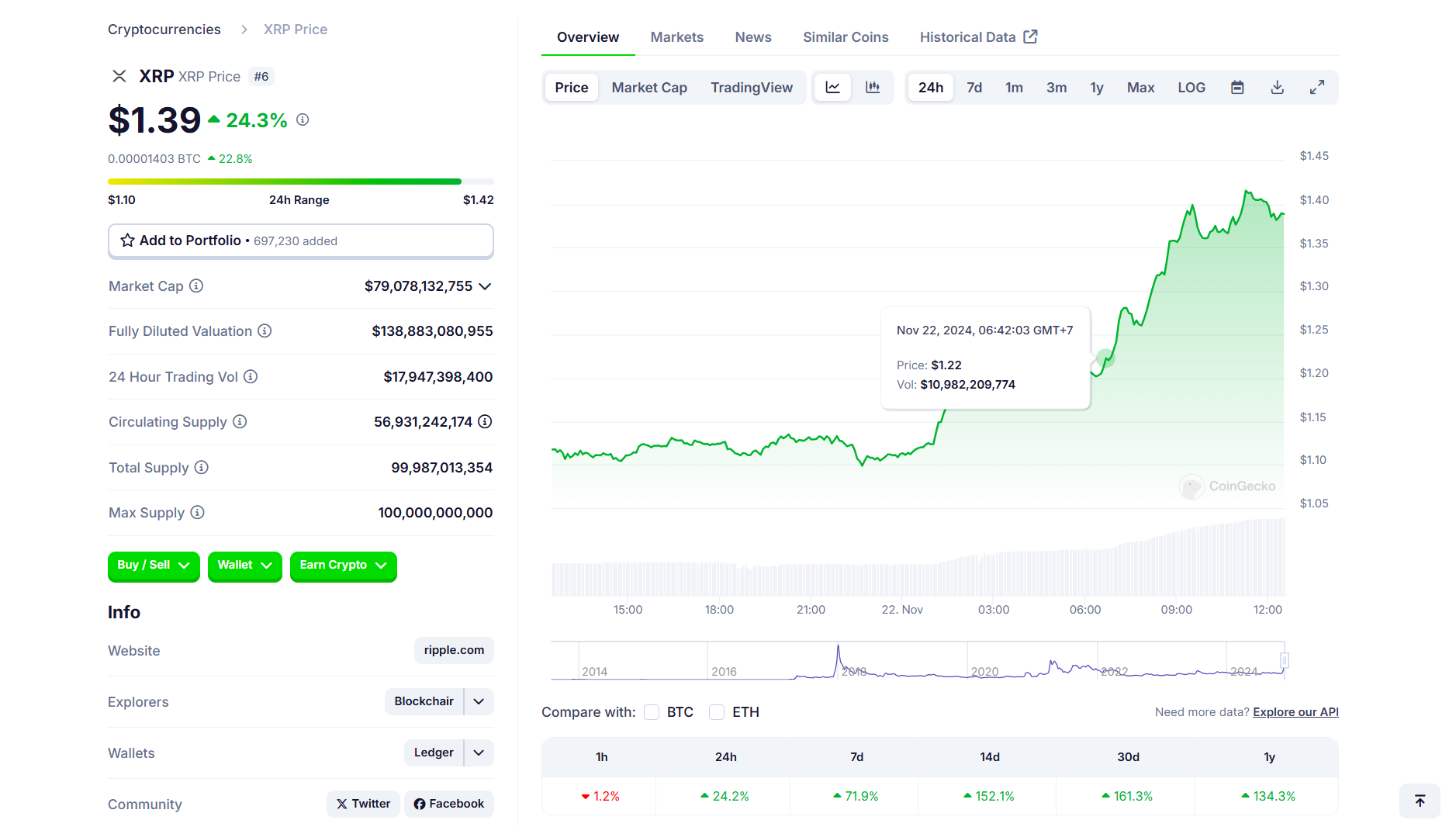

Ripple’s XRP token rose by 25% on Friday to above $1.4, sustaining its upward trajectory after SEC Chair Gary Gensler introduced his time period will formally conclude on January 20. Gensler’s exit might immediate the company to reassess its strategy to present litigation, presumably resulting in a choice in opposition to pursuing its enchantment within the SEC vs. Ripple lawsuit.

Consensys CEO Joe Lubin expects a positive authorized surroundings for digital property beneath Trump’s presidency. He suggests ongoing SEC instances in opposition to crypto firms could also be “dismissed or settled.”

Pantera’s authorized boss Katrina Paglia anticipates fewer actions and potential dismissals following the departure of Gensler. Many SEC lawsuits in opposition to crypto firms are anticipated to lower or settle with out main admissions of guilt post-Gensler.

New management might result in the SEC coming to an settlement with Ripple quite than persevering with its prolonged litigation course of. Though monetary penalties could also be concerned in a settlement, Ripple would have the ability to proceed its operations with out the burden of ongoing litigation.

XRP has skyrocketed 138% this 12 months, dwarfing Ethereum’s efficiency and shutting in on Bitcoin’s year-to-date positive aspects, in accordance with knowledge from CoinGecko.

The sixth-largest cryptocurrency by market capitalization has skilled a interval of stagnation since final 12 months’s market restoration, with costs hovering between $0.5 and $0.6, whereas many of the crypto market is on the rise.

Simply final week, XRP surpassed the $1 threshold, reaching its highest worth in three years amid hypothesis about Gensler’s potential resignation and rumors of a gathering between Trump and Ripple’s CEO. The primary has now been confirmed.

XRP now eyes the $2 stage, in accordance with crypto analyst Ali Martinez. He believes Gensler’s departure from the SEC is “the very best factor that would occur to Ripple.”

‘@GaryGensler leaving the @SECGov is the very best factor that would occur to @Ripple. Now, $XRP targets $2! https://t.co/YEDiZtrnB1 pic.twitter.com/LLE4n0MC8z

— Ali (@ali_charts) November 21, 2024

Potential XRP ETFs

The potential approval of a spot XRP ETF within the US might act as a bullish driver for XRP’s worth.

Bitwise and Canary Capital are looking for SEC approval for his or her respective spot XRP ETFs. These proposed ETFs are at present on maintain as a consequence of ongoing authorized disputes over XRP’s standing as a safety.

On Thursday, asset supervisor WisdomTree introduced the launch of a bodily XRP ETP in Europe.

The fund, also called WisdomTree Bodily XRP ETP (XRPW), goals to offer buyers with publicity to the spot worth of XRP.

WisdomTree claims that this product is the lowest-cost XRP ETP obtainable in Europe and is absolutely backed by the underlying asset, securely saved in chilly storage.

With this launch in Europe, many members of the crypto group are optimistic that comparable XRP ETF merchandise will quickly debut within the U.S.

Share this text