Robert Method

The electrical car business is displaying promising indicators of enhancing investor sentiment after XPeng (NYSE:XPEV) introduced that it acquired a $700M funding from German auto firm Volkswagen (OTCPK:VWAGY) (OTCPK:VLKAF) (OTCPK:VWAPY). In a strategic partnership, XPeng and Volkswagen agreed to collectively develop two battery electrical autos below the Volkswagen model and the deal might pave the best way for related offers that mix the steadiness sheet power of European automotive firms with the technological know-how and momentum of Chinese language electrical car start-ups. I consider the deal is a large optimistic for XPeng and the business as nicely, and I’m upgrading my ranking from maintain to purchase because of this!

Earlier ranking and causes for ranking change

Earlier than the announcement of the XPeng-Volkswagen partnership I rated Chinese language electrical car firm XPeng as a maintain as a result of the corporate suffered from rising pricing stress within the business, leading to weaker car margins, and since XPeng under-performed rivals equivalent to NIO (NIO) or Li Auto (LI) relating to supply development charges. I’m upgrading XPeng to purchase in response to the Volkswagen partnership announcement.

Why the XPeng-Volkswagen partnership is a giant deal

Chinese language electrical car firms have confronted a confidence disaster within the final two years as a consequence of slowing development, challenges to demand in addition to mounting profitability issues. XPeng, for instance, is just not anticipated to be worthwhile till FY 2026 (based mostly off of consensus estimates), a profitability date that has been pushed out by two years currently as a consequence of demand challenges within the business and a weakening value atmosphere that resulted in XPeng reporting unfavorable car margins for the first-quarter. What additional weighed on XPeng was a weak outlook for the third-quarter which means a 39% decline in deliveries Y/Y.

Final week, XPeng reported that it entered right into a long run strategic partnership with German auto producer Volkswagen. This settlement states that each firms are going to collectively develop two battery electrical autos below the Volkswagen model and that the German automotive firm goes to take a 5% minority place in XPeng, investing a complete of $700M (at a valuation of $15 per ADS).

The cooperation and funding partnership between the 2 auto firms is clearly a massively optimistic growth for XPeng for the reason that Chinese language firm has suffered from a deterioration in investor confidence after it successively dissatisfied buyers with its supply achievements. Shares of XPeng jumped on the information and traded 15.5% increased on Friday, lifting up the complete sector.

By getting into right into a strategic partnership with Volkswagen, XPeng is just not solely securing further funds to ramp up its personal manufacturing and deliveries in China, however XPeng might finally leverage the partnership and enter the European market in a quick and environment friendly method with out having to construct its personal manufacturing capabilities or distribution community, which prices some huge cash and is a burden particularly for start-ups with restricted assets. Moreover, the Volkswagen funding reveals that a big European automotive model has confidence in XPeng’s general EV technique and technological growth capabilities.

Whereas the deal clearly is a giant win for XPeng, I consider it might mark the start of a brand new pattern during which established European automotive manufacturers and Chinese language EV start-ups be part of forces to leverage one another’s growth strengths and tackle the competitors. NIO and Li Auto are two EV firms that might additionally enter into related collaboration and funding partnerships with European (or American) automotive producers with a purpose to share growth dangers and open up development alternatives in new areas. For the sector as an entire, the XPeng-Volkswagen partnership is a huge step ahead.

Valuation of XPeng relative to different EV rivals

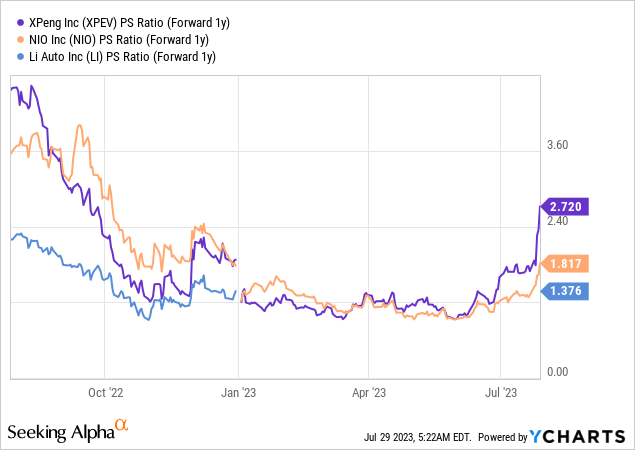

Li Auto nonetheless has the bottom price-to-revenue ratio (1.37X) within the EV business group, which I discover wonderful contemplating that Li Auto is crushing it relating to its supply development and the corporate is predicted to be worthwhile this yr, manner sooner than the competitors.

EV valuations as an entire recovered final week, following the announcement of the XPeng-Volkswagen deal, with shares of NIO hovering 11% and Li Auto taking pictures up 10%. Whereas XPeng is now the highest-valued Chinese language EV start-up within the business group with a price-to-revenue ratio of two.7X, I consider shares proceed to have revaluation upside as buyers digest the significance of the deal and its implications for the sector as an entire.

Dangers with XPeng

One of many key dangers with XPeng is that the EV maker has seen a unfavorable car margin within the first-quarter and slowing supply development as a consequence of demand challenges in China. Within the brief time period, these are headwinds for XPeng’s valuation. The XPeng-Volkswagen deal, then again, has succeeded in refocusing buyers’ consideration on the massive image… which is the large ramp within the EV business and the rising acceptance of Chinese language EV start-ups and their expertise by established European automotive manufacturers.

Ultimate ideas

The XPeng-Volkswagen strategic partnership that units out phrases for the joint growth of two battery electrical autos and features a $700M funding is a a lot larger deal, for my part, than buyers might notice. Established European automotive manufacturers at the moment are trying to spend money on Chinese language EV start-ups in a bid to speed up product growth, leverage R&D strengths and share dangers/prices. In addition to receiving $700M at a time of continuous working losses, the deal potential creates a springboard for XPeng into the European market. I consider the deal is transformative, not only for XPeng, but in addition for the complete Chinese language EV business and extra offers might observe. As European automotive manufacturers search out extra strategic growth and funding partnerships with different EV firms, equivalent to NIO and Li Auto, the business as an entire may gain advantage from a return of investor optimism!

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.