Gold (XAU/USD) worth outlook:

- Gold costs flip cautious amid easing fears of banking contagion

- XAU/USD Threatens assist on the February 2023 excessive

- US Greenback positive factors, dragging safe-havens decrease

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to Publication

Gold futures ease after a short return of danger urge for food

Gold costs are buying and selling decrease after the US Greenback managed to regain confidence, pushing danger belongings greater. With the US Greenback gaining a portion of current losses, protected havens dipped, driving treasured metals decrease.

Though fears of contagion within the banking sector appeared to have eased, the steadiness of the US banking system stays unknown. Nevertheless, after a short lived retest of $2,000, gold futures pulled-back, falling beneath the February excessive, at the moment offering resistance at $1,975.2.

With an array of high-impact financial information releases contributing to risk-appetite, technical ranges have offered a further catalyst for worth motion.

Really helpful by Tammy Da Costa

Buying and selling Foreign exchange Information: The Technique

Gold (XAU/USD) Technical Evaluation

As XAU/USD continues to commerce well-above the 50-day transferring common (MA), bulls look like shedding steam. With front-month futures at the moment buying and selling beneath the yearly excessive, a broader vary of assist has fashioned round the important thing psychological stage of $1,950.

To Be taught Extra About Worth Motion, Chart Patterns and Shifting Averages, Try the DailyFX Training Part.

Because the barrier of assist of resistance at the moment stays intact, gold futures stay susceptible to developments within the US economic system.

XAU/USD (Gold) futures Every day Chart

Chart ready by Tammy Da Costa utilizing TradingView

Really helpful by Tammy Da Costa

How you can Commerce Gold

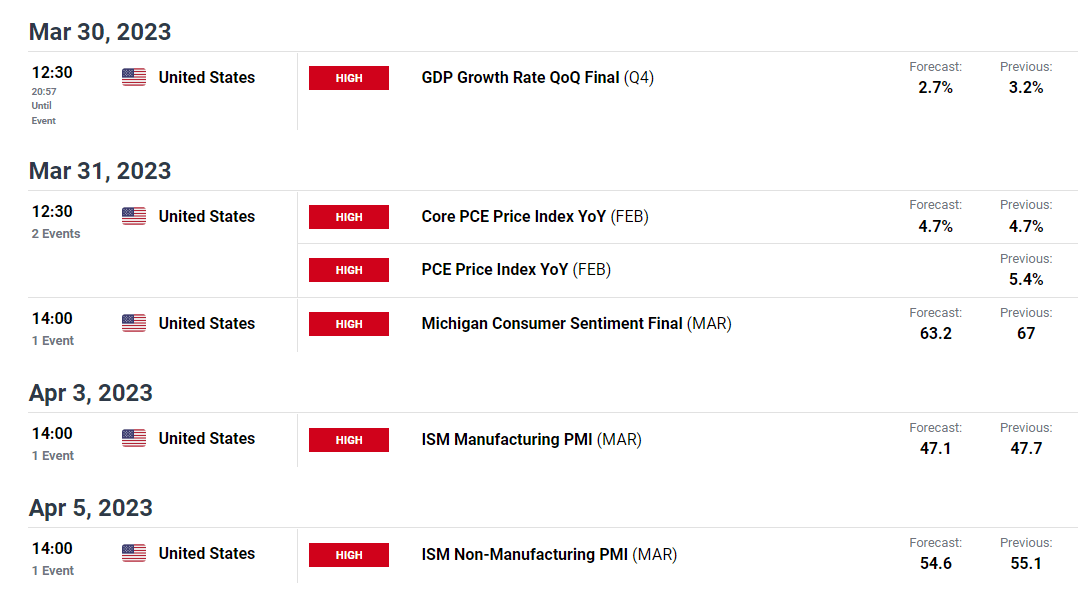

For the rest of the weak, the financial calendar may both threaten or enhance expectations for the US economic system.

With GDP, Core PCE and Michigan sentiment nonetheless on faucet, safe-haven belongings may proceed to commerce with restricted movement till the underlying development is confirmed.

DailyFX Financial Calendar

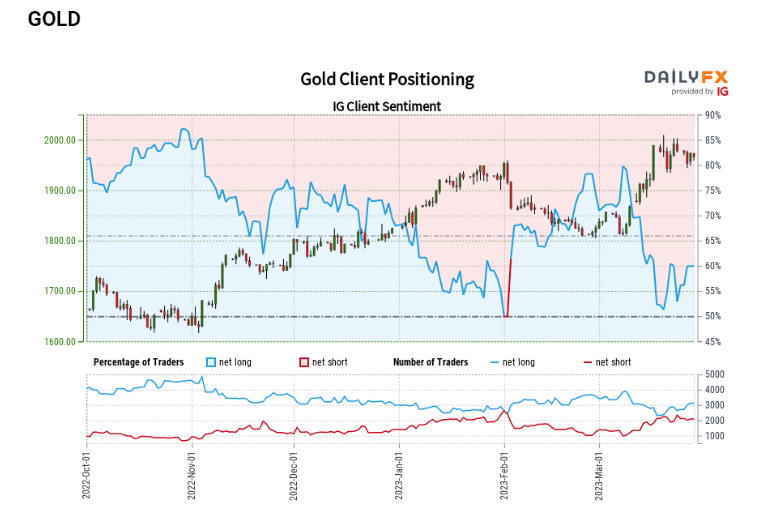

Gold Sentiment

On the time of writing, Gold: Retail dealer information exhibits 61.00% of merchants are net-long with the ratio of merchants lengthy to brief at 1.56 to 1.The variety of merchants net-long is 5.36% greater than yesterday and eight.33% greater from final week, whereas the variety of merchants net-short is 2.16% decrease than yesterday and 5.83% greater from final week.

We sometimes take a contrarian view to crowd sentiment, and the actual fact merchants are net-long suggests Gold costs could proceed to fall.

Merchants are additional net-long than yesterday and final week, and the mix of present sentiment and up to date modifications provides us a stronger Gold-bearish contrarian buying and selling bias.

Gold Worth Ranges to Watch

| Assist | Resistance |

|---|---|

| 1950 | 1975.2 |

| 1918.2 | 2000 |

| 1900 | 2014.9 |

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and comply with Tammy on Twitter: @Tams707