Gold (XAU/USD) Information and Evaluation

- Determinants of gold’s worth are pulling in several instructions – what this implies for gold

- Pullback in gold has some room to maneuver however a bullish continuation stays central to the present panorama within the absence of a diplomatic answer to the Ukraine disaster

Determinants of Gold’s Value are Pulling in Completely different Instructions

The gold worth is set by various various factors, which now appear to be diverging as fairness markets and different dangerous property seem to have discovered their toes.

Sometimes, the next are some examples of things that both enhance or weigh on the gold worth:

- Bullish Components: Declining actual yields (low nominal rates of interest and rising inflation), Geopolitical uncertainty/battle, monetary market crashes/danger aversion

- Bearish Components: Sturdy greenback, elevated danger urge for food, rising yields

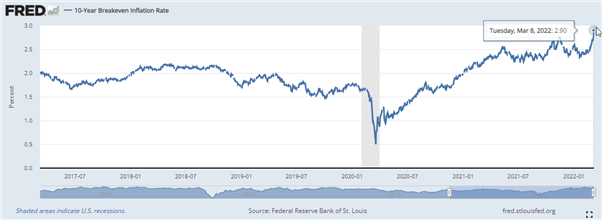

Actual Yields Nonetheless Favor Gold Upside, For Now

With nominal rates of interest at or beneath zero % for developed nations through the world financial restoration and with inflation at multi-decade highs, actual rates of interest have come underneath nice stress. When actual rates of interest are low, non-interest yielding gold turns into a extra enticing possibility, significantly when the value of gold picks up momentum.

Markets anticipate 6 fee hikes from the Fed this 12 months, with the primary all however actually arriving subsequent week on March the 16th nonetheless this has accomplished little to weigh on gold costs as inflation heats up.

The chart beneath is the Federal Reserve’s long run inflation gauge which reached a excessive of two.90 just lately.

FRED 10-12 months Breakeven Inflation Price (Inflation Expectations)

Supply: IG, ready by Richard Snow

Gold’s Protected Haven Enchantment

As well as, gold has acquired a serious enhance largely as a result of its secure haven enchantment as Russia continues to invade Ukraine. Due to this fact, basically, there’s lots of help for gold costs within the brief to medium time period.

Greenback Energy Continues

In the same transfer, the U.S. greenback has strengthened considerably because the invasion additionally as a result of its safe-haven enchantment and liquidity profile. Then, considering that gold is priced in {dollars}, this impact tends to restrict gold costs usually leading to a decline within the treasured metallic’s worth. Nonetheless, gold and the US greenback have risen in tandem recently.

Gold (XAU/USD) Key Technical Ranges

Dangerous property like US and EU equities and danger related foreign money pairs just like the AUD and GBP have all seen a sizeable carry right this moment as danger sentiment seems to have eased in a single day on information that Ukraine is not urgent for Nato inclusion and is open to a “compromise” relating to the standing of the 2 breakaway pro-Russian areas.

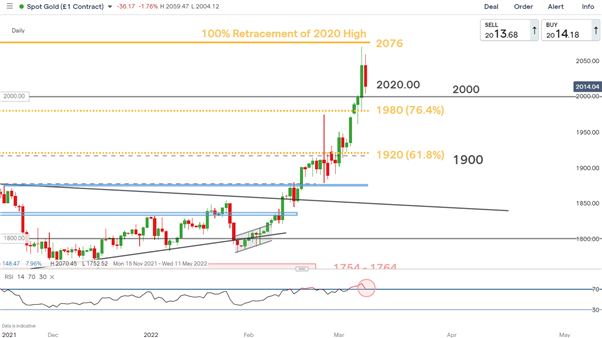

Markets seen this as a glimmer of progress alongside agreed ceasefire corridors permitting Ukrainians to flee battle areas. Spot gold has pulled again considerably from the prior excessive because the market was buying and selling in overbought territory for a while (every day chart).

The extent of help at 2020 has already been surpassed with the psychological stage of 2000 the subsequent stage of help. Additional declines might see a transfer in the direction of the 1980 stage. Nonetheless, the invasion of Ukraine continues within the absence of any diplomatic answer and due to this fact gold stays extremely risky and prone to a bullish continuation ought to danger sentiment bitter once more.

Gold 4-Hour Chart

Supply: IG, ready by Richard Snow

The every day chart reveals gold’s parabolic rise and now emphasizes the energy of the pullback. The market was so closely oversold that it’s but to commerce beneath such elevated ranges, that means the pullback has room to proceed earlier than bulls try and reignite the bullish development.

Gold Each day Chart

Supply: IG, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX