Silver Technical Evaluation

Really useful by Richard Snow

Learn concerning the high alternatives in Q1 2023

Silver Makes an attempt to Discover Help at Effectively-Recognized Degree

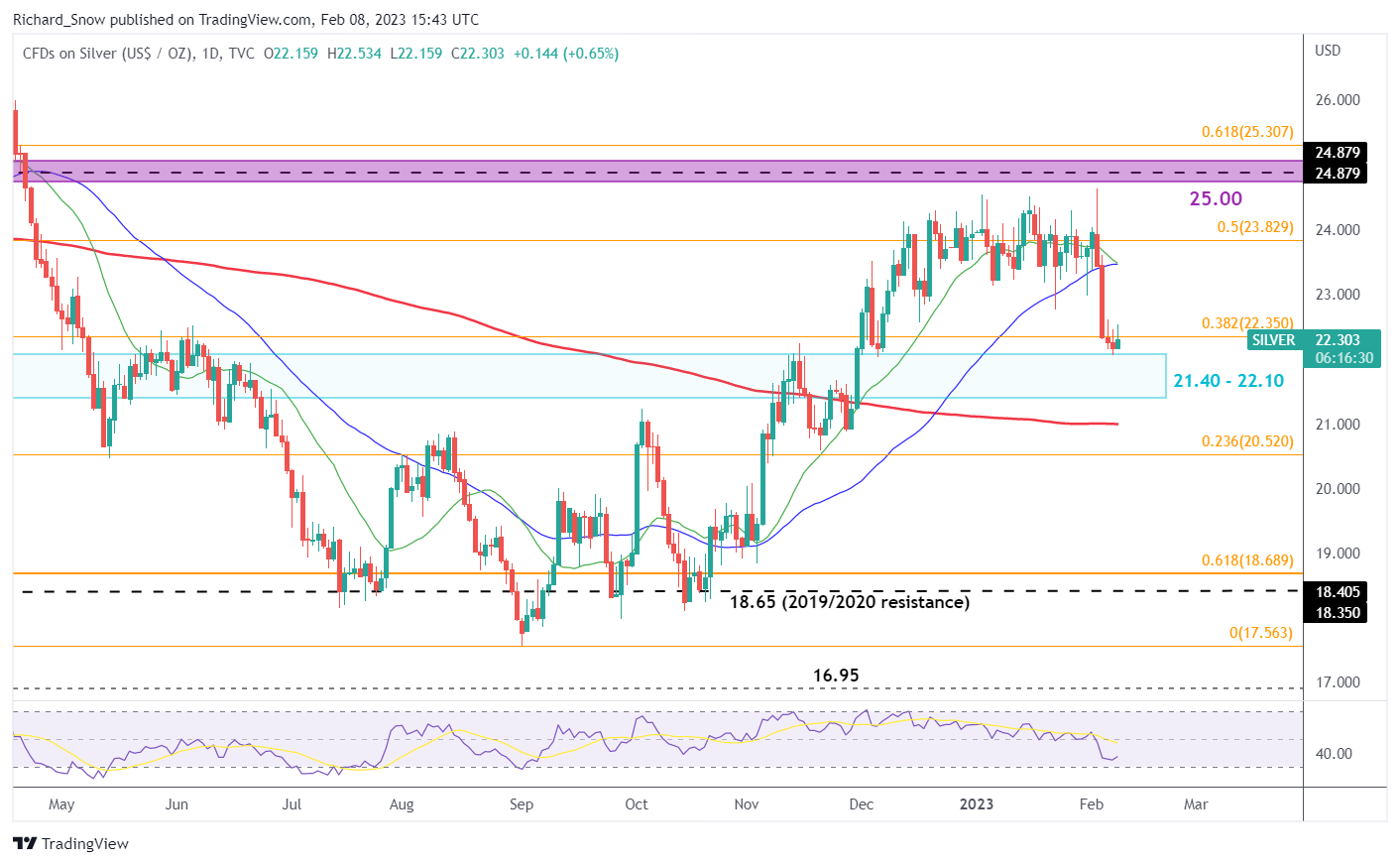

Silver, very similar to gold, has witnessed a powerful run up which has lately come underneath menace. An strategy of the zone of resistance with a midpoint of 25.00 – which has halted bullish value motion prior to now – proved an excessive amount of to deal with as soon as once more, leading to a decline of over 10% over the past 4 buying and selling days.

The weekly chart beneath helps reveal the band that has contained nearly all of value motion since September 2021. The plain exceptions to this may be seen on the chart however within the absence of a robust sufficient catalyst with lasting momentum, value motion outdoors of this band has in the end didn’t encourage a brand new pattern.

As soon as extra, we discover ourselves on the backside of the band, testing the higher aspect of the zone of help (21.40-22.10). It’s not been unusual to see prolonged decrease wicks making an attempt to pierce beneath the zone of help in prior makes an attempt, signaling the persistence of bulls inside this zone.

Silver (XAG/USD) Weekly Chart

Supply: TradingView, ready by Richard Snow

Upon nearer inspection through the each day chart, it’s simpler to see the extent of indecision at present ranges as Monday and Tuesday’s value motion had little between them with immediately displaying a slight transfer increased however remaining near flat.

The closest problem for a bullish reversal presents itself through the 38.2% Fibonacci retracement of the most important 2021-2022 decline. This week, costs have tried to shut above the road however failed on each makes an attempt with immediately showing as if we might see a continuation of this sample. An in depth above the 38.2% Fib opens up the opportunity of a transfer in the direction of the 50% Fib and the higher aspect of the band at 25.00.

Whereas the 200 easy transferring common (SMA) suggests the long-term uptrend stays in play, shorter and medium-term indicators within the 20 and 50 SMA seem above the present value degree on the cusp of a bearish crossover. A each day shut beneath 21.40 suggests the bearish transfer has the potential additional draw back and would must be monitored for bearish continuation setups.

Silver (XAG/USD) Each day Chart

Supply: TradingView, ready by Richard Snow

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to E-newsletter

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX