J Studios/DigitalVision through Getty Photos

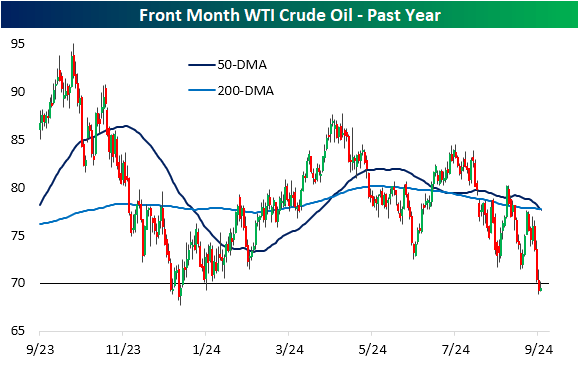

Alongside equities, it has been a tough week for crude oil. On catalysts of assumed weaker demand and provide information out of the Center East, front-month WTI futures are already down 5.56% month up to now, with the steepest declines occurring on Tuesday. As proven beneath, crude has been falling all through the previous 12 months, and these most up-to-date declines have introduced the value of black gold to the low finish of its vary. Whereas final fall it was within the mid-$90 vary, this week it moved into the $60 vary (right now costs are rebounding again above $70). The one different occasions previously 12 months that WTI was beneath $70 was briefly again in December. Though entrance month futures are hitting the low finish of the previous 12 months’s vary, these costs are literally at a premium in comparison with out-month futures as crude markets are presently in backwardation.

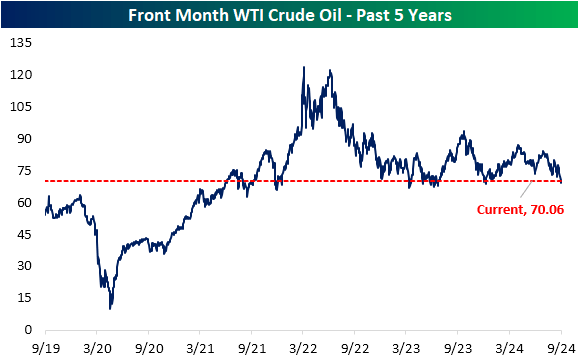

Increasing the time-frame out, beneath we present the value of crude over the previous 5 years. Once more, the newest prior occasion of WTI having a $60 deal with was final December, and there have been a handful of different temporary durations of the value being as low. Since Q2 2021 as crude costs recovered from the pandemic, the excessive $60 vary roughly has marked a notable degree of help.

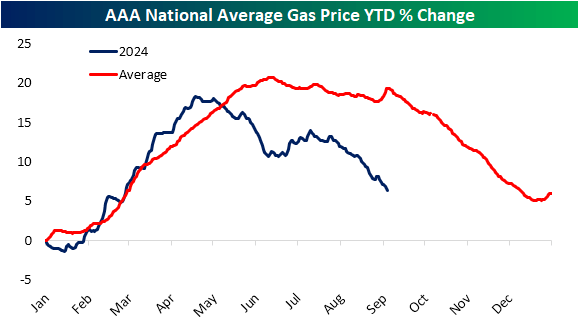

That decline in crude oil has resulted in decrease fuel costs. Seasonally, it’s typical for costs on the pump to roll over throughout the summer season months, with declines accelerating within the fall. This 12 months, nevertheless, costs have been falling since mid-spring. In response to AAA, the nationwide common for a gallon of gasoline yesterday was at $3.31, which is the bottom worth since late February. That’s the lowest worth of fuel on 9/4 since 2021 ($3.19).

Authentic Publish

Editor’s Word: The abstract bullets for this text had been chosen by In search of Alpha editors.