SimplyCreativePhotography

Funding Abstract

Worthington Industries, Inc. (NYSE:WOR) is an organization that creates a wide range of helpful merchandise utilizing metal. They focus on including worth to metal processing and creating merchandise for shoppers, buildings, and sustainable mobility. Their Metal Processing phase takes flat-rolled metal and turns it into merchandise for various industries resembling automotive, building, {hardware}, agriculture, and HVAC.

Regardless of the range and rising presence, WOR has it hasn’t helped them in growing the revenues on a yearly foundation. As a substitute, they noticed a decline in each the highest and backside traces. However trying on the QoQ outcomes the corporate noticed a rise as automotive demand rose and metal manufacturing skilled modest development. The relative stability I see with the corporate and the great dividend it presents while shopping for again shares makes me in a position to charge it a purchase. WOR has been in a position to pay a dividend for the final 31 years and has throughout that point additionally been growing the payout because of the ever growing money flows the corporate has had. Presently the leveraged FCF margins sit at 5.36%, beating out the sector common of three.54%. I do not suppose we are going to see huge development, however as an alternative, a value-accumulating firm that can generate worth for shareholders for a lot of a long time.

A Shift In Manufacturing Will Profit

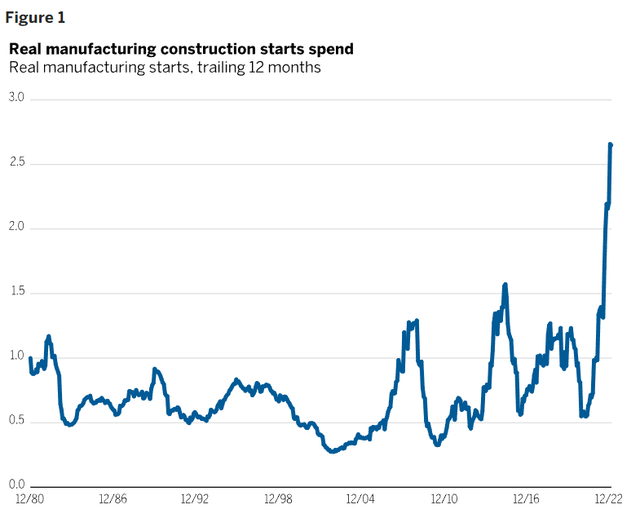

One of many main tendencies driving development for firms like WOR is deglobalization, as extra companies are shifting manufacturing out of China and into different international locations like India or Vietnam. Nonetheless, one other pattern that has emerged as a result of pandemic is the motion of firms again to the US to hedge towards international constraints. By relocating their manufacturing to the US, firms hope to create a extra environment friendly and streamlined enterprise mannequin that may climate the hardest of instances. This shift additionally creates the next demand for companies throughout the nation as a result of shut proximity of the manufacturing amenities.

Market Spotlight (wellington.com)

The US authorities has additionally launched incentives for firms to extend their manufacturing throughout the nation, which has additional fueled the pattern of shifting again to the US. All this ends in that an organization like WOR may have a a lot simpler time promoting their product domestically to a demanding market at a better worth than what they might get in a creating nation like India for instance. A big a part of the revenues that WOR generates is from an finish market like automotive, which ought to proceed rising steadily for a few years forward, fueling the revenues of WOR as nicely.

Quarterly Outcome

Within the final report from the corporate, they skilled a 20% lower on a YoY foundation which could have buyers operating away in concern. However seeing as WOR is prone to commodity fluctuations it is no surprise as metal costs usually are not on the similar ranges as 12 months in the past.

The web gross sales got here in at $1.1 billion and with revenues like this, the p/s is definitely fairly low at 0.58 on a ahead foundation.

Firm Prioritize (Earnings Report)

What I believe will probably be watched probably the most going ahead is the margins the corporate maintains. Within the earnings presentation, the corporate talked about that they wish to improve margins and reduce the asset depth which ought to carry them the next ROA than the 5.91% they’ve at present. A lot of the objectives are relatively primary and I might have appreciated to see extra mentions of addressing new markets or making strategic investments going ahead to realize extra market share.

Within the report, there was additionally a point out of the influence the decrease metal costs had on working capital. This actually highlights the significance of getting a robust money place to leverage when this occurs. Which the corporate has strived for as they sat with $267 million in money on the final quarter finish, up $232 million from the identical quarter final yr.

I believe the metal manufacturing form of overshadowed among the good issues that occurred within the quarter. Just like the constructing merchandise phase noticed a 14% improve YoY as greater common sale costs benefited the corporate.

Shifting ahead I believe it will likely be important to see the margins and whether or not the corporate can persist with conserving a slimmer enterprise mannequin and improve margins. 11% in TTM gross margins usually are not nice and to gas a constructive long-term outlook this wants to enhance.

Dangers

One of many main dangers going through an organization like WOR I believe was highlighted within the final report. Commodity fluctuations can actually damage margins and make for inconsistent outcomes. However I believe that can also be simply the character of the market they’re in. The long-term outlook although for metal appears to stay robust as robust markets like India and China are nonetheless putting huge calls for.

Value noting for buyers is that the corporate goals to separate the metal processing phase of the corporate by early 2024. I believe that is an fascinating transfer as it’s going to current buyers with the potential for making a pure metal play with an organization that’s as financially secure as WOR. I will probably be watching out for extra information going ahead relating to this and what among the evaluated advantages of holding on to shares in WOR are within the meantime.

Valuation & Wrap Up

I believe that what worries buyers probably the most with an organization like WOR is that they are not in a position to improve margins and stay aggressive in a difficult market like metal. With a 20% YoY lower in internet gross sales, it is simple to see why some may flip the corporate away. However I believe what’s vital to have a look at is the QoQ outcomes, which appear to indicate a constructive uptrend for the corporate as metal costs rebound barely and demand will increase within the automotive end-market, which is the corporate’s largest.

Inventory Value (Looking for Alpha)

Wanting ahead, the estimates are shaky and I believe that will probably be seen within the outcomes from the corporate additionally. The administration appears to stay assured that demand will sustain, CEO Andy Rose stated “We now have good momentum heading into our fourth quarter and are optimistic that underlying demand for our key finish markets will stay wholesome.”

Seeing because the final quarter noticed drops in gross sales, I believe the following few quarters will probably be all about trying on the margins. Can the corporate preserve them and likewise improve them, regardless of a difficult market surroundings? I believe it is truthful to estimate that development will gradual for the corporate throughout 2023, however I additionally suppose it is truthful to estimate it’s going to decide up relatively shortly in 2024 and 2025, reflecting the identical development the business may have. Nonetheless it seems, shopping for when the p/e is that this low presents little threat in my view, and buyers can benefit from the good dividend within the meantime.

All in all, I believe what WOR presents is a dividend alternative for buyers searching for publicity to a typically steadily rising business like metal, while additionally having their shares recognize in worth by way of buybacks. The p/e appears to be in step with the sector and the web debt/EBITDA sits at 1.97, which I believe highlights that debt ought to influence the above-mentioned advantages like dividends and buybacks. I’ll charge WOR inventory a purchase for now and look ahead to studying additional into the separation of the metal phase in 2024.