Workday (NASDAQ:) supplies enterprise cloud purposes in america and internationally. Its purposes assist its clients to plan, execute, analyze, and lengthen to different purposes and environments to handle their enterprise and operations. It serves skilled and enterprise companies, monetary companies, healthcare, schooling, authorities, expertise, media, retail, and hospitality industries.

WDAY Q3 2024 experiences earnings at 4:01 PM ET Monday, Nov 26, 2024

|

WDAY Earnings Statistics from Q3 2013

|

|||

|

EPS |

1W % transfer publish earnings |

2W % transfer publish earnings |

1M % transfer publish earnings |

|

BEATS 43 |

-2.28% |

-3.09% |

-2.57% |

|

MISSES 4 |

6.55% |

4.89% |

-0.02% |

43 beats since Q2 2013 4 Misses since Q2 2013

|

Analyst Scores |

|||

|

SOURCE |

BUY |

HOLD |

SELL |

|

Refinitiv |

28 |

9 |

1 |

|

TipRanks |

22 |

6 |

1 |

|

Earnings Expectation |

|

|

EPS |

1.72 USD |

|

Income |

2.13B USD |

Value Efficiency:

|

Value Efficiency [Close 267.69 Nov 25, 2024]

|

|||

|

52-Week Vary |

199.81 – 311.28 |

Quantity |

3,351,100 |

|

1W |

2.55% |

Common quantity |

1,775,375 |

|

1M |

11.74% |

|

|

|

3M |

2.96% |

|

|

|

6M |

24.51% |

|

|

|

YTD |

-2.21% |

|

|

|

1Y |

14.21% |

|

|

Fundamentals:

|

|

|||

|

Market Capitalization, $Okay |

70,953,752 |

Value/Gross sales |

9.79 |

|

Shares Excellent, Okay |

265,000 |

Value/Money Stream |

171.27 |

|

Annual Gross sales, $ |

7,259 M |

Value/E book |

8.51 |

|

Annual Earnings, $ |

1,381 M |

Value/Earnings ttm (Trailing 12-month) |

171.84 |

|

EBIT $ |

342 M |

Earnings Per Share ttm |

1.56 |

|

EBITDA $ |

688 M |

Most Current Earnings |

$1.75 on 08/22/24 |

|

60-Month Beta |

1.35 |

|

|

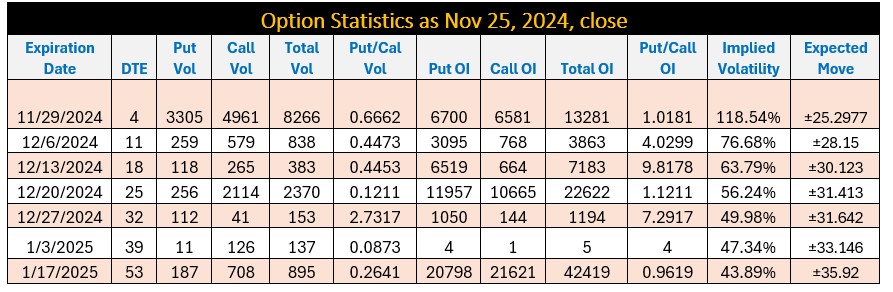

Possibility Statistics:

- Put/Name ratio for Nov. 29 expiry is 1.0181% extra calls than places which suggests the next three eventualities:

- With Put/Name ratio is round 1.0181 to 9.8178 for the subsequent three upcoming expiries counsel that the merchants are very bullish.

- Incomes miss or decrease steerage might set off a short-lived sell-off adopted by a fast rally.

- Incomes and steerage in line or higher than estimates could set off a pointy rally.

Key Highlights:

- WDAY monetary administration options are in excessive demand.

- Cloud options are utilized by 35 federal authorities purchasers worldwide.

- Introduction of world HR and payroll options in collaboration Strada throughout the quarter.

- And a partnership with Equifax (NYSE:) to speed up and streamline the employment and revenue verification course of.

Technical Evaluation Perspective:

- WDAY has initiated a bullish flag sample between August ’24 to Oct’24 focusing on 305 to 310 within the coming weeks.

- Inventory failed to interrupt November 2021 excessive at 307 on a second try in February 2024 forming a double high sample a triggered a drop to 199.81 in August 2024.

- It appears to be like that WDAY goes to check 305 -310 impediment publish Q3 earnings. The upside outlook is legitimate so long as 255/250 help stays intact on a day by day shut foundation after the earnings.

- Failure to carry 255/250 help on day by day shut chart would pave the way in which for added decline to 230 area.

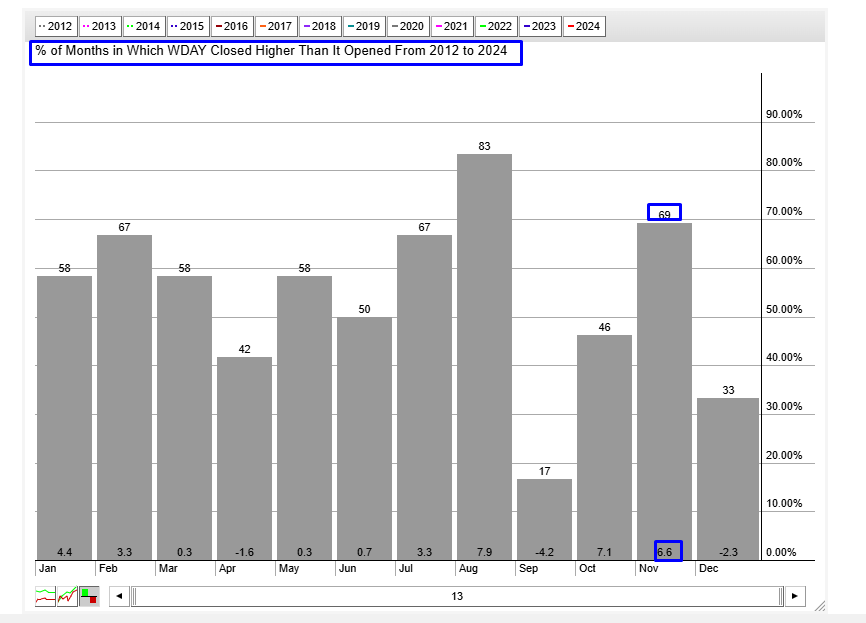

- WDAY closes 6.6% larger in November 69% of the time since 2012.

Conclusion:

WDAY is heading to 305 to 310 marks offered 255/250 help stays intact on day by day shut foundation publish Q3 earnings.