SimonSkafar

Wolfspeed (NYSE:WOLF) reported a brilliant quarter, but the investment story is all about the massive EV related pipeline. The auto sector continues to be one of the best areas to invest in the semiconductor space. My investment thesis is Bullish on the stock long term based on the surging pipeline, though the recent big rally suggests not rushing into Wolfspeed until a pullback occurs.

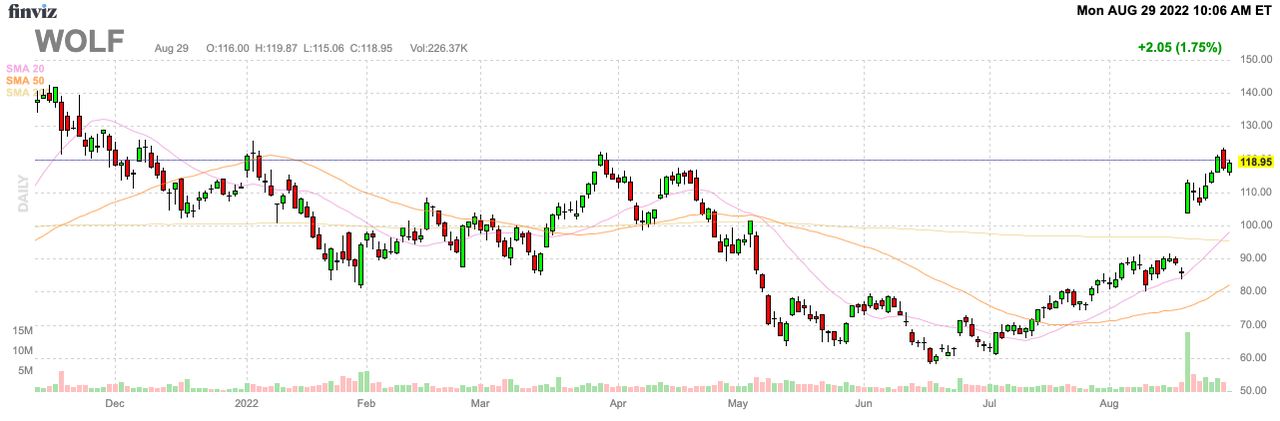

Source: FinViz

Surging Pipeline

Wolfspeed reported FQ4’22 revenues blew past estimates. The company reported revenues of $229 million for 57% growth, beating analyst estimates by a wide $21 million.

The stock appears expensive due to Wolfspeed only reporting FY22 revenues of $746 million while the market cap is some 20x higher at $14.5 billion. The company focuses on technology for green energy sources via high-voltage applications for silicon carbide. In essence, the semi. company focuses on the areas of high growth for the next decade and exactly why investors have to focus on the pipeline and not current revenue levels. EVs and related charging station power device demand will only surge over the next decade.

The pipeline continues to surge evidenced by another year of record numbers. CEO Gregg Lowe had this to say about the pipeline growth via the FQ4’22 earnings call:

The opportunity pipeline for silicon carbide has more than doubled to $35 billion in a single year. Our fiscal 2022 design-ins totaled $6.4 billion, representing a 3x increase from our fiscal 2020 design-in total and a 119% increase compared to the prior year. We had another record-setting design-in performance of $2.6 billion in fiscal Q4.

Wolfspeed added an incredible $2.6 billion in design-ins for FQ4 alone. The company added to the pipeline in excess of 11x the revenues reported in the quarter leaving the stock trading at hardly above 2x design wins.

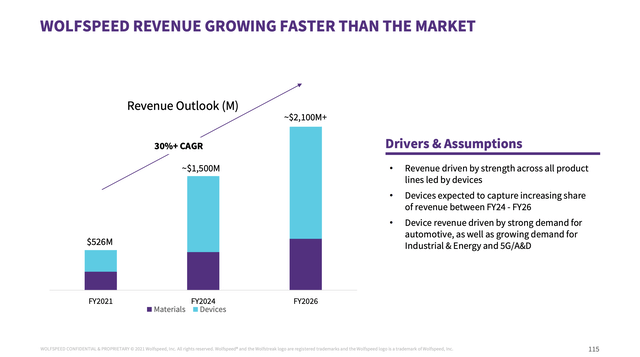

The stock market should clearly focus on the backlog knowing Wolfspeed is set to generate these higher revenue levels having signed deals and built a new fab in Mohawk Valley. Management now suggests the 2026 revenue total will surge 30% to 40% beyond the prior $2.1 billion target. At 40%, Wolfspeed is now targeting $2.94 billion in FY26 revenue.

Source: Wolfspeed 2021 Investor Day presentation

The company already has the contracted revenue and the company is now operating in FY23. Investors need to understand that FY26 isn’t that far away and the business doesn’t face the risk of a normal tech company still needing to deliver new products over the time period to garner the higher sales.

CapEx Hitch

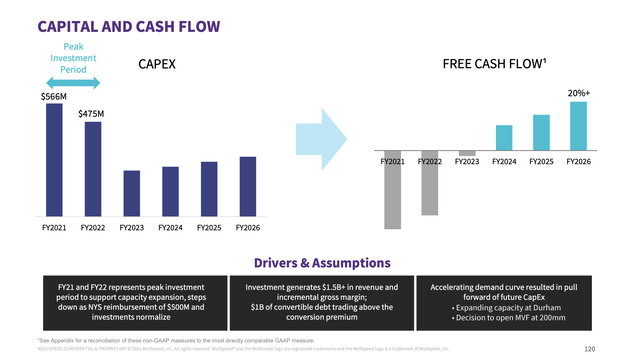

The only major negative to the investment story is that Wolfspeed needs to invest aggressively in capex the next few years in order to meet the surging demand. At the 2021 investor day, the company had provided the following capex and free cash flow view with Wolfspeed reaching a near breakeven level this FY.

Source: Wolfspeed 2021 Investor Day presentation

Now, the semi. company forecasts spending $550 million in net capital this year to further buildout the Mohawk Valley facility to meet surging demand. The amount doesn’t even include further expansion in materials and device capacity requiring a path to finance the growth.

Wolfspeed ended FY22 with $1.2 billion in cash on the balance sheet. The company forecasts needing additional capital to fund the large capex spending relative to the current business level.

With the stock surging back above $110 for a market cap of $14.5 billion, the company is in a great position for possible equity financing. In addition, Wolfspeed only has $1 billion in total debt on the balance sheet providing plenty of capacity for additional borrowing considering the design wins already booked.

The company forecasts FCF margins topping 20% in FY26 providing what would easily top $600 million in cash flow generation on an annual basis in a few years. The stock appears expensive trading at 14x FY23 revenue targets of ~$1.1 billion, but Wolfspeed is a lot more reasonably priced considering revenues are set to reach $3.0 billion in a few short years.

Takeaway

The key investor takeaway is that Wolfspeed is poised for substantial growth in the next few years with the power devices and materials needed to meet surging EV demand. The stock valuation is probably stretched here making an ideal entry point on any future sell offs.