Headwinds are building for the US economy, stoking forecasts that recession risk is rising. The labor market, however, remains resilient, suggesting that the economy will continue to expand for the near term.

Private payrolls in March , marking the tenth straight month of 400,000-plus increases. Meanwhile, — considered a leading indicator for the labor market and the economy — continue to print near 50-year lows, a sign that labor-market stress remains low.

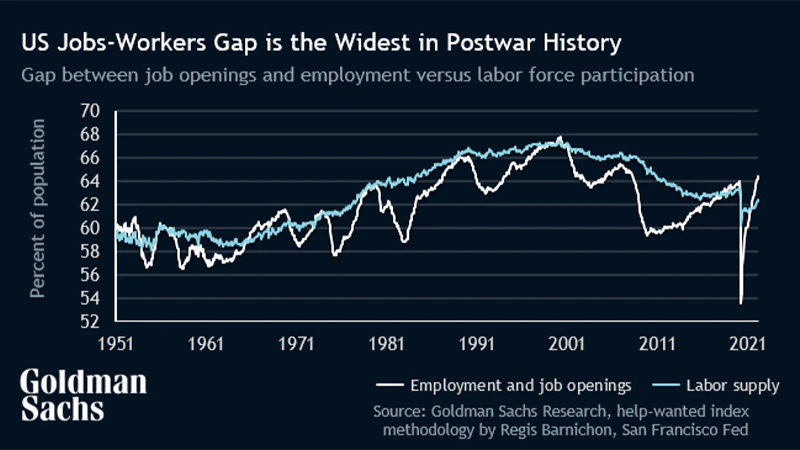

New research from Goldman Sachs also finds that the US jobs-workers gap is the widest in post-war history, which offers support for thinking that the Federal Reserve could beat the odds and engineer a soft landing for the economy. History suggests that the central bank’s efforts to lower inflation raise the odds of a recession – a hard landing. “It’s a delicate balance, but there are several reasons that it could be more achievable than in the past,” economists at Goldman Sachs advise.

The difference between the total number of jobs (employment plus job openings) and the total number of workers – currently at 5.3 million-plus – “shows that the labor force is at its most overheated level in postwar history.”

Analysts at the investment bank reason that “it should be easier to reduce the jobs-workers gap during this cycle than in the past because the employment market is still normalizing after COVID disruption, which Goldman Sachs Research expects will add as many as 1.5 million workers to the economy in excess of normal population growth. And unlike laying off workers, closing open positions doesn’t have negative second-round effects that ripple through the economy.”

It helps that household balance sheets are stronger compared with the onset of most recessions, the bank adds. Overall, Goldman estimates the odds of a US recession in the next 12 months at just 15%.

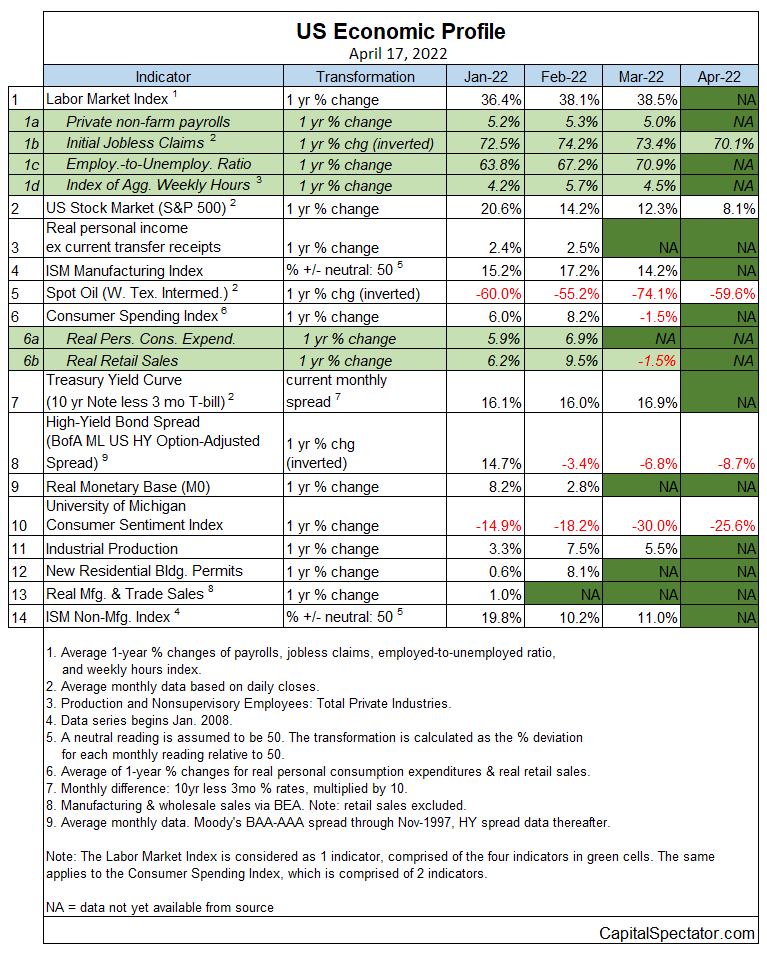

One caveat is that payrolls are a lagging indicator and so an economic recession could start well before it’s obvious in the labor market. Nonetheless, a broad set of key indicators overall currently show that US recession risk is low and will likely remain so for the immediate future.

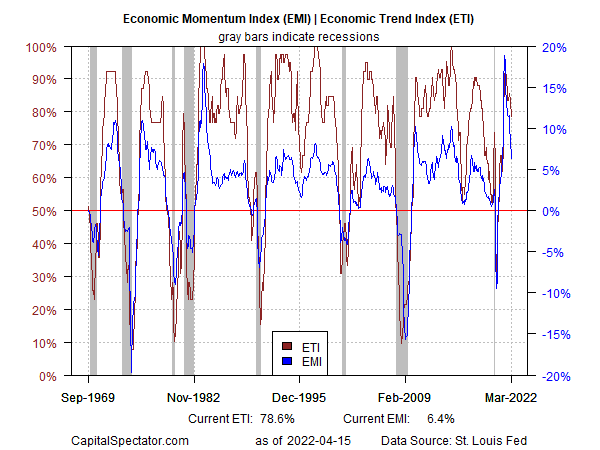

The latest issue of the US Business Cycle Report shows that a pair of proprietary business cycle indexes – Economic Trend Index (ETI) and Economic Momentum Index (EMI) – remain well above their respective tipping points that mark the start of economic contractions.

EMI & ETI Index Chart

These benchmarks are calculated using a broad, diversified set of economic and financial indicators, listed below.

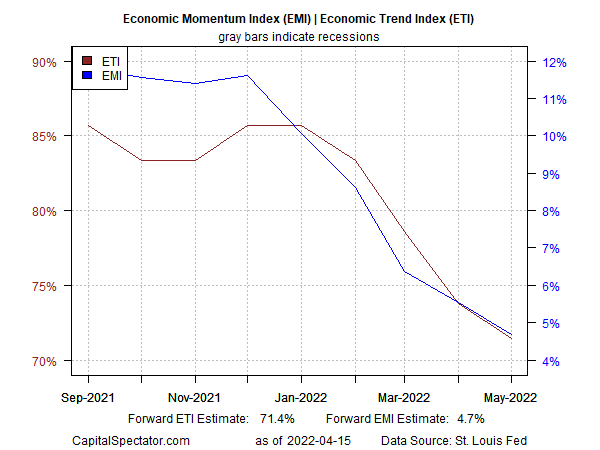

Although ETI and EMI have been signaling a slowdown in US growth for months, near-term projections for the benchmarks through May continue to forecast growth. But the deceleration is persistent and so the main risk for the economy looks set to arrive in the summer, assuming the slowdown continues.

EMI & ETI Index Chart

Keep in mind that forecasting recession risk beyond a couple of months is highly uncertain and so it’s unclear if the various macro and financial headwinds will eventually trigger a contraction. As Goldman reminds, “History suggests it’s not easy to cool the labor market without causing GDP to slump.”

For now, at least, the US economy is beating the odds. That’s likely to remain so for the next month or so. Beyond that, no one really knows, which leaves the only game in town: re-run the incoming numbers… frequently.