U.S. and global markets recoiled from the higher inflation/CPI data last week. The Fed raised by 75pb on June 15. The Fed also warned that other, more aggressive rate increases might be necessary later this year.

Before the Fed decision, global markets opened on Sunday, June 12, and quickly started selling downward. U.S. Indexes sold off on Monday, June 13, by more than 2.5% almost across the board. A brief rally after the Fed decision seems to have evaporated in early trading on Thursday, June 16.

It is clear that global markets expected inflation to stay elevated but were hoping for some moderately lower data showing the recent Fed moves had already dented some inflation concerns. Now, it appears the Fed has its backs against a wall and moved rates aggressively higher to stall inflation (and possibly destroy global asset values). From my perspective, this is unknown territory for the Fed and global central banks. That means traders should expect increased volatility and the possibility of a very determined reversion of price over time.

Another Global Financial Crisis May Be Unfolding

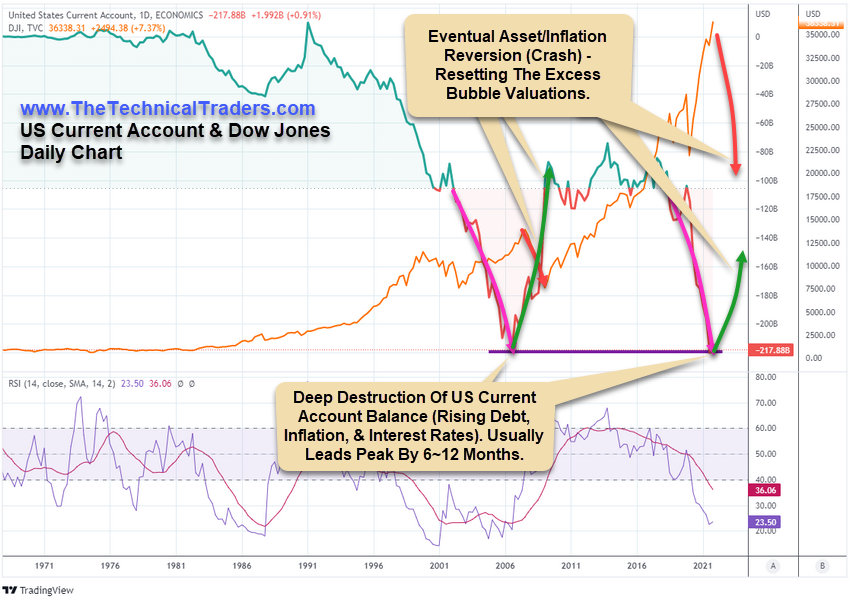

The research conducted by my team and I shows some interesting new data. In particular, the U.S. Current Account data is very near to the levels reached just before the global financial crisis in 2006 (near -$218 billion). I consider this a very clear sign that the U.S. economy, inflation, consumer engagement and asset values have continued to hyper-inflate since the COVID-19 virus event.

The chart below highlights the U.S. Current Account data and the price data. Notice how the lowest level of the U.S. Current Account data reached a deep trough (September 2006) about 12 months before the absolute peak in the DJI (September 2007). This time, the U.S. Current Account trough formed in September 2021, and the peak in the DJI happened in December 2021 – only three to four months later.

The global markets have continued to consume cheap U.S. dollar liabilities over the past 10+ years as the Fed kept interest rates very low for an extended period. Not only did this feed an extreme global speculative phase, it also created an extreme credit/debt liability issue throughout the globe as rates increased. Debt holders are forced to roll debt forward at higher rates if they cannot pay off these liabilities completely – being over-leveraged. This same scenario is very similar to how the global financial crisis started. Over-leveraged speculative trading in mortgage-backed securities and other global assets.

Skilled Traders Saw This Problem Many Years In Advance

I’ve been informing my subscribers that an event like this was starting to take place throughout 2020 and 2021. Below, are some of the articles posted in our blog warning traders that the global markets were transitioning away from the endless bullish price trends from 2011 through 2021.

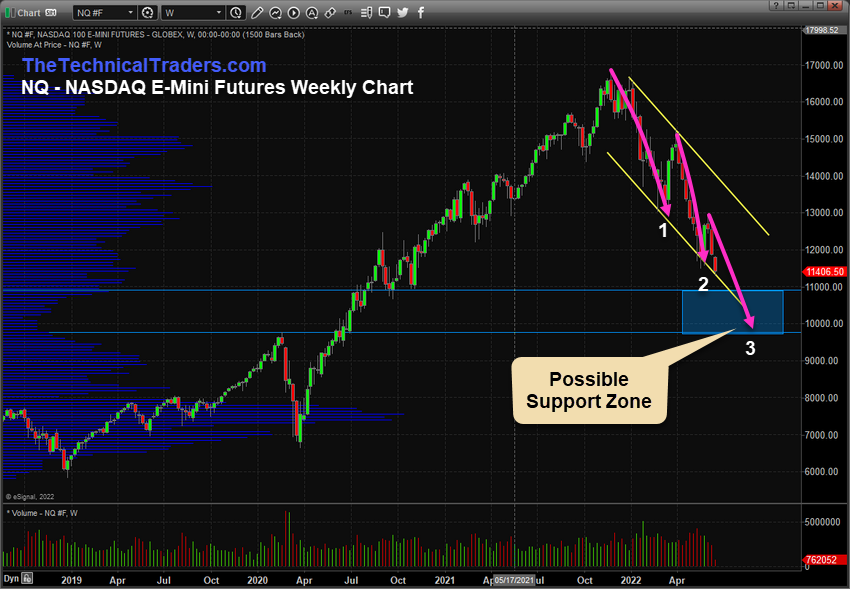

NASDAQ May Fall To $9,750 Before Attempting To Find Support

The technology sector is leading the downward price trend in the major U.S. indexes. The could fall to levels close to $9,750~10,750 before attempting to find any real support.

Ultimately, the NASDAQ may fall to levels near the COVID-19 lows, near $6,500. But right now, the most logical support level exists just above the COVID-19 2020 highs.

I expect this new global price revaluation may last throughout the rest of 2022 and possibly carry into early 2023. It depends on what the Fed does and how this event unfolds. If there is an orderly unwinding of excesses in the markets, we may see an extended decline as global expectations transition to new normal economic expectations. If a new crisis event blows a massive hole in the global economy, like in 2008-09, a very sudden decline may occur – shocking the global markets.

My research suggests the Fed is far behind the curve and has allowed the excess speculative rally to carry on for too long. Global central banks should have been raising rates to moderate levels near the end of 2020 and in early 2021. Now, we have an excess phase bubble similar to the dotcom and global financial crisis events merged. We have an extreme technology bubble and an excess global credit/liability bubble.

If you have not already adjusted your assets to protect from downside risks, it’s time. When doing so, please consider the long-term risks of trying to ride out any extended downtrend in price. Are you willing to risk another 25% to 40% of your assets, hoping the global markets find a bottom soon?