Recently, the Euro has been buying and selling in a decent vary particularly towards america greenback regardless of some tryouts of a break to the upside. The 14-Day common true vary, which measures the common of the space between the excessive and the low posted throughout this 14-day interval, dropped near its lowest degree since February 2022.

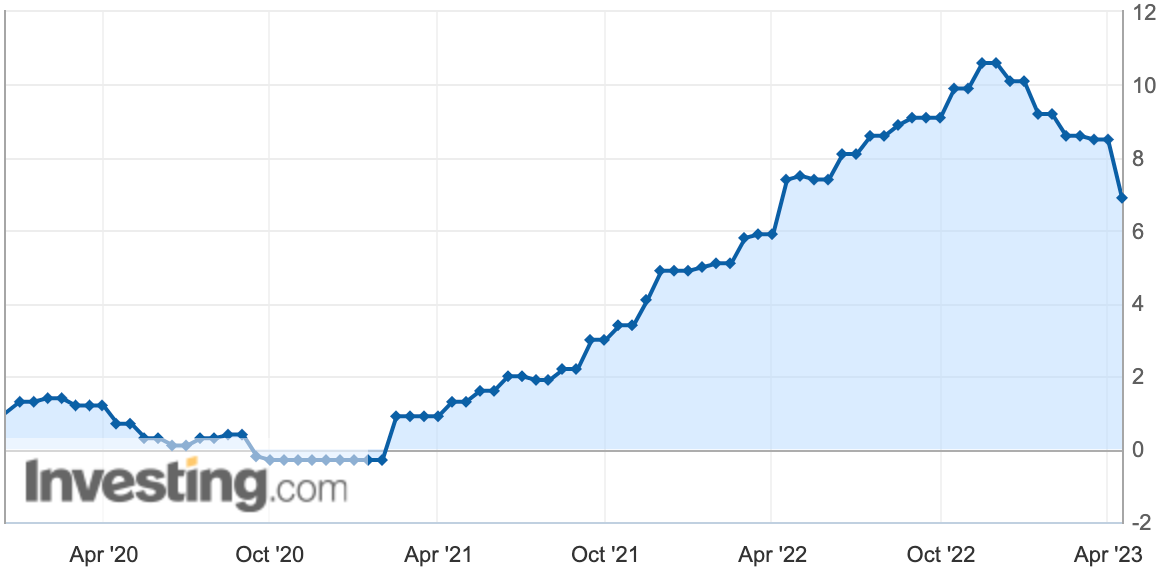

The truth that Central banks might be near ending their financial coverage tightening cycle just isn’t leaving a lot room for directional strikes, however somewhat a extra uneven buying and selling. Because the starting of the yr, the pair had a buying and selling vary of round 600 pips in comparison with +1000 pips, on the identical time final yr.

Vary Jan-April 2022 / 2023

What could lead on the Euro by means of the subsequent directional transfer?

The Preliminary studying of the Eurozone April Shopper Value Index is due tomorrow, and since it’s only two days forward of the European Central Financial institution’s determination on financial coverage, it’s broadly adopted by merchants and buyers. The headline inflation studying has eased considerably on a year-on-year foundation, supported by a major drop in vitality costs. Nonetheless, the core inflation studying which excludes meals and vitality remained considerably excessive and is anticipated to return out at 5.7% tomorrow.

At the moment, the market is pricing in a chance of 80% likelihood that the ECB will increase rates of interest by 25 foundation factors, whereas the remaining 20% is for a 50 foundation factors charge hike. Any shock to the upside in inflation readings might push the market to cost in a bigger rate of interest hike, which is able to are available in favor of the Euro over its counterparts.

Eurozone Shopper Value Index YoY

Eurozone Core Shopper Value Inde YoY

Technical Evaluation

As you possibly can see within the chart under, the EUR/USD pair has been in some way consolidating in a decent vary near its highest degree since April 2022, regardless of a trial of a break to the upside final week. In a bullish situation, the pair might rally to $1.1185, the excessive recorded on March thirty first, 2022, whereas in a bearish situation, the pair might drop to the 200-H4 exponential shifting common near $1.09.

EUR/USD H4 time. Exponential shifting common 55, 100, 200.

Buying and selling throughout the information entails excessive threat, and also you higher be well-informed on completely different facets of the market earlier than initiating any commerce. The above shouldn’t be thought of as buying and selling recommendation however somewhat an unbiased market commentary.