BITCOIN, CRYPTO KEY POINTS:

READ MORE: Oil Worth Forecast: Restoration Continues as Expectations for OPEC Cuts Develop

Bitcoin costs proceed to carry the excessive floor however the $38k stage stays a stumbling block. The rumors that an ETF approval would come by the November seventeenth failed to return to fruition with Bloomberg ETF analyst James Seyffart commenting that we could not get any approval till January. Surprisingly Bitcoin has remained resilient within the face of what many understand because the SEC searching for any motive to delay their determination.

Beneficial by Zain Vawda

Get Your Free Bitcoin Forecast

BITCOIN SPOT ETF DELAY TO WEIGH ON PRICES?

We’ve heard feedback from either side of the spectrum with MicroStrategy founder Michael Saylor as soon as extra wanting like a genius. The Bitcoin fanatic has renewed his bullish rhetoric relating to Bitcoin with Saylor claiming {that a} potential demand surge could also be on its approach. Saylor is probably not flawed nonetheless, given {that a} ETF approval is more likely to result in an enormous surge in demand. Probably the most fascinating Tweet by Saylor was his “price of standard pondering” one which confirmed the beneficial properties in each Bitcoin and the SPX since August 10 2010, the date at which MicroStrategy adopted it Bitcoin technique. Since, Bitcoin is up a whopping 214% compared to the SPX development of 31%.

Another excuse cited for Bitcoin holding the excessive floor happened following the victory by Argentinian far proper candidate Javier Milei who’s a recognized Bitcoin fanatic. Argentina has been grappling with runaway inflation with Milei important of the Central Financial institution and conventional finance. That is additionally seen as an enormous step for the crypto trade because it means a Bitcoin fanatic can be a member of the G-20. Market members could also be hoping that this might result in constructive developments round crypto regulation transferring ahead.

Trying on the efficiency right this moment and as you possibly can see from the warmth map under, most of the smaller cash are within the crimson right this moment with Solana and Avalanche the most important losers.

Supply: TradingView

READ MORE: HOW TO USE TWITTER FOR TRADERS

Beneficial by Zain Vawda

Get Your Free Introduction To Cryptocurrency Buying and selling

TECHNICAL OUTLOOK AND FINAL THOUGHTS

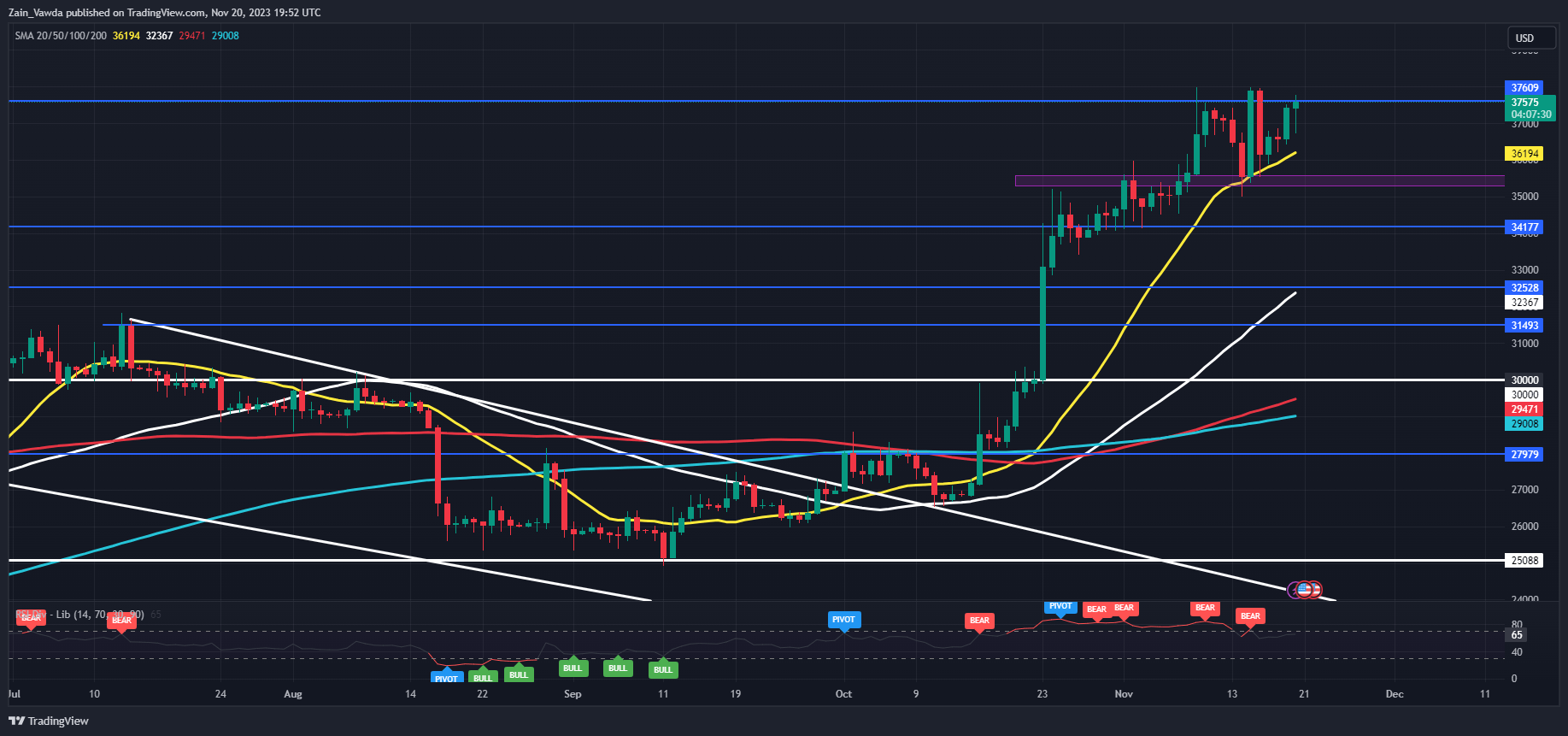

From a technical standpoint BTCUSD is fascinating because it hovers slightly below the $38k mark. If worth continues to wrestle to interrupt larger quickly then a deeper retracement could also be within the offing forward of the New Yr which is probably not a nasty factor. This could enable could be patrons a greater danger to reward alternative earlier than the ETF determination and halving subsequent 12 months.

Nonetheless, what we now have seen of late is Crypto whales proceed to carry and construct their positions whereas the retail buying and selling panorama has seen a slowdown of late. Quite a lot of that is right down to the tightening monetary situations globally leaving shoppers with much less disposable revenue.

BTCUSD Day by day Chart, November 20, 2023.

Supply: TradingView, chart ready by Zain Vawda

Resistance ranges:

Help ranges:

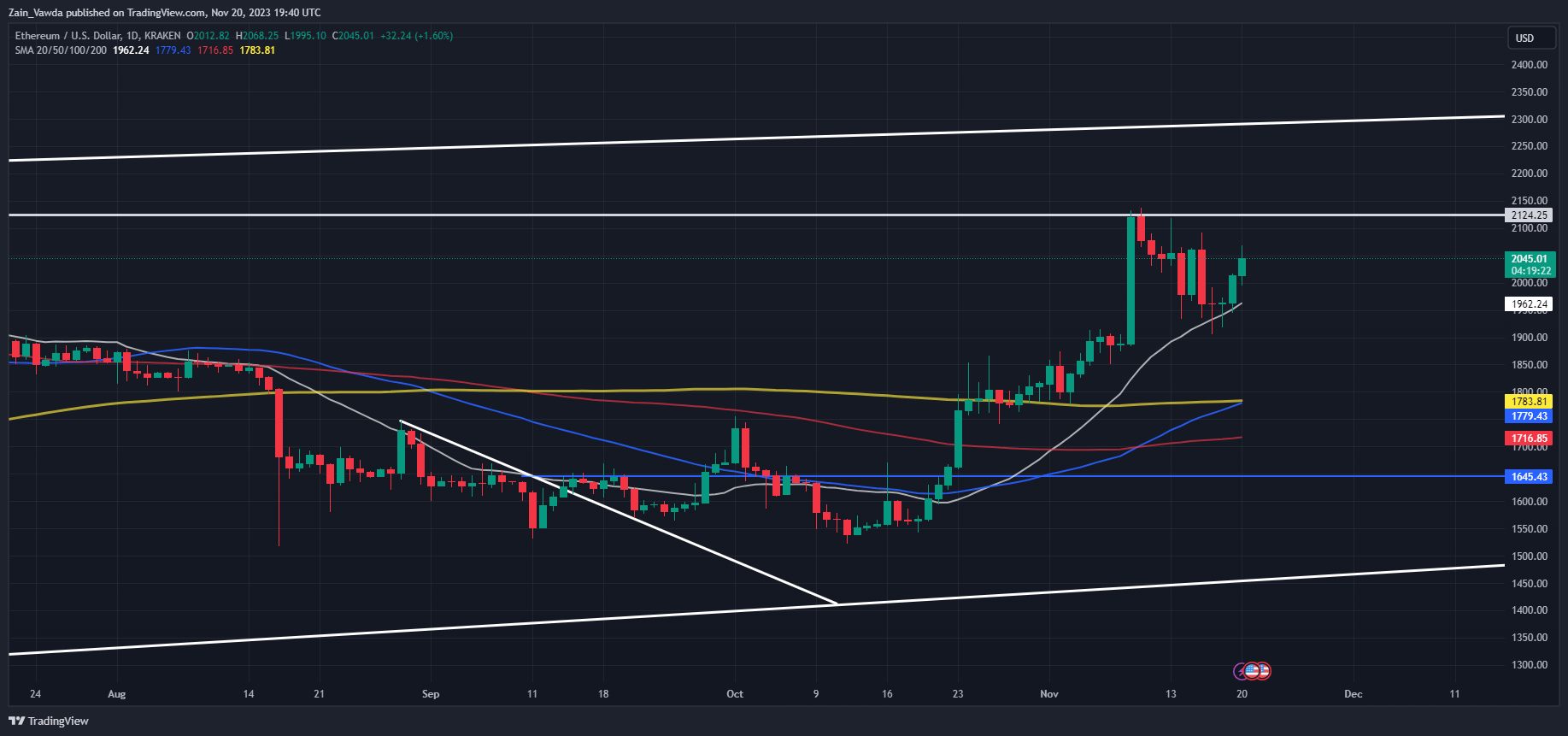

ETHUSD Day by day Chart, November 20, 2023.

Supply: TradingView, chart ready by Zain Vawda

Taking a look at Ethereum and the weekly timeframe hints {that a} retracement could also be incoming this week. The weekly candle closed as a bearish inside bar hinting at additional draw back forward which shall be invalidate with a day by day candle shut above the 2124 stage. So long as worth stays under this stage we could face some promoting stress.

Worth motion on the day by day timeframe does trace at a recent excessive nonetheless, having printed a brand new decrease excessive and bouncing off assist supplied by the 20-day MA final week. The combined indicators right here will give market members meals for thought as we even have a golden cross sample with the 50-day MA crossing above the 200-day MA on the time of writing. All in all, it is a slightly combined technical image which doesn’t provide quite a lot of readability.

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to Publication

— Written by Zain Vawda for DailyFX.com

Contact and comply with Zain on Twitter: @zvawda