MicroStockHub/iStock via Getty Images

DocuSign (NASDAQ:DOCU) is certainly a company worth exploring since it’s the leader in electronic signatures and contract life cycle management software. It seems to still have a long runway for growth, although this growth has been decelerating rapidly. We still find the company interesting enough that we decided to analyze it and check out its valuation to see if it is worthy of investment. There were two red-flags that we found, one is the well-known growth deceleration that the company is experiencing, but much less discussed is the excessive amount of stock-based compensation the company gives out, which basically explains most of its free cash flow and adjusted earnings.

Other than the two red flags mentioned above, we are very impressed with the company. Its vision to modernize the contracting process to make it more automated and collaborative is inspiring, and we can see the company selling more add-on features and to manage the whole contract lifecycle, not only the signature part. We therefore find the Agreement Cloud platform very exciting, and do believe that it can add meaningful growth.

Management believes that DocuSign has a total addressable market of $50 billion, but we are not convinced the size of the opportunity is really that large given the growth deceleration trend. Especially given that the market is dominated by DocuSign and its biggest competitor Adobe (ADBE).

In any case, we do believe DocuSign to be an attractive business, it is more the valuation we are concerned about, and the two flags we mentioned, decelerating growth and excessive stock-based compensation, reduce the amount we are willing to pay for the business.

Competitive Advantages

There are several things that make DocuSign an attractive business, these include most of the revenue being recurring in nature, and strong competitive advantages. DocuSign benefits to a certain degree from network effects, given that the more people that use a given e-signature solution, the more likely a new participant will be to use this same solution. There are also scale advantages, as there are some fixed costs including R&D and software development that require a critical mass of users before the service can be profitable, and the largest provider therefore has a cost advantage compared to smaller competitors. Finally, there is the brand, which is respected in the industry and is very well known to the point that it has almost become synonymous with e-signing.

Financials

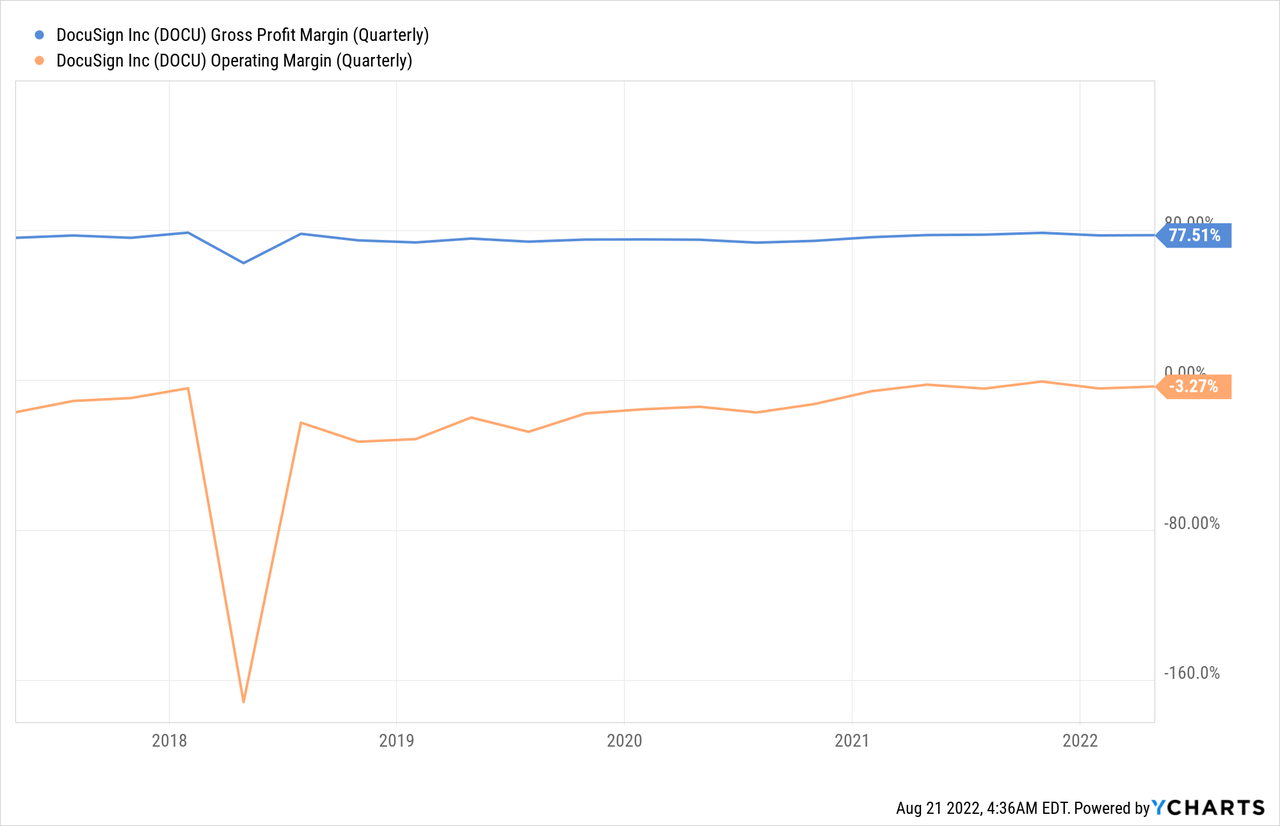

DocuSign has very high gross profit margins, which reflect its competitive advantages. It is also showing operating leverage, with its operating margin improving in general the last few years. Unfortunately, the company still has a negative operating margin, and as we’ll soon see, this is in large part the result of excessive stock-based compensation.

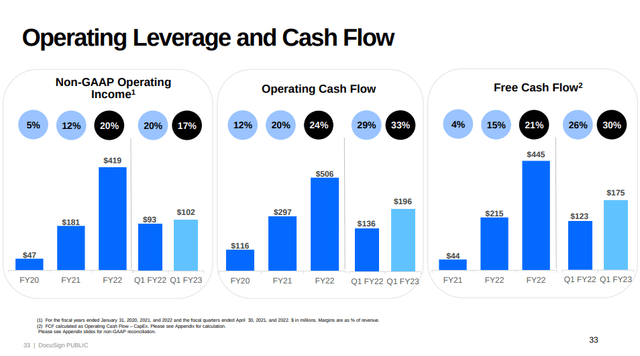

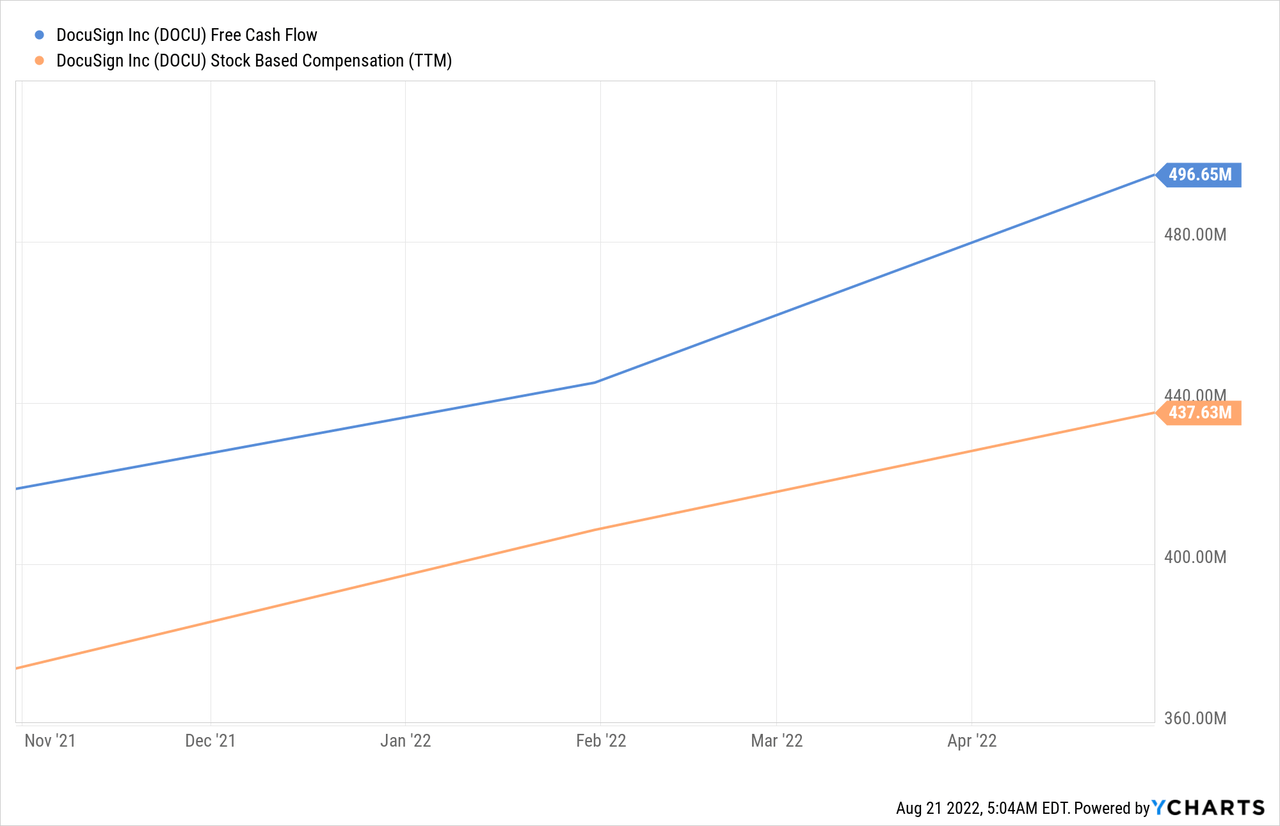

This is also the main reason why the company can boast of a Non-GAAP operating margin of ~20%, while its GAAP operating margin is still negative. It’s a similar story with the operating cash flow, and free cash flow, where the results basically evaporate once stock-based compensation is taken into account.

DocuSign Investor Presentation

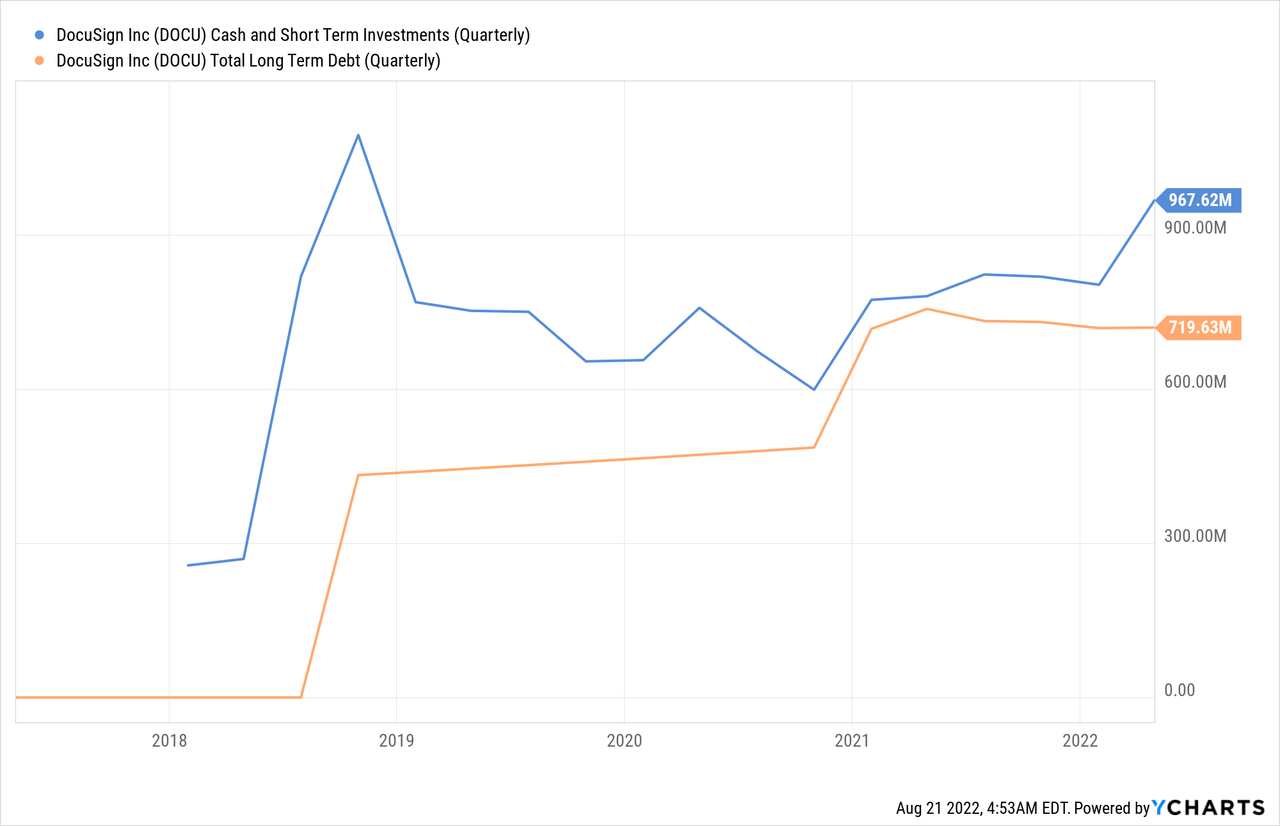

Balance Sheet

DocuSign has a very strong balance sheet with more cash and short-term investments than long-term debt. This gives the company the flexibility to increase investments in the business or go after M&A opportunities should they present themselves.

Growth

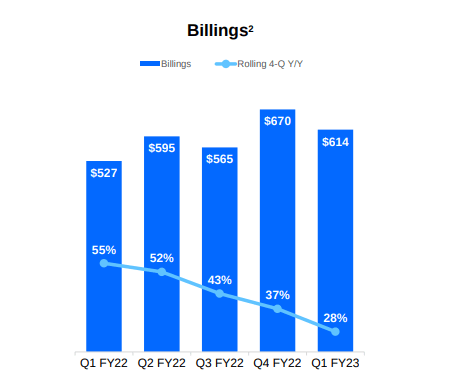

Looking at billings we can see how much growth has decelerated, with the rolling 4Q y/y growth rate cut almost in half from Q1 FY22 to Q1 FY23. There are a lot of people talking about this deceleration, and we believe it is the main reason the shares have fallen as much as they have from their peak. That said, 28% is nothing to sneeze at, and at the right valuation it can make sense to buy the shares. One thing that will be interesting is to see if growth stabilizes in the next few quarters, given that the trend the last few quarters has been for growth to slow more and more. This understandably makes investors anxious, as it is difficult to tell where growth will stabilize.

DocuSign Investor Presentation

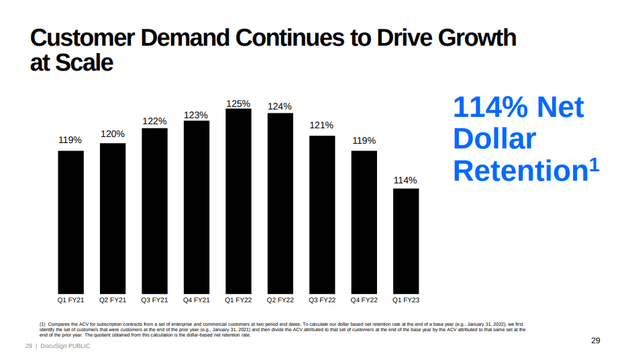

Going into more detail, we can see that one of the reasons for the growth deceleration is that DocuSign is no longer expanding share of wallet as quickly as before. It used to have a net dollar retention rate higher than 120%, but most recently this too has gone down.

DocuSign Investor Presentation

Stock-based compensation

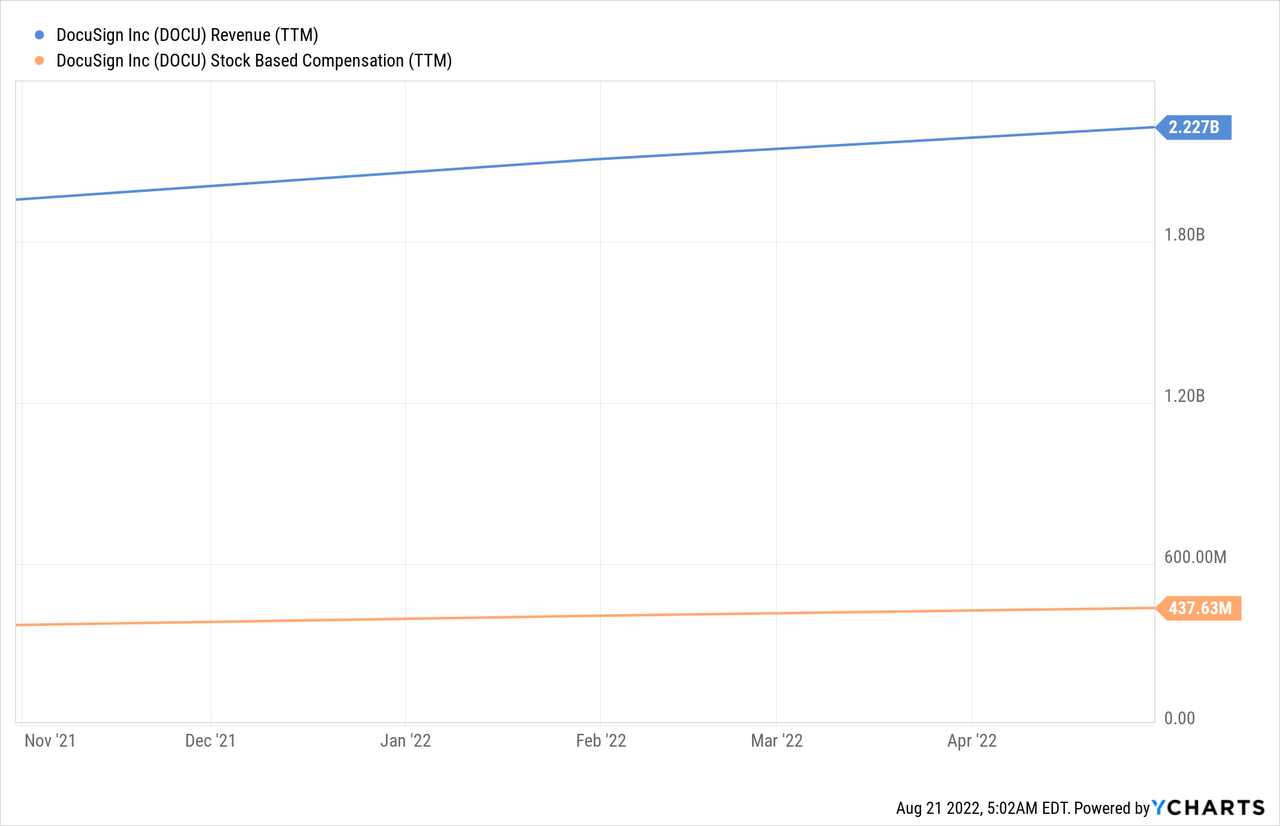

We believe stock-based compensation to be excessive at DocuSign, given that for the trailing twelve months it represents around 20% of revenue.

As can be seen below, its stock-based compensation is almost equivalent to its free cash flow. If we subtract stock-based compensation from operating earnings, or from free cash flow, there is very little cash left for shareholders in the company. If you believe, as we do, that stock-based compensation is a real expense, then the valuation is a lot higher than it seems using the company’s adjusted numbers.

Valuation

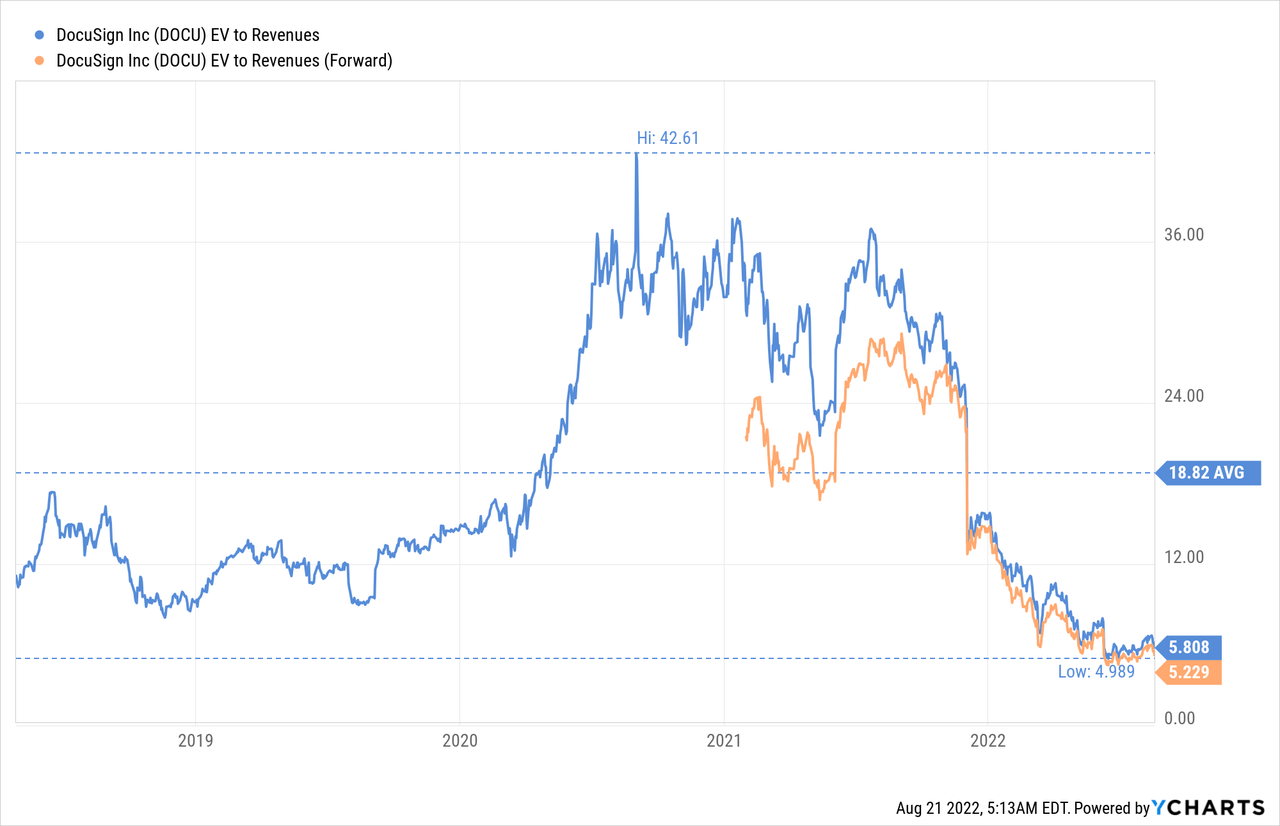

Some might say that shares are cheap because they are trading at one of its lowest EV/Revenues multiples, significantly below its historical average. The problem we see is that a 5-6x multiple can still be high if there is not enough growth or profitability to come with it. The problem we DocuSign is that growth is quickly decelerating, and stock-based compensation is taking most of the profitability away.

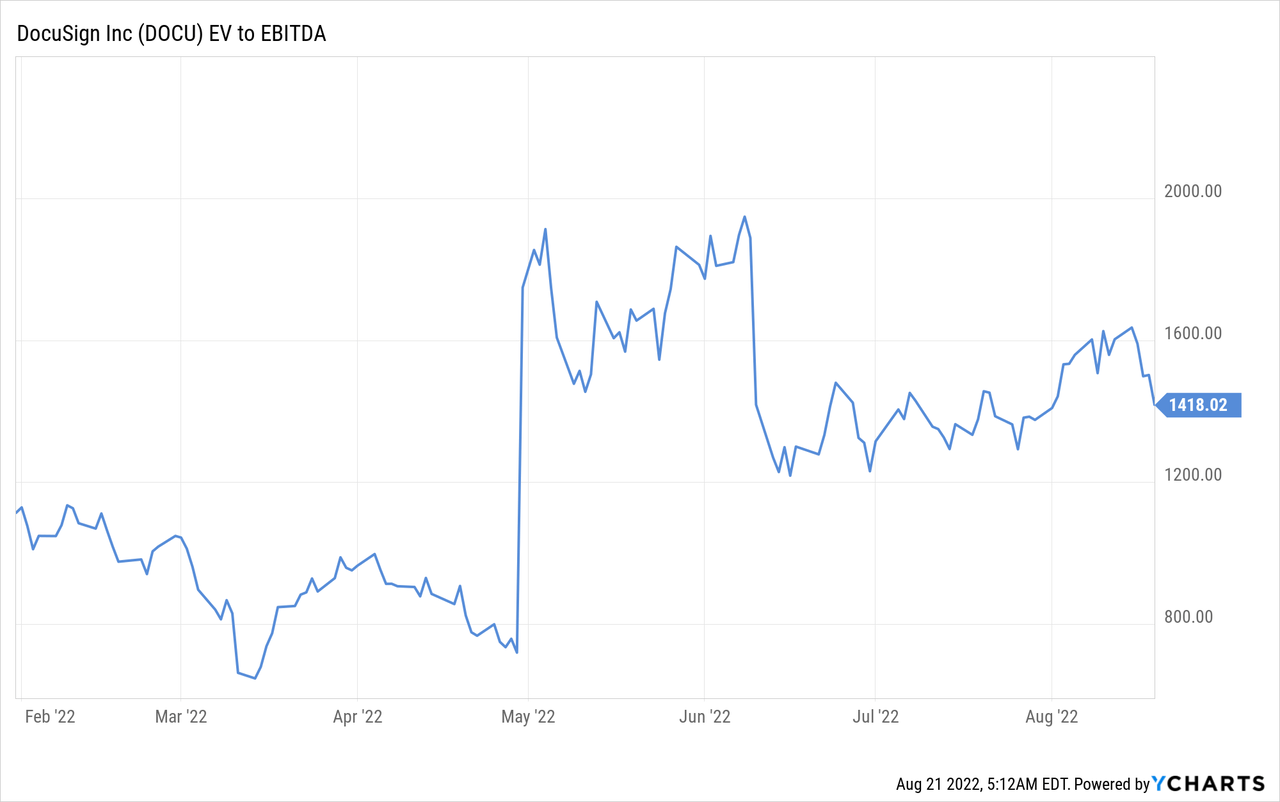

Looking at EV/EBITDA, we can see that shares are trading at a triple digit multiple. As much as we like the company, we cannot recommend the shares when trading at such a high EV/EBITDA multiple.

Risks

We see a lot of risks with DocuSign, including a high valuation, excessive stock-based compensation, and quickly decelerating growth. At least the balance sheet is quite strong with more cash and short-term investments than long-term debt. A lower valuation would mitigate a lot of the risks, but we view the current valuation as still quite high.

Conclusion

DocuSign is a business with strong competitive advantages, and significant growth opportunities. Unfortunately, the valuation is too high, especially once stock-based compensation is taken into account. At current prices, and with little real profitability and growth decelerating, we do not find shares attractive. We’ll keep the company on the watch list hoping one day the market offers a good entry opportunity.