Nattakorn Maneerat

WhiteHorse Finance (NASDAQ:WHF) is an externally-managed and closed-end enterprise improvement firm that gives loans to non-public (i.e., not publicly traded) American firms whose valuations vary from $50 million to $350 million. The corporate additionally owns 66% of a three way partnership with State Lecturers Retirement System of Ohio which additionally operates like a BDC. There are lots of issues to love about this firm resembling its low-cost valuation, steady distribution historical past however it’s additionally value noting that the corporate has a comparatively quick historical past and its enterprise mannequin is untested in a recessionary atmosphere which makes it considerably a speculative play particularly contemplating the kinds of loans it makes.

The corporate makes use of first lien and second lien kind of loans (backed by actual property) at floating charges to generate a revenue from charge spreads (the distinction between the speed it might borrow and the speed it might mortgage out cash) which may additionally fluctuate from everyday. To make the issues extra sophisticated, the corporate principally affords loans to firms whose debt is both rated beneath funding grade (usually referred to as “junk”) or no ranking in any respect which makes it a speculative play. That is particularly necessary to know as a result of the corporate has been round since 2011 so we do not precisely know the way it could carry out throughout an occasion just like the 2008 recession. For the reason that firm’s complete existence was throughout a bull market, favorable financial circumstances and intensely accommodative Federal Reserve (nicely till final yr), it’s tough to foretell the way it will do when circumstances will not be as favorable.

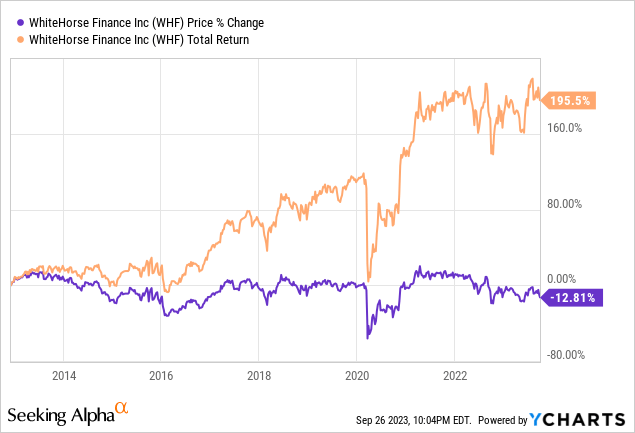

Having stated that, this firm affords a well-covered 12% dividend yield and traders with sturdy danger urge for food and thirst for revenue may discover worth on this firm. Since inception, the inventory’s value is down barely (about -13%) however it’s whole return is up near 200% totally pushed by dividends. Then once more since this firm is legally acknowledged as an funding firm underneath the Funding Firm Act of 1940, it has to distribute just about all of its income to shareholders so I’m not stunned that every one of its returns got here from dividends. The truth that the inventory held on throughout this time is considerably assuring since we have seen so many high-yielders have their NAV erode drastically over time (particularly mortgage REITs) by 50% or extra. If a inventory that yields +10% drops solely -13% in additional than a decade, I’d name it a win at this level. Then once more understand that this firm has by no means seen a recession so its efficiency won’t be pretty much as good underneath much less very best circumstances.

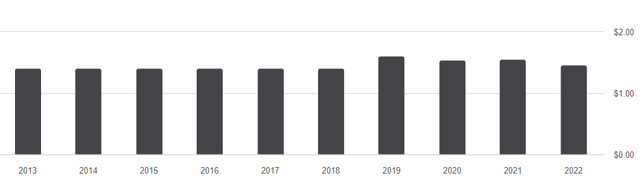

With regards to this firm’s distribution historical past, one factor you’ll be able to say about it (apart from it having a excessive yield) is that it has been very constant over time. Since its inception, the inventory has been paying about 30-40 cents per share per quarter. Dividend hikes have been nearly non-existent with this firm however you may as well say the identical about dividend cuts. You may depend on this firm to pay about the identical yr after yr so long as enterprise circumstances stay favorable.

WHF Dividend Historical past (Looking for Alpha)

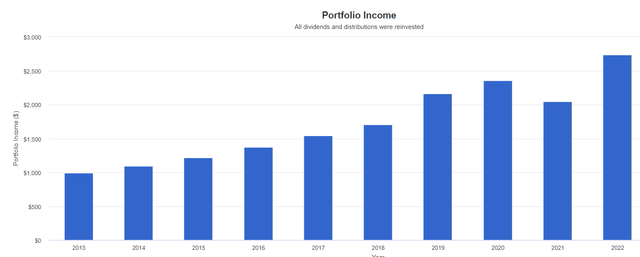

Regardless that there is not a lot of dividend hikes, you’ll be able to create your individual hikes by reinvesting all or a few of your distributions. For instance for those who had purchased $10k value of WHF precisely a decade in the past, held till at the moment and reinvested your dividends (assuming in a tax sheltered account resembling a 401k) your annual revenue would have grown to $2,740 indicating a yield of 27.4% towards your authentic funding. This can be a well-known phenomenon referred to as “energy of compounding”.

Progress of $10k invested in WHF (Portfolio Visualizer)

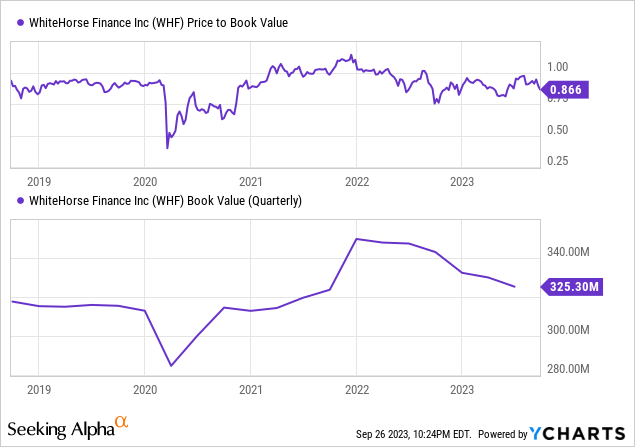

The corporate trades at a value to e book worth ratio of 0.866 indicating a 13.4% low cost towards its e book worth. Having stated that, we must also notice that the corporate’s e book worth has been declining for the final couple years however this should not shock anybody since bond market has been in a bear market since late 2021 on account of charges going increased with a purpose to curb inflation. I might really say that the fund’s e book worth is holding up nicely and it is solely down about 10% from its peak whereas many bonds and bond funds are down by far more. This may very well be as a result of nearly all of the loans issued by WHF are shorter time period loans with maturities starting from 1 to five years and people are inclined to lose much less worth as in comparison with long term bonds or debt devices when yields are rising.

Consensus estimates name for the corporate incomes $1.85 this yr and $1.73 subsequent yr which signifies that the corporate trades for a ahead P/E of seven for the subsequent 2 years. It additionally signifies that the corporate can simply cowl its annual distribution of $1.50 so long as it meets these numbers however there won’t be a lot room for a dividend hike until the corporate can beat these estimates by a big margin.

Analyst estimates for WHF (Looking for Alpha)

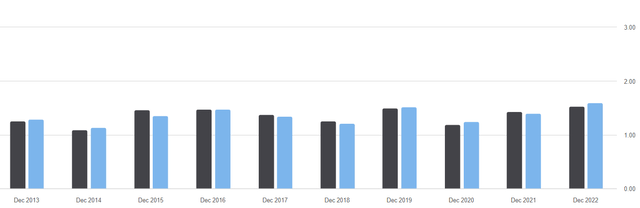

Traditionally talking the corporate has a historical past of both assembly estimates or barely falling behind (by 3-4%) however its earnings beats are very uncommon. Within the beneath chart darkish bars signify precise earnings and blue bars signify estimates the place you’ll be able to see the way it carried out within the final 10 years. I would not guess on them beating estimates this yr contemplating the inverted yield curve we’re seeing in bond markets.

WHF historical past of earnings surprises (Looking for Alpha)

So, what is the ultimate verdict on this firm? It actually is determined by who you might be, what your objectives are and the way a lot danger tolerance you’ve got. I’m inclined to say that this inventory warrants a glance and it would not damage to provoke a small place however be sure that your place isn’t too massive. You can begin a place that is as small as 1% of your whole portfolio worth and reinvest dividends alongside the best way to develop your place over time. If this inventory performs nicely, its weight in your portfolio will continue to grow which is an efficient factor. If the inventory performs badly, your losses will probably be restricted. That is very true on this atmosphere with a lot uncertainty and the Fed immediately turning from super-accommodative to super-unfriendly. This places us in uncharted waters and nobody is aware of what’s coming subsequent. At unsure occasions, you need to restrict your publicity to shares like this one which depends on small firms whose credit standing is beneath funding grade and badly in want of capital. When capital markets dry up, these are the primary firms which have the chance of going underneath and you do not need to be caught holding a big place of that.