Darren415

By James Knightley, Chief Worldwide Economist

Sturdy client spending means 4% GDP progress is feasible

The US economic system has had a stellar summer time, with third-quarter GDP progress set to come back in near 4% annualised. Sturdy client spending has been the most important driver, with households eager to keep up their life by tapping financial savings and borrowing on bank cards, whereas inflation continues to eat into spending energy. Leisure, tourism and journey have carried out significantly strongly, with air passenger numbers hitting file highs, cinema attendance climbing and record-breaking live performance excursions by Taylor Swift and Beyoncé benefiting motels, eating places and bars wherever they carried out.

Residential building has finished higher than anticipated, too, with an absence of present properties on the market boosting costs and making residence constructing extra worthwhile. Non-residential building additionally continues to profit from authorities initiatives, together with the Inflation Discount Act and the CHIPS Act that promote funding in vitality infrastructure and semiconductor manufacturing services.

Greater for longer Fed messaging drives borrowing prices up sharply

This implies the US jobs market has remained scorching with the Federal Reserve cautious that until the economic system cools sufficiently, inflation could not gradual sustainably to the two% goal, regardless of latest beneficial knowledge. On the September FOMC assembly, the Federal Reserve left the door open to an extra fee rise whereas signalling it noticed much less likelihood of rate of interest cuts subsequent yr. The market has additionally been reconsidering the prospect of coverage easing and, together with lingering issues over the dimensions of US authorities borrowing wants over coming years, we’ve got seen Treasury yields climb. Longer-dated yields are at their highest degree since 2007; we count on the 10-year to quickly hit 5%.

That is pushing borrowing prices greater all through the economic system, with the tempo of enhance reigniting discuss of potential monetary stress rising in some unspecified time in the future. We already know that bank card and auto mortgage delinquencies are rising shortly whereas mortgage charges, that are quick approaching 8%, are prompting a downturn in potential residence purchaser visitors. Automobile mortgage charges are climbing and even good high quality company names will not be immune from the rise in borrowing prices, resulting in some market concern in regards to the affect on funding plans and long-term company revenue progress. Industrial actual property stays the massive fear although given weak valuations, subdued workplace utilization and the prospect of serious refinancing wants over the subsequent 18 months.

Family headwinds set to blow a lot more durable as Taylor Swift strikes on

The challenges dealing with the economic system and the family sector, particularly, will intensify within the present quarter now that Beyoncé’s tour has concluded and Taylor Swift has moved on to stimulating Latin America’s economies. The Federal Reserve’s personal Beige Ebook warned that the summer time spending splurge was principally thought of “the final stage of pent-up demand… from the pandemic period”. It additionally famous that there have been reviews that “customers could have exhausted their financial savings and are relying extra on borrowing to assist spending”. There have been important revisions to private revenue and spending numbers and our calculations recommend that there’s a bigger financial savings battle chest left than we had beforehand thought. Nonetheless, we would definitely agree that for a lot of lower-income households, the money financial savings accrued in the course of the pandemic through diminished spending and better incomes have been run all the way down to zero.

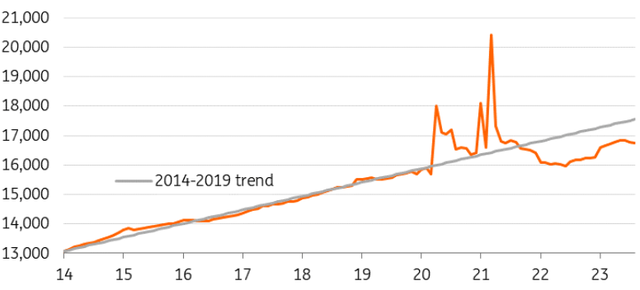

These knowledge revisions additionally confirmed a regarding development for actual family disposable revenue (RHDI). Whereas incomes spiked in the course of the pandemic, they’ve dropped again and have successfully flatlined over the previous two years. Moreover, they’re over $800bn under the place the pre-pandemic development of progress means that we needs to be. In reality, RHDI has fallen for the previous three months, which raises actual issues about how lengthy client spending can stay so robust. If we don’t have significant revenue progress, financial savings are depleted and credit score is far more durable to come back by, the economic system extra broadly will wrestle given client spending accounts for almost 70% of financial exercise. And that is earlier than we contemplate the extra monetary pressures from the restart of pupil mortgage repayments.

US Actual Family Disposable Revenue ($bn) relative to the 2014-19 development

Macrobond, ING

Inflation will supply the Fed the pliability to reply with fee cuts

Auto strikes can even present a headwind for the economic system, hitting suppliers and logistic corporations, with some short-term lay-offs already introduced whereas a authorities shutdown could solely have been quickly delayed by the latest stop-gap deal.

There has at the very least been excellent news on inflation with three consecutive 0.1% or 0.2% month-on-month prints for the Fed’s favoured measure – the core private client expenditure deflator. Slowing housing prices will more and more depress this core inflation measure though latest rises in meals and vitality prices will imply headline inflation charges will likely be slower to fall.

Given the backdrop of inflation wanting much less threatening and the financial outlook wanting more and more difficult, we proceed to doubt that the Fed will carry via with one other rate of interest enhance. The spike in Treasury yields is doing the heavy lifting, but when they proceed to maneuver greater on the present tempo it dangers triggering financial ache that would shortly snowball. In consequence, we proceed to see the dangers skewed in direction of extra aggressive coverage easing than the market is pricing for subsequent yr with fee cuts probably beginning within the spring.

Content material Disclaimer

This publication has been ready by ING solely for data functions no matter a selected consumer’s means, monetary state of affairs or funding goals. The knowledge doesn’t represent funding advice, and neither is it funding, authorized or tax recommendation or a proposal or solicitation to buy or promote any monetary instrument. Learn extra.

Unique Put up