TommL

Have you learnt who has been lacking from the newest gold bull run? The Chinese language. And but, we’re nonetheless seeing gold push to document highs.

What occurs when the Chinese language bounce again into the market with each toes?

One other Document

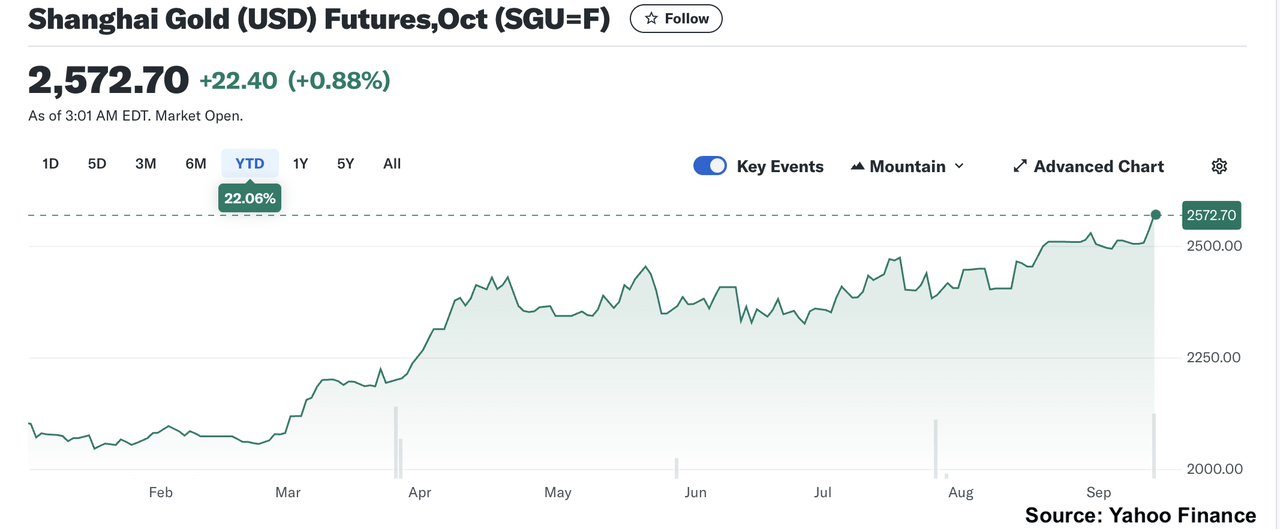

Gold set one other new document on Thursday as buyers drool over the prospect of an rate of interest reduce subsequent week. The gold worth climbed by about 1.8 %, peaking at round $2,559 per ounce. By early Friday morning, the yellow metallic was up almost $8 at $2,577.

Buyers shrugged off a small uptick in core CPI final month and a larger-than-expected improve in producer costs, anticipating that the Federal Reserve goes to chop rates of interest anyway. As one analyst instructed CNBC, “We’re headed in the direction of a decrease rate of interest setting, so gold is changing into much more engaging.” And even when the primary reduce is barely 25 foundation factors, many analysts suppose we might see deeper cuts at future Fed conferences.

One other analyst identified rising weak point within the labor market, telling CNBC, “The journey that they’re going to embark on in slicing charges goes to go for an prolonged time period.”

Gold began this bull run in mid-February, driving from just below $2,000 to just about $2,400 in mid-April. After buying and selling sideways for a number of months, the rally discovered new legs late final month because it grew to become more and more clear the Fed was ready to give up to inflation and start slicing rates of interest.

The place are the Chinese language?

An enormous issue within the gold rally final spring was shopping for within the East. In reality, Western buyers have been largely absent from the primary run-up. We might see the shift of gold from the West to the East in gold imports flowing into China.

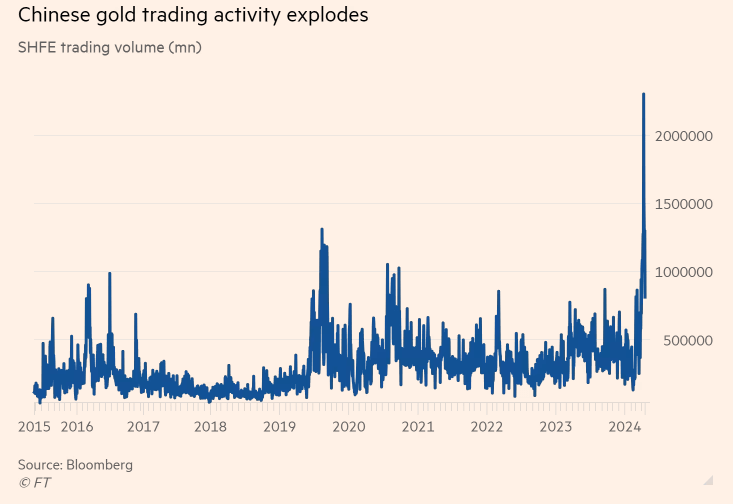

We will additionally see China’s urge for food for gold in exercise on the Shanghai Futures Trade. An article within the Monetary Instances final spring stated Chinese language gold hypothesis “helped supercharge” the gold rally. World Gold Council chief market strategist John Reade instructed the Instances, “Chinese language speculators have actually grabbed gold by the throat.“

A sagging Chinese language inventory market, together with actual property costs, pushed many buyers into the protection and stability of gold. However as costs hit document highs and regulators put some shackles on futures buying and selling, Chinese language gold demand cooled over the summer time, placing the worldwide gold rally on maintain.

In Could, the Individuals’s Financial institution of China stopped reporting will increase in its gold reserves, and bodily demand slumped. One of many components that saved Western buyers out of the gold market was excessive rates of interest, because the Fed and different Western central banks fought worth inflation. Since gold is a non-yielding asset, increased rates of interest are inclined to create headwinds for gold. However the state of affairs in China was a lot completely different. In response to the financial malaise, the Chinese language central financial institution drove rates of interest to all-time lows, making gold much more engaging.

Within the spring, the Shanghai Futures Trade tightened buying and selling circumstances, elevating gold margin necessities from 10 to 12 % and rising the every day worth restrict from 9 to 11 %. Gold globally traded sideways for a number of months this summer time as Chinese language gold demand cooled, however it started to rally once more in August regardless of an empty Chinese language chair on the desk.

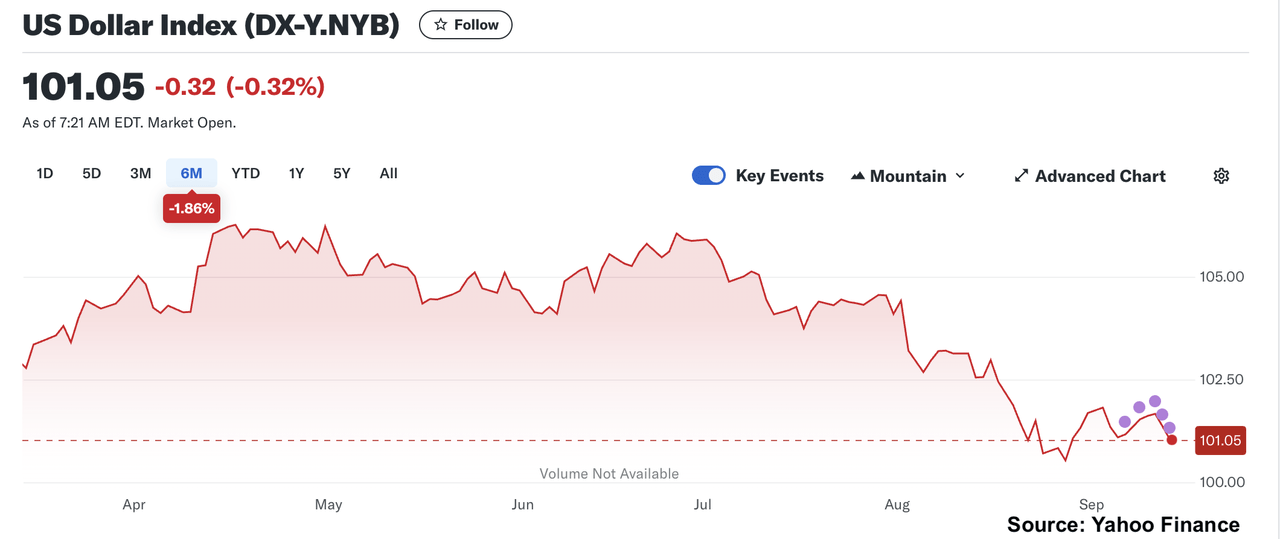

Gold’s latest worth features have largely been pushed by components within the West. Greenback weak point has helped gold. In reality, the most recent improve in gold costs is extra a operate of greenback weak point than gold power.

We have seen an uptick in gold demand in North American and European markets with the promise of charge cuts. (The European Central Financial institution has already jumped on the slicing prepare.) We see proof of this renewed curiosity in gold with optimistic flows of gold into Western ETFs. In the meantime, buying and selling on the Shanghai Futures Trade has run sideways in a comparatively slender vary because the spring rally.

When Chinese language gold futures break by means of the present resistance stage, we might see one other fast run-up within the worth of gold, as soon as once more supercharging the gold bull run. In the meantime, because it turns into clear that gold costs aren’t going to fall any time quickly, bodily demand in China, in addition to different Asian markets, will probably decide up steam once more. These dynamics point out that this gold bull probably nonetheless has loads of legs.

Unique Submit

Editor’s Notice: The abstract bullets for this text have been chosen by Looking for Alpha editors.