csfotoimages/iStock Editorial through Getty Photographs

Funding thesis

My preliminary bullish thesis about Wells Fargo (NYSE:WFC) has aged properly because the inventory delivered a 41% whole return since late September 2023, considerably outperforming the broader U.S. market. In the present day I wish to replace my thesis in mild of the upcoming Q1 2024 earnings launch. There are just a few non permanent challenges within the macroenvironment that may possible proceed to constrain the financial institution within the close to time period. Furthermore, my valuation evaluation means that after the large rally during the last 12 months, the inventory is now very near its honest worth. I feel {that a} 5% upside potential isn’t definitely worth the danger of shopping for earlier than earnings and downgrade WFC to “Maintain”.

Wells Fargo Q1 earnings preview

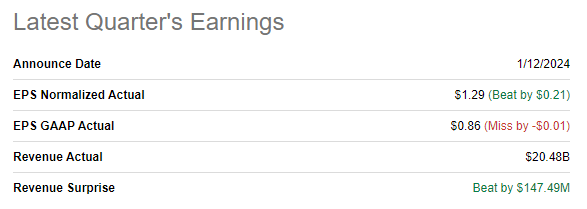

Earlier than I start to preview the upcoming earnings launch, let me spotlight the most recent earnings launch first. The financial institution reported its This fall earnings on January 12 and surpassed consensus estimates. Income grew YoY by 4.2% and the adjusted EPS shrank from $1.45 to $1.29 primarily because of the weak internet curiosity revenue.

Searching for Alpha

The upcoming earnings launch is scheduled for April 12. Consensus estimates forecast Q1 income to be $20.15 billion, a 2.8% YoY drop. The adjusted EPS is predicted to swing in the identical path by lowering YoY from $1.23 to $1.11.

Searching for Alpha

I think about cautious consensus estimates to be honest given the difficult surroundings for banks. Excessive rates of interest proceed to place strain on the web curiosity revenue, and that’s the major purpose I imagine the chance of delivering large beat in earnings or steerage is sort of low. The rates of interest are nonetheless excessive and the current public speech of Jerome Powell means that the Fed is unlikely to be in rush to chop charges.

Certainly, the current developments within the macro surroundings demonstrates formidable resilience of the U.S. financial system. It grew quicker than anticipated in This fall 2023, and the Q1 2024 progress forecast continues to be stable at above 2%. It seems to be just like the Fed is doing nice job because the inflation is step by step cooling down in direction of historic ranges whereas the labor market remaining robust. America’s technological edge achieved by large investments in innovation additionally contributed with the brand new wave of the digital revolution, which most individuals name “the AI revolution”. Company earnings are at report highs even within the present tight financial circumstances. Due to this fact, I feel that the Fed certainly doesn’t have a lot causes to be in rush to chop charges. It is a non permanent, however nonetheless a headwind for WFC.

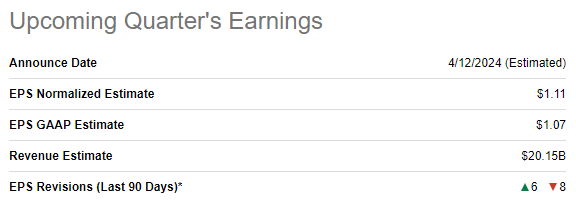

My cautiousness can also be backed by consensus projections for the upcoming earnings releases of WFC’s closest friends: Financial institution of America (BAC) and Citigroup (C). Within the beneath desk we are able to see that each one the three giants are anticipated to show income drop and EPS shrinkage.

Compiled by the creator

To summarize, given the present financial surroundings, it’s tough to anticipate a bombastic earnings launch from WFC. The financial institution is predicted to carry out higher than its closest friends in Q1, however nonetheless, key metrics are poised to shrink. I don’t anticipate sharp adjustments within the financial coverage so long as the financial system is robust and fueled by record-high company earnings and a resilient labor market, with unemployment charges nonetheless near historic lows.

WFC inventory valuation evaluation

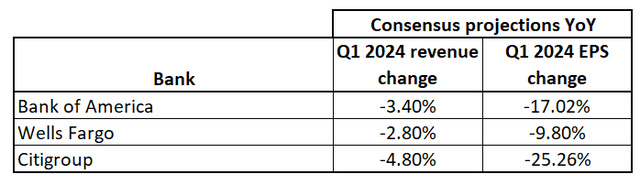

WFC rallied by 54% during the last twelve months and had a stable +15% YTD. The financial institution considerably outperforms each the broad U.S. market (SPY) and the Monetary sector (XLF) in 2024. Valuation ratios look blended in opposition to WFC’s historic averages, which means that the inventory is now roughly pretty valued.

Searching for Alpha

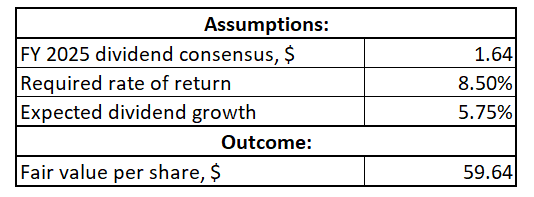

In my earlier evaluation I relied on the dividend low cost mannequin [DDM] method to derive WFC’s fair proportion value and arrived at round $59. For the reason that final shut isn’t very far at $56.7, I feel I ought to use the DDM once more and replace the enter information in step with the modified surroundings. I’m utilizing the identical 8.5% required fee of return, which is in step with the beneficial by valueinvesting.io vary. I replace the present dividend to FY 2025 consensus estimate of $1.64 since I’m calculating the goal value for the subsequent 12 months. Dividend progress is all the time difficult to mission and final time I’ve used 6%, which is a comparatively aggressive assumption. Given the notable uncertainty concerning the Federal funds charges cuts timing and extent, I incorporate a barely decrease dividend progress projection of 5.75%.

Writer’s calculations

In keeping with my DDM simulation, I improve my goal value to $60. This means a 5% upside potential from present ranges, which I can’t name as “engaging valuation”. Furthermore, if we have a look at WFC’s share value chart during the last 10 years, we are able to see that $60 is a powerful resistance stage and the inventory at present trades to its early 2022 highs.

Searching for Alpha

Dangers to my cautious thesis

Making funding selections earlier than earnings is dangerous for each bulls and bears. Everyone knows that even shares of enormous corporations and banks like WFC can transfer double digits in both path after the earnings launch. There’s all the time a chance that there is likely to be an sudden and sudden robust earnings beat or extra optimistic than anticipated steerage adjustments, which could trigger the share value to spike. On this case, my cautious thesis is very unlikely to age properly.

The financial institution’s administration has demonstrated stable dedication to protect worth for shareholders through stringent price management. WFC laid off nearly 5% of its workforce in 2023, which is a large transfer from the administration, highlighting robust dedication to maintain profitability. Some further minor layoffs had been already introduced in 2024. That mentioned, I imagine there’s a chance that the administration would possibly introduce new notable layoff rounds. It will result in an upward revision of long-term EPS expectations from Wall Avenue analysts and extremely possible will enhance the share value.

Is WFC inventory a purchase/promote/maintain?

The primary time I shared my bullish thesis about WFC, it was a pleasant deep worth alternative which emerged because of the panic within the U.S. Monetary sector final yr, after a number of regional banks collapsed. This play turned out properly, however my valuation evaluation means that after the large rally during the last a number of months, WFC may be very near its honest worth. There are nonetheless some challenges for the financial institution to develop its progress and enhance profitability, that are non permanent, however I imagine they are going to persist in 2024. Shopping for earlier than earnings is inherently dangerous, and I’m cautious about WFC immediately, with a score downgrade to “Maintain”.