- Will ECB policymakers go away the door open to a March fee minimize?

- UK knowledge eyed amid division on the BoE

Eurozone GDP might go away bloc on the point of recession

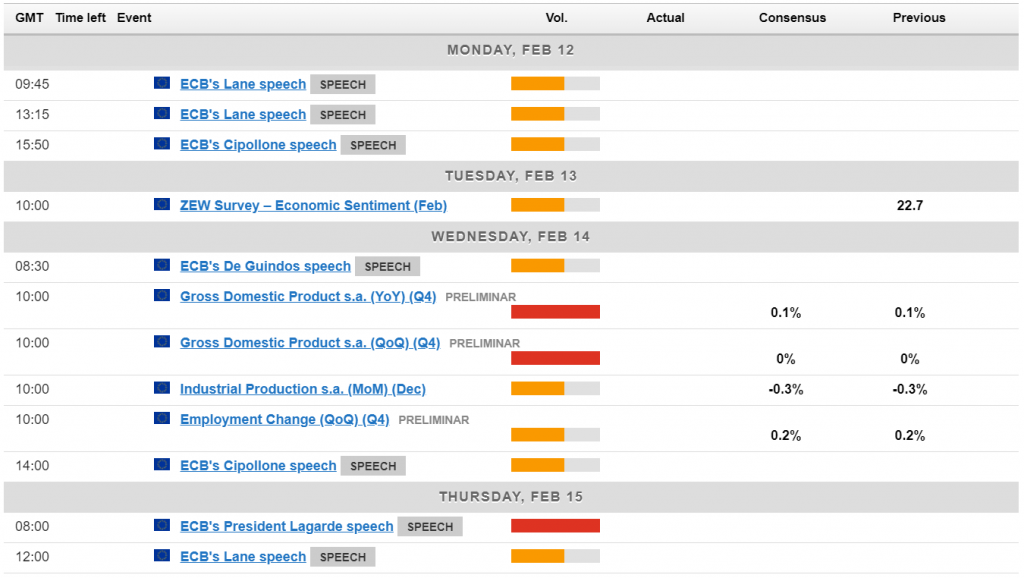

The eurozone seems to have averted a recession on the finish of final 12 months however it could have merely been delayed.

GDP knowledge for the fourth quarter shall be launched on Wednesday and is anticipated to point out the bloc didn’t develop once more within the closing months of the 12 months. It is going to solely take a slight miss to depart the euro space vulnerable to being in recession within the present quarter.

That mentioned, ECB policymakers most likely received’t be significantly swayed by whether or not the eurozone is simply in technical recession or not. That it’s occurring whereas inflation is falling – and is anticipated to fall a lot additional within the coming months – might do although. And we’ll hear from various them subsequent week.

EURUSD Each day

Supply – OANDA

has trended larger for many of the week after a nasty begin to it and an finish to final. It’s run into assist across the 61.8% Fibonacci retracement stage which ought to be an fascinating take a look at going ahead.

Can the BoE be satisfied to chop charges in Could?

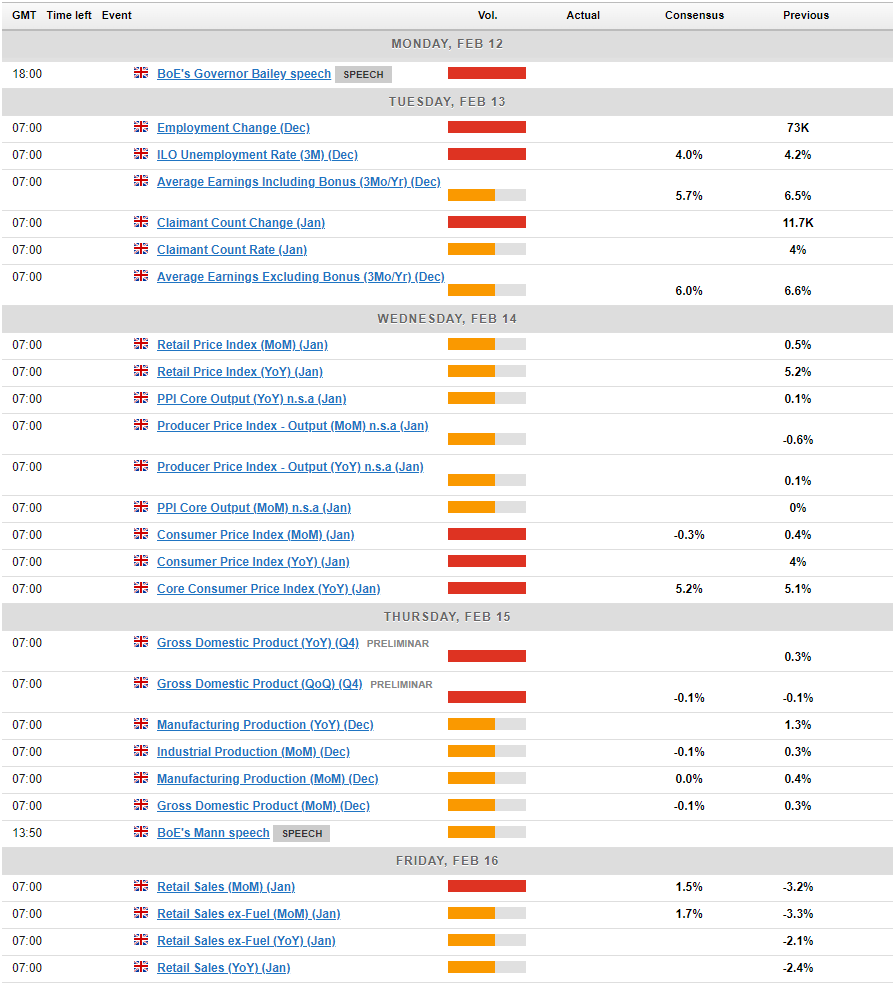

The Financial institution of England will not be prepared to chop rates of interest but however we must always have a greater thought subsequent week simply how shut they’re.

The standout launch is of course the CPI knowledge on Wednesday because the BoE mandate is inflation at 2% – half the extent it stood at in December. Inflation is anticipated to fall over the approaching months however a higher decline in January might assist the case of slicing charges sooner. Equally, a better quantity may very well be a large setback and counsel progress has stalled which might see fee expectations pared again once more.

The roles report on Monday can also be key, most notably the common earnings part, as it is a main contributor to cost pressures. Significantly within the companies sector, an space central banks are most involved about on the subject of getting inflation sustainably again to 2%. Common earnings development each together with and excluding bonuses had been above 6% within the three months to December, a stage far too excessive to be in line with 2% inflation.

GBPUSD Each day

Supply – OANDA

The pound has rebounded towards the this week however that’s occurred after it broke beneath the neckline of a topping formation between 1.26 and 1.28. retraced again to the 50% Fibonacci retracement stage however has failed to interrupt above there thus far.

Unique Publish