Published on July 15th, 2022 by Quinn Mohammed

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth over $360 billion, as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can follow Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Buffett’s Berkshire Hathaway owned just over 62 million shares of General Motors (GM) for a market value of $2.7 billion. General Motors represents about 0.75% of Berkshire Hathaway’s investment portfolio. This marks it as the 17th largest position in the public stock portfolio.

This article will analyze the automobile manufacturer in greater detail.

Business Overview

General Motors produces cars, trucks, and automobile parts and provides automobile financing solutions to its customers. GM’s brand portfolio includes Chevrolet, Cadillac, Baojun, Buick, GMC, Holden, Jiefang, Wuling, Maven, and OnStar.

General Motors reported first quarter 2022 results on April 26th, 2022. For the quarter, revenue was $35.98 billion, up 10.8% from $32.47 billion in the first quarter of 2021. Net income fell by $83 million year-over-year to $2.94 billion. The company’s net income margin was down by 110 basis points to 8.2%.

Source: Investor Presentation

The company posted diluted earnings-per-share of $1.35 for the quarter, which was down from $2.03 in the prior year period. Adjusted diluted EPS, however, fell from $2.25 in the prior year period to $2.09 in the most recent quarter.

Leadership is guiding for full-year diluted EPS between $5.76 and $6.76 and adjusted diluted EPS of $6.50 to $7.50. Additionally, the company anticipates generating net income between $9.6 billion and $11.2 billion, and adjusted EBIT between $13.0 billion and $15.0 billion.

We estimate that General Motors can generate $6.90 in earnings-per-share for the fiscal 2022 year.

Growth Prospects

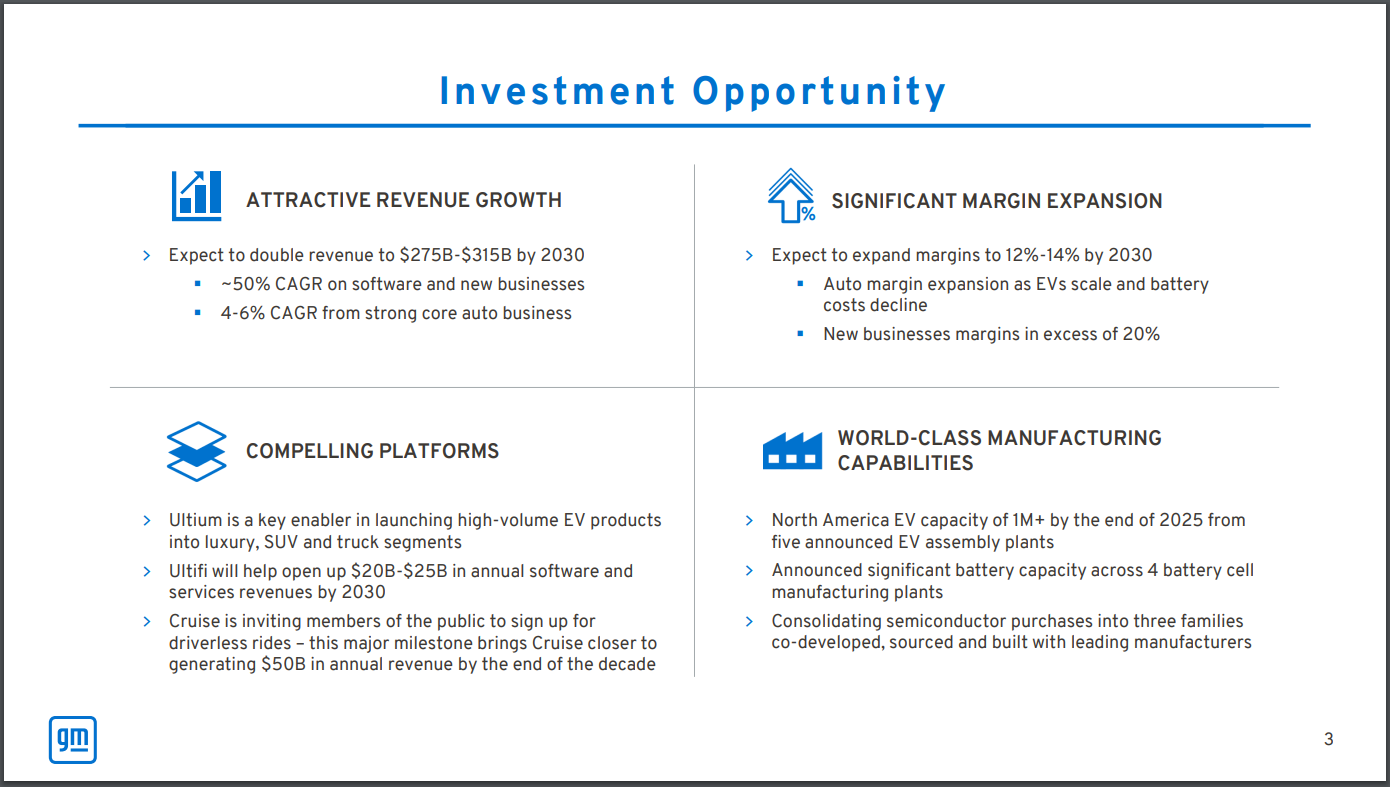

General Motors is forecasting massive revenue growth within the decade, anticipating a doubling of their revenue by 2030. At that point, GM will be generating revenue of $275 billion to $313 billion.

Source: Investor Presentation

The bulk of this growth is anticipated to come from the company’s software and new businesses, with only mid-single digit growth from its established, core auto business.

The company is making a big push on going all electric. GM is aiming to convert 50% of their North American and China footprint to EV by 2030. The company is investing in EV assembly facilities to reach this goal. Increasing their international market share will also likely add to earnings growth.

The company is also moving forward on its integrated autonomous vehicle (AV) strategy with Cruise. GM now owns about 80% of Cruise after acquiring SoftBank’s equity ownership stake for $2.1 billion and making an additional $1.35 billion investment in the company.

GM may also opportunistically repurchase shares, however, over the last decade, the company has actually increased its overall share count. Still, shares outstanding have decreased since their high in 2014.

In the short term, the microchip shortage and increased cost inflation weigh on the company’s performance, but increased pricing offsets this. The company is hard at work trying to increase margins in a difficult environment.

We project that the company can grow earnings per share by about 6.0% annually through 2027.

Competitive Advantages & Recession Performance

General Motors has a relatively stable position in the US market and the Chinese market, and General Motors is among the best-positioned companies in the truck market. The company has a massive network of dealerships from which to market and sell their vehicles. GM also invests heavily in R&D and in its AV strategy with Cruise.

General Motors’ dividend was cut in 2020, and the company had to be restructured following bankruptcy during the Great Financial Crisis. All this to say, GM is not a reliable dividend payer, and is not recession resistant. Income investors, or dividend growth investors, may be better off keeping their distance from GM as an investment.

Valuation & Expected Returns

Shares of General Motors have traded for an average price-to-earnings multiple of around 7.6 and 6.9 in the last ten and five years, respectively. Shares are now trading below this average, which indicates that shares could be undervalued at the current 4.7 times forward earnings.

Our fair value estimate for General Motors stock is 6.5 times earnings. If this proves correct, the stock will benefit from a 6.8% annualized gain in its returns through 2027.

Shares of General Motors currently pay no dividend, which compares unfavorably to the ten-year average yield of 3.2%. Before 2020, the company paid a $1.52 annual dividend. This was cut near the beginning of the COVID-19 pandemic, but earnings actually grew following the initial drop as the demand for autos was immense.

Putting it all together, the combination of valuation changes and EPS growth produces total expected returns of 13.2% per year over the next five years. This makes General Motors a buy, but the company has a poor history, and hasn’t produced much in terms of total returns since its listing in 2010.

Final Thoughts

General Motors has undergone numerous transformations over the decades. Today, the company is aggressively moving towards an all-electric fleet. The company is also investing heavily in autonomous vehicles. The landscape is fierce and competitive.

GM is not a reliable income or dividend growth stock, as the company has both undergone bankruptcy in the past and cut its dividend.

Today, GM appears to offer solid value and an intact growth thesis, but its total return history is lacklustre.

Other Dividend Lists

Value investing is a valuable process to combine with dividend investing. The following lists contain many more high-quality dividend stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].