Dimitrios Kambouris/Getty Pictures Leisure

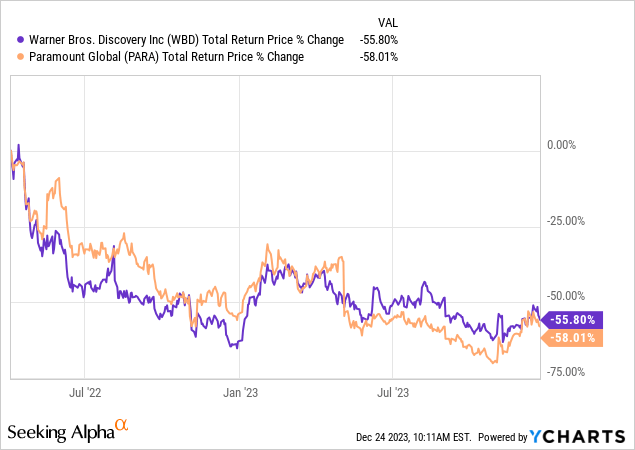

The response by Wall Road analysts relating to a attainable merger between the 2 media corporations was largely detrimental. Warner Bros. shares fell 5% on the information. Shares of each Warner Bros. Discovery (NASDAQ:WBD) and Paramount World (PARA) have carried out horribly, with each down over 50% since April 2022. They’ve been affected by disappointing theatrical releases, unprofitable (Paramount+) to barely worthwhile (Max for WBD) streaming companies and the gradual loss of life of cable networks. Warner Bros. guides for substantial beneficial properties in streaming earnings by 2025 and synergy financial savings. Discussions inside Warner Bros. about whether or not it must make a take care of Paramount or one other media firm to make its streaming content material bundle extra engaging have been ongoing. These discussions are stated to nonetheless require extra time and additional consideration.

The corporate stories in three segments: Studios, Networks (HBO, CNN, TNT, CBS, MTV, and Comedy Central), and the Direct-to-Shopper (DTC) phase. Studios includes the earnings from function movies and licensing of tv applications, Networks is for the home and worldwide tv networks, whereas DTC is for the premium pay-TV and streaming companies. Studios, Networks, and DTC made up 22%, 74%, and three% of the final quarter’s adjusted EBITDA respectively. Warner Bros. Discovery is accessible in 220 international locations and 50 languages.

The analyst negativity in direction of a deal largely stemmed from the leverage of the businesses, in addition to the dearth of scale in comparison with Netflix and Disney. This rationale for why a deal could be unhealthy is a bit onerous to observe given a merger is exactly one approach to tackle each of the problems analysts are frightened about. Some analysts imagine that even a mixed firm wouldn’t have sufficient content material to help maintainable development however clearly a greater diversity could be provided by the mixed firm in comparison with what both might supply by itself. The regulatory evaluate course of would seemingly haven’t any likelihood of continuing rapidly or easily given Lina Khan’s scrutiny of any merger that may pose anticompetitive issues.

A proposal from Warner Bros. would seemingly come within the type of an all inventory providing given its heavy debt burden. This might examine poorly to potential competing bids that supply a money element. Given the problem of constructing a deal occur, another choice could be a three way partnership that mixes Max and Paramount+. The merger would promise billions in financial savings in studio operations in addition to from combining the overlapping cable networks. The elevated content material providing would enable the corporate to compete in opposition to the opposite media giants (Disney (DIS) & Netflix (NFLX)) as one other business strikes extra firmly in direction of an oligopoly.

|

Firm |

Market Cap |

EV/EBITDA |

P/E |

ROEQ % |

P/S |

Debt/Eq |

|

WBD |

27.48B |

3.52 |

– |

-10.35 |

0.65 |

1 |

|

PARA |

9.77B |

39.1 |

– |

-6.58 |

0.32 |

0.79 |

|

NFLX |

213.05B |

10.68 |

48.54 |

21.23 |

6.51 |

0.76 |

|

DIS |

166.6B |

16.42 |

70.74 |

2.42 |

1.88 |

0.51 |

Financials

The corporate’s financials paint a combined image identical to the projections from the assorted analysts. On one hand the corporate has demonstrated the power to constantly generate constructive free money circulate together with $2.851 billion within the final 9 months. Nevertheless, web revenue was detrimental in 2022 in addition to for the final three and 9 month reporting durations. This was largely pushed by amortization of acquisition associated intangibles in addition to restructuring bills. The corporate operates with substantial leverage with a debt to fairness ratio barely under one. The typical maturity of its debt is 15 years and the corporate was capable of repay $2.4 billion in Q3. Thankfully, the corporate has lower than three billion maturing yearly on common over the subsequent 5 years because it factors out within the newest earnings presentation. The corporate aim is to realize long run gross leverage (gross debt divided by the newest 4 quarters of adjusted EBITDA) of two.5 to three instances

Discounted Money Circulate Valuations

A number of DCF mannequin variations that assume a ten% low cost price present us that Warner Bros. has the potential for substantial upside. Any optimistic projections require assumptions that it may maintain profitability and free money circulate whereas deleveraging the steadiness sheet. We have to see proof of the customarily talked about synergy financial savings. Warner Bros. had a mean EPS of 0.65 over the past 5 years. If we assume a mean 20% development price over the subsequent 5 years, WBD is at the moment buying and selling at 66% of honest worth. This mannequin exhibits WBD as undervalued if we assume no less than an 11% development price over the subsequent 5 years.

|

2022 |

2021 |

2020 |

2019 |

2018 |

|

|

Diluted EPS |

(3.82) |

1.54 |

1.81 |

2.88 |

0.86 |

If we excluded 2022 and begin with the bottom EPS quantity from the prior 4 years from 2018 of 0.86 the mannequin would look a lot completely different. In that case any common annual development price over 5% would present that WBD is buying and selling at a reduction to honest worth.

Specializing in the presumed future development driver, streaming, the corporate reported 95.1 million subscribers in Q3 which was 0.7 million lower than reported for Q2. The corporate is aiming for $1B+ profitability from the direct to client subscription companies globally by 2025. Warner Bros. expects the phase to be no less than break-even in 2023 and initiatives $5.3B of total free money circulate for the yr.

Last Ideas

An funding in Warner Bros. Discovery falls firmly within the speculative class given all of the uncertainties and questions on the way forward for media and the leveraged steadiness sheet. Which streamers will develop or survive as shoppers examine the completely different content material choices and cancel one subscription to leap to a different. If Warner Bros. can obtain its synergy financial savings estimate of over $5 billion and the $1B plus profitability goal for its streaming enterprise the inventory would shoot larger. This might particularly be the case if we see actual indicators the corporate can deleverage the steadiness sheet. Given the uncertainty and huge decline within the shares, we imagine it’s time for an opportunistic preliminary funding in Warner Bros. with strategic additions in the course of the ups and downs that may include the continuing merger discussions and shifts within the media panorama.