- Escalating U.S.-China commerce struggle is concentrated on the semiconductor trade

- Each nations wish to ramp up investments in mass manufacturing of semiconductors

- Amid the geopolitical standoff, one in every of these three firms may come out on prime

Final 12 months was outlined by a rising commerce struggle between the USA and China centered round semiconductors. These tiny however essential parts, sometimes called the “oil of the twenty first century,” play a significant function in producing digital gadgets which have develop into an integral a part of our each day lives, starting from easy calculators to highly effective computer systems.

With the rise of synthetic intelligence, the demand for built-in circuits, chips, and superior electronics is predicted to skyrocket. This development has caught the eye of governments worldwide, as they acknowledge the strategic significance of those applied sciences.

So, how will firms main the worldwide semiconductor manufacturing fare within the race to mass-produce semiconductors?

Utilizing InvestingPro instruments, Let’s analyze which firms could be thought-about on your portfolio because the commerce struggle unfolds.

You are able to do so for nearly any inventory by clicking on the next hyperlink: Begin selecting shares in the present day!

Taiwan Semiconductor Manufacturing

One of many fundamental metrics in chip manufacturing is nanometers-in easy phrases, the smaller, the higher. Taiwan Semiconductor Manufacturing (NYSE:) is the world’s main producer of 5-nanometer chips, nevertheless it additionally produces 3-nanometer, 4-nanometer, and can quickly produce 2-nanometer chips.

The corporate employs greater than 50,000 folks and produces greater than 10 million semiconductor merchandise yearly. Though the primary quarter of this 12 months was barely weaker than the earlier quarter (typical for the corporate over the previous few years), income and internet income have remained secure.

TSMC Income Development

Supply: InvestingPro

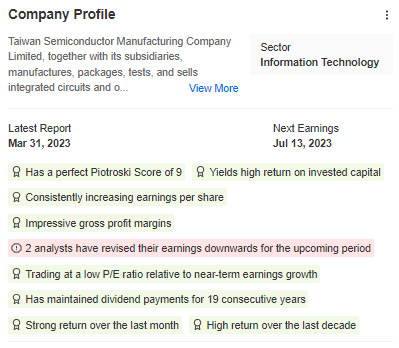

InvestingPro features a profile abstract that lists the basic traits of an organization. For TSMC, the optimistic traits outweigh the unfavourable ones.

TSM Firm Profile

Supply: InvestingPro

Geopolitical danger poses a major risk to TSMC’s enterprise, notably resulting from potential Chinese language aggression. The USA has taken a agency stance in defending the island, creating a possible flashpoint for future battle.

This example provides uncertainty and challenges to the corporate’s operations and development prospects.

Samsung Electronics

Samsung Electronics (LON:) confronted challenges within the first quarter of 2023 resulting from demand points, ensuing within the firm’s lowest working revenue since 2009 at $455 million.

Surprisingly, the corporate’s inventory didn’t lose a lot. As an alternative, it has continued its uptrend because it approaches the subsequent milestone at $1400.

Trwa wojna o półprzewodniki. Które spółki mogą być największymi wygranymi?

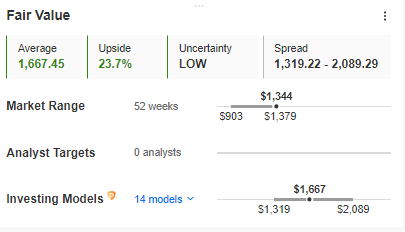

Nevertheless, the inventory nonetheless has extra room to rally, based on InvestingPro. Its truthful worth is estimated at round $1660-1670 per share.

Samsung Truthful Worth

Supply: InvestingPro

The persistence of development regardless of weak quarterly outcomes highlights buyers’ excessive hopes for this sector. It’s broadly thought to be one of the vital promising industries within the years to return.

Qualcomm

Qualcomm (NASDAQ:), a worldwide semiconductor producer, provides chips to a variety of shoppers spanning from watches to highly effective PC servers. A extremely anticipated occasion this 12 months is the launch of the brand new Snapdragon 8+ Gen 3 processor, following the discharge of Era 2.

Outstanding cellphone producers Xiaomi and Oppo eagerly await this launch. Nevertheless, there may very well be potential geopolitical dangers related to partnering with these main producers from China.

From a technical perspective, the corporate’s inventory worth has proven a powerful restoration close to the latest lows of round $102, indicating a double-bottom formation.

Qualcomm Each day Chart

Consumers might face a provide zone close to $125, however a rally towards this 12 months’s peak worth of $140 per share is all the time doable.

InvestingPro instruments help savvy buyers analyze shares, like we did on this article. By combining Wall Road analyst insights with complete valuation fashions, buyers could make knowledgeable selections whereas maximizing their returns.

Begin your InvestingPro free 7-day trial now!

Discover All of the Information you Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counseling, or advice to speculate as such it isn’t meant to incentivize the acquisition of property in any manner. I want to remind you that any sort of asset, is evaluated from a number of factors of view and is extremely dangerous and subsequently, any funding choice and the related danger stay with the investor.