- Fed minutes present cut up over September lower however Wall Avenue rallies

- Greenback eases from close to 2-month excessive as focus turns to CPI report

- Gold and oil steadier after latest losses

Fed Minutes Add Little Readability

The minutes of the Federal Reserve’s September coverage assembly revealed on Wednesday did little to finish the uncertainty concerning the tempo of fee reductions over the approaching months. Policymakers had been divided over whether or not 50 foundation factors was the suitable dimension to start the rate-cutting cycle and whereas a “substantial majority of contributors” supported the transfer, it appears that evidently some might have completed so reluctantly.

Fed officers had been additionally eager to emphasize that September’s outsized lower shouldn’t be interpreted as a sign for fast coverage easing.

However, the considerably much less dovish-than-anticipated minutes didn’t spark a lot response within the markets, with expectations of a 25-bps fee lower in November falling solely barely.

Fairness Markets Stay Upbeat

Shares on Wall Avenue briefly dipped after the minutes earlier than recovering to complete the session increased. The closed at a brand new all-time excessive, suggesting investor confidence is excessive as merchants enter the Q3 earnings season, which will get into full swing on Friday with the key financial institution earnings.

Nvidia (NASDAQ:) has been a key driver of the most recent upswing on Wall Avenue amid robust demand for its new Blackwell AI chip. However its inventory closed decrease on Wednesday because the rally paused for breath. Google mum or dad, Alphabet (NASDAQ:), additionally bucked the broader market development as ongoing worries concerning the US authorities’s efforts to separate the enterprise proceed to weigh on the inventory.

Globally, the bullish sentiment has been bolstered currently by China’s newest stimulus insurance policies. After the frustration concerning the absence of any new measures in Tuesday’s press briefing, traders are hopeful there will probably be extra particulars within the subsequent scheduled announcement this Saturday. Particularly, markets need to see how Beijing will use fiscal coverage to spice up the economic system, and particularly, the property sector.

Greenback Regular Forward of CPI Report

In foreign exchange markets, the was buying and selling flat close to two-month highs towards a basket of main currencies, because the climb in Treasury yields slowed. Towards the , the buck settled within the 149 area after reclaiming the deal with yesterday.

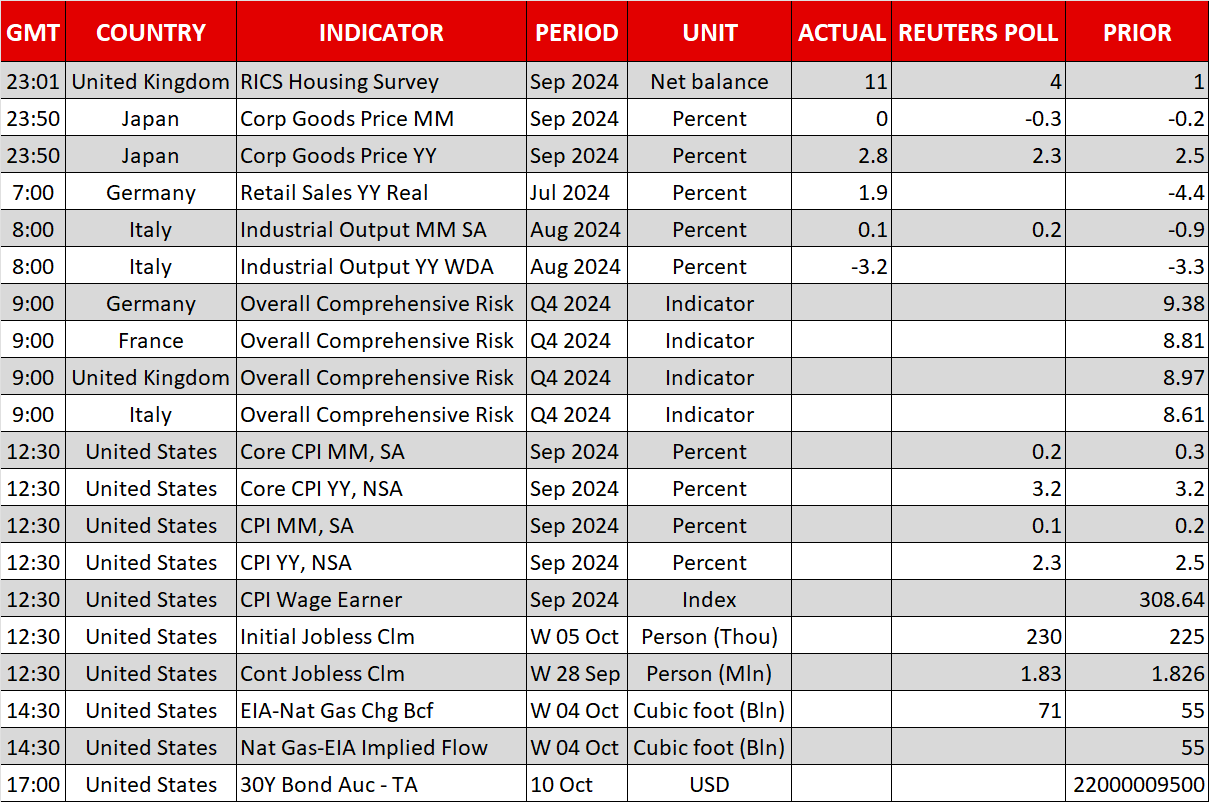

Markets are more likely to keep in consolidation mode till the discharge of the US CPI report at 12:30 GMT. The info is predicted to indicate a drop within the headline determine to 2.3% however no change in core CPI at 3.2%. Any important upside surprises that make a fee lower in November much less doubtless may push the greenback even increased whereas placing an finish to the rally in US equities.

Gold Halts Decline, Oil on Alert for Israel’s Subsequent Transfer

Such a state of affairs would even be damaging for , which has simply managed to halt a week-long slide. The valuable steel has been in a gradual retreat because the greenback recovers from its late September lows. Heightened tensions within the Center East have offered some assist, however for oil, there’s been a pointy pullback this week as Israel weighs its response to the latest Iranian assault.

are barely increased right now, however a resumption of the pullback is probably going until Israel carries out its deliberate retaliatory strike within the coming days.