Michael M. Santiago/Getty Photographs Information

Inflation is your #1 enemy in the long run

This text analyzes Walgreens Boots Alliance (NASDAQ:WBA) and CVS Well being (NYSE:CVS) beneath the context of a long-term holding in our household retirement portfolios. Each are good examples for instance our funding technique and the philosophy of our newly launched market service. We’ve got been holding each for a number of years and have exited our CVS place just lately as a consequence of its valuation enlargement (to be detailed later), and we’re nonetheless holding WBA.

You will notice why they’re good candidates to battle the surging inflation, the #1 enemy for long-term monetary safety. You would possibly really feel a bit unusual that we maintain a inventory like WBA or CVS for this objective. You might be most likely extra acquainted with the concept of utilizing high-yield inventory to battle inflation. And WBA’s dividend yield is “solely” 4% and CVS about 2%.

A key lesson we have realized is that at any stage in life, we all the time want to obviously delineate short-term points from long-term points. So opposite to the favored recommendation of constructing “a” retirement portfolio or “the” excellent retirement portfolio, we advise you all the time construct 2 portfolios – one for the long run (for instance, to care for issues 30 years later and property planning for teenagers/grandkids) and one for the quick time period (in case it’s essential to go to the ER subsequent month). That is diversification at a grand degree!

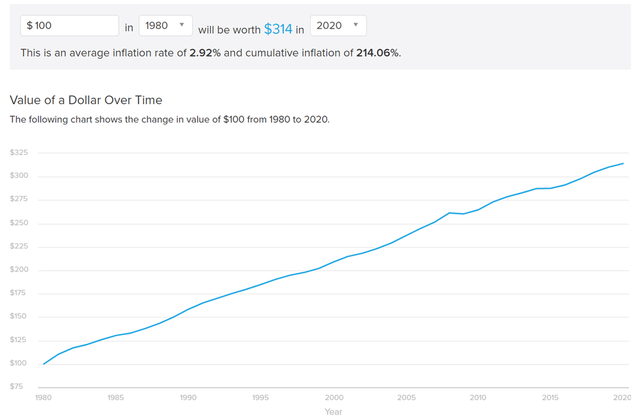

And inflation is your #1 enemy in the long run, as you may see from the next chart. In 40 years, you’ll need greater than $314k to keep up the identical buying energy of a present $100k revenue if inflation averages 2.92% – the common inflation within the US from 1980 to 2020. Additionally, observe that the inflation charge between 1980 and 2020 is comparatively delicate. In the event you shift the timeframe by 10 years to 1970 to 2010, the common historic inflation charge can be 4.45%, and greater than $562k can be wanted to keep up the identical buying energy of a present $100k revenue.

Supply: smartasset.com/investing/inflation-calculator

Underneath this background, hope it now feels much less unusual why we think about WBA and CVS for anti-inflation functions in our retirement portfolios. The concerns are for his or her long-term prospects, not for the present revenue or short-term acquire. You will notice from this text why they could be a key hedging piece in opposition to a number of long-term dangers. Specifically:

- Each WBA and CVS have demonstrated pricing energy in the long run to not solely hedge inflation threat but additionally to battle again. They each take pleasure in secular help in the long run as a result of healthcare price has and can proceed to surpass inflation.

- Moreover, each additionally present an earnings yield that’s properly above treasury charges, due to this fact offering you with a secure cushion in opposition to curiosity uncertainties.

- Each characteristic an inexpensive valuation, each in relative and absolute phrases. In WBA’s case, it options a big low cost, offering an extra margin of security.

- And at last, each take pleasure in shiny development prospects within the coming years. As to be detailed later, for WBA, I’m optimistic concerning the new management workforce and their initiatives on development, particularly the in-store healthcare clinics. For CVS, it enjoys development alternatives from its vertical integration and the aggressive roll-out of its digital and in-store clinics. Lastly, the expansion stagnation as a consequence of COVID vaccination must be solely momentary for my part.

WBA and CVS: Endurance and pricing energy

You might be most likely extra acquainted with the concept of utilizing high-yield inventory to battle inflation. Nonetheless, in the long run, pricing energy and endurance are the final word hedges in opposition to inflation. And each WBA and CVS have demonstrated loads of pricing and endurance.

Firstly, each are aided by a secular tailwind in the long run. The healthcare sector is a good place for worth traders as a result of it caters to a basic human want that isn’t going to alter or go away anytime quickly. All indicators present that the necessity will solely intensify with inhabitants development, longer life expectancy, extra interconnected world, et al. The next projection from the US Medicare and Medicaid heart highlights such long-term secular help. Nationwide well being spending is projected to develop at a median annual charge of 5.4%, far exceeding inflation, for 2019-28 and to succeed in $6.2 trillion by 2028.

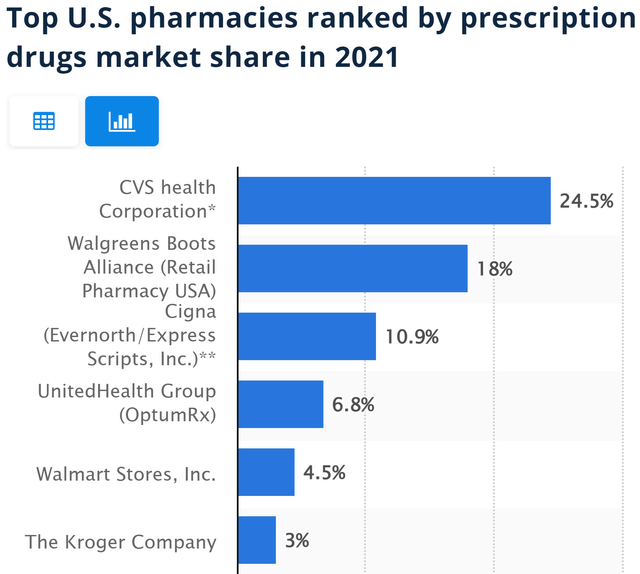

In addition to the secular help, each additionally enjoys a large moat as a consequence of their scale and depth of attain. CVS and WBA are the highest 2 pharmacies by pharmaceuticals, as you may see from the next chart, and I’m optimistic that they are going to keep as the size chief. The market has apprehensive concerning the competitors from new on-line entrants equivalent to Amazon a number of years in the past. Nonetheless, I feel the market exaggerated the competitors and overacted to it. Let’s put issues beneath historic perspective and study a latest case research when Walmart entered the retail pharmacy market. At the moment, WMT was as formidable a drive as Amazon is right now. But, it took greater than a decade for Walmart to seize about 4.5% of its market share right now. And the market share grabbed by Walmart got here from the weaker gamers, not the highest gamers like WBA or CVS. Since Walmart entered the retail pharmacy, the market shares of WBA (and CVS too) have truly grown.

Supply: Largest U.S. pharmacy by prescription income share from Statista

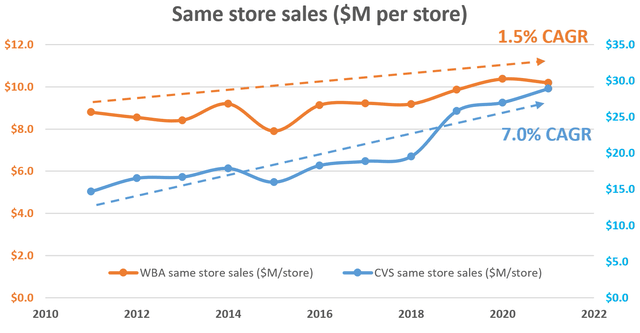

One other very telling indicator of their aggressive benefit is the same-store gross sales, as proven within the following chart. First, once more, each WBA and CVS have truly been rising each in scale and profitability since Amazon determined to hitch the pharmacy house. The variety of shops elevated from 8,210 initially of the last decade to about 14,000 right now. And on the similar time, their same-store gross sales have additionally elevated as seen from the chart beneath. In WBA’s case, it elevated from about $8.5M per retailer in 2011 to greater than $10M per retailer now, at an annual CAGR of 1.5%. CVS’ case is much more spectacular. It elevated from about $14.7M per retailer in 2011 to nearly $29M per retailer now, at an annual CAGR of seven.0%. A big cause of CVS’ higher same-store metrics includes its acquisition of Aetna in 2018. The acquisition of Aetna created substantial vertical consolidation alternatives and accelerated the same-store development as you may see by the uptick after 2018 within the chart beneath.

However in each circumstances, the same-store gross sales are fairly wholesome and aggressive. To place issues beneath perspective, the gross sales of a Walmart retailer on common are about $50 million, about 5 occasions that of a WBA retailer and two occasions of a CVS retailer. However take into consideration how a lot bigger a WMT retailer is in comparison with a WBA or CVS retailer to make the additional gross sales.

Writer

WBA and CVS: Earnings yield far above rates of interest

One other issue inseparable from inflation is the risk-free charges. If treasury bonds yield considerably above inflation, then preventing inflation can be fairly easy. For instance, if 30-year Treasury bonds yield 4%, then buying them would shield in opposition to inflation as much as 4% for the following 30 years.

Nonetheless, the present low rate of interest surroundings definitely makes preventing inflation very difficult for atypical traders. With the present 10-yr treasury bond yield charge close to 2.3% and inflation anticipated to be 7%+, bond traders can be truly shedding cash – fairly a bit at the very least within the quick time period. Though observe that this dialogue largely is dependent upon the timeframe. I don’t anticipate the present 7%+ inflation charge to maintain itself in the long run. And within the case that it does, then the Treasury yields must modify and will not stay solely at 2.3%. However beneath the present circumstances and within the close to time period (undecided how lengthy it will final), bond traders can be taking return-free dangers as an alternative of having fun with the risk-free return that bonds are supposed to supply.

That is the place WBA and CVS will help in a second means.

Many traders solely think about dividend yield as “yield”. Admittedly, for traders who search present revenue, solely a money dividend issues. Nonetheless, for different long-term traders, incomes yield is what’s actually issues. The reason being that it would not actually matter how the enterprise makes use of the earnings (paid out money dividends, retained within the checking account, reinvested to additional develop the enterprise, or used to repurchase shares), so long as used sensibly (as each WBA and CVS has demonstrated previously), it will likely be mirrored as a return to the enterprise proprietor. That’s the reason incomes yields are extra basic for long-term shareholders.

Specifically, I particularly favor using pretax earnings (or EBT, earnings earlier than taxes) yield for the next causes as detailed in my different writings:

• After-tax earnings don’t mirror enterprise fundamentals. Taxes can change infrequently as a consequence of components that haven’t any relevance to enterprise fundamentals, equivalent to tax regulation adjustments and capital construction change. Plus, there are many methods to decrease the precise tax burden of an organization.

• Pretax earnings are simpler to benchmark, say in opposition to bond earnings. The perfect fairness investments are bond-like, and once we converse of bond yield, that yield is pretax. So a 10x EBT would offer a ten% pretax earnings yield, straight corresponding to a ten% yield bond.

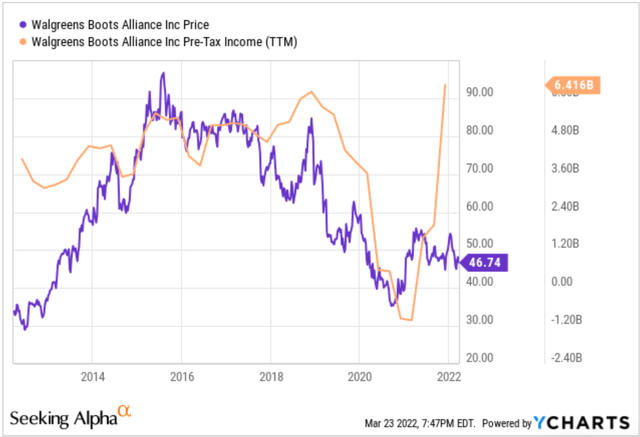

And as of this writing, WBA is buying and selling at about 7.8x FW EBT and CVS at about 9.3x FW EBT, due to this fact each equal to an fairness bond yielding 10%+.

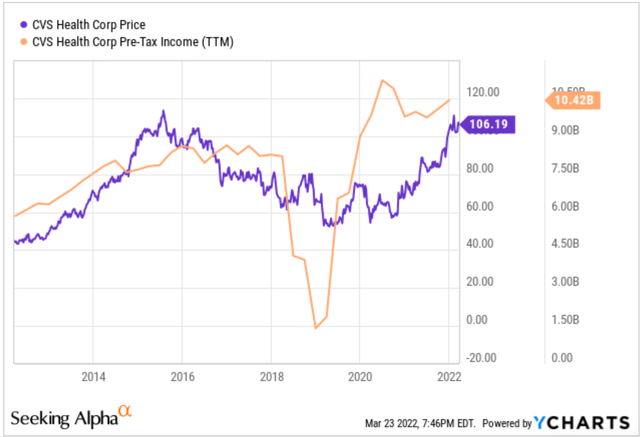

Searching for Alpha and YCharts Searching for Alpha and YCharts

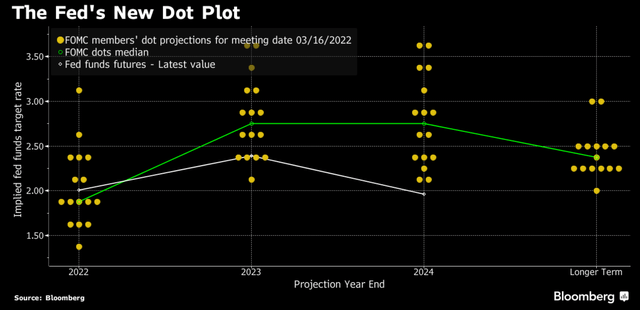

Now, let’s think about the more severe situation for the rates of interest within the subsequent few years based mostly on the Fed’s dot plot as proven beneath within the chart beneath the desk. The chart exhibits the dot-plot from the latest Fed assembly minutes. And their longer-term projections are within the vary of two% to three%, on common 2.5% above the present near-zero charges. Let’s suppose the rates of interest do rise in line with this dot plot. And to make a worst-scenario forecast, let’s additional assume that A) the charges rise to the ceiling of this dot plot, and B) the 10-year treasury charges all the time keep about 2% above the Fed fund charges. Underneath these assumptions, the 10-year treasury charges might be about 5% in the long run.

As seen, even beneath these dramatic assumptions, each WBA and CVS nonetheless present a yield unfold comfortably above or on par with the 10-year treasury charges – even when their earnings utterly stagnate for the following few years.

Supply: Fed’s newest dot-plot launched Mar 2022.

WBA and CVS: Each moderately valued

Lastly, let’s check out their valuations.

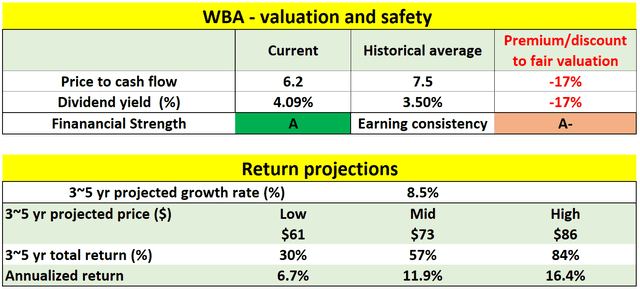

For WBA, as you may see from the desk beneath, it’s considerably undervalued, by about 17%, each when it comes to dividend yield and worth to money stream multiples. For the following 3-5 years, an higher single-digit annual development charge is predicted (about 8.5%) in my evaluation. And the consensus tasks a good greater development charge, about 11% CAGR to 2026. Even with an 8.5% development charge, the whole return within the subsequent 3-5 years is projected to be in a spread of 30% (the low-end projection) to about 84% (the high-end projection), translating right into a wholesome 6.7% to 16.4% annual complete return. The important thing development drivers in my evaluation are:

- The brand new management workforce and their initiatives on development. WBA has appointed Rosalind Brewer as the brand new Chief Government Officer, and Stefano Pessina as Government Chairman of the Board. Brewer is a 35-year shopper and retail trade veteran with deep expertise in transformational, operational, and digital methods. Pessina is an trade legend who constructed the WBA as it’s right now. And he holds a 16.5% stake in WBA, and nearly all of his private fortune is vested in WBA. I’m very optimistic about this new administration workforce – a really succesful CEO and a board chair who has actual pores and skin within the enterprise.

- And I welcome most of the new initiatives that they’re enterprise. Walgreens is investing in in-store healthcare clinics and enterprise main portfolio reshaping. It has just lately acquired majority stakes in VillageMD and CareCentrix. These investments ought to reignite earnings development in fiscal 2023 and thereafter.

- Lastly, at its present undervaluation, share repurchases might be very efficient and accreditive to spice up shareholder returns.

Writer

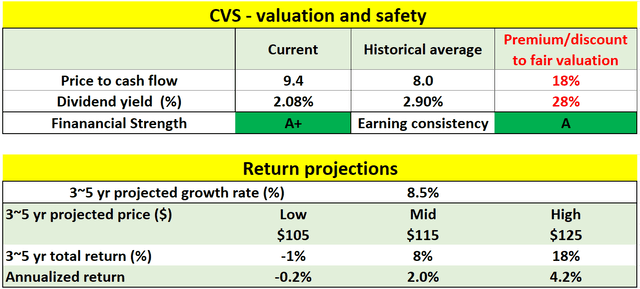

For CVS, as you may see from the desk beneath, it’s reasonably overvalued, by about 18% when it comes to its historic worth to money stream multiples and by about 28% when it comes to its historic dividend yield. For the following 3-5 years, the same development charge is predicted (about 8.5%) contemplating its Aetna integration and rollout of clinics. Resulting from its present valuation, the whole return within the subsequent 3-5 years is projected to be in a spread of -1% (i.e., breaking even) to about 18% (translating right into a 4.2% annual complete return). It’s not essentially the most thrilling return. Nonetheless, it’s extra interesting than on the floor when adjusted for dangers should you think about its tremendous monetary power (A+), incomes consistency (A), and in addition the secular tailwind aforementioned. Wanting ahead, the important thing development drivers embody:

- Every of CVS’ three enterprise models inked between 9% and 10% advances. Specifically, CVS has been aggressively rolling out its digital and in-store healthcare clinics.

- As a result of slowing projection of Covid-19 vaccination charges, administration is anticipating stagnation for 2022. Nonetheless, the expansion charge is projected to choose up once more, and administration expects excessive single-digit development in 2023 and double-digit beginning 2024 to 2026 – very in keeping with the consensus estimates.

- Lastly, there may be additionally a risk for that further COVID-19 photographs could also be accredited and supply one other catalyst for CVS.

Writer

Dangers

Although each shares face some dangers – dangers frequent to each and in addition dangers distinctive to every of them.

Each shares face some draw back dangers because of the pandemic. Each shares had been impacted on the entrance finish and pharmacy gross sales throughout the COVID-19 outbreak. Though the vaccination is progressing extensively, the pandemic is much from over but, and uncertainties like new variants nonetheless exist. The interruptions proceed to harm retailer foot visitors.

Each (and the healthcare sector generally) are uncovered to coverage uncertainties too. Reimbursement strain, greater prescription attrition from Half D relationships, and the chance of disruptive drive coming into the provision chain (equivalent to Amazon) all pose dangers to its basic profitability.

For WBA, there are some uncertainties with its present process initiatives. The management is enterprise a spread of strategic restructures. A few of the key efforts embody the latest divesture of Alliance Healthcare, its latest $970M funding in Shields Well being Options, and a possible takeover of healthcare IT agency Evolent Well being. I’m bullish about these strategic initiatives myself. Nonetheless, these initiatives have excessive uncertainty and excessive reward taste, and all have a level of uncertainty of their outcomes.

For CVS, it relies upon extra closely on debt financing after its Aetna acquisition, and there are some dangers with Fed’s plan to boost rates of interest within the close to time period. CVS’s present long-term debt is about $58B. Therefore, a 1% enhance in its rate of interest would translate into $580M of further curiosity bills. Its web revenue is about $10.4B in 2021. Due to this fact, the extra curiosity bills are about 5.5% of its web revenue, a non-negligible threat. Though, the fact is extra difficult and could possibly be higher or worse than my estimate right here. For instance, there’s all the time the chance that the rates of interest rise extra dramatically than the Fed’s present dot-plot, or that its borrowing charges rise sooner than the Fed charges. Alternatively, CVS’s debt (like all smart firm) is well-laddered. So the consequences of upper curiosity prices might be gradual and never abrupt to provide administration time to reply and adapt.

Conclusion and closing thought

This text analyzes WBA and CVS beneath the context of a long-term holding for our retirement portfolios. Initially, we advise you all the time delineate short-term and long-term monetary wants and construct 2 portfolios correspondingly. Second, all the time acknowledge the hazard of inflation in the long run.

Underneath this background, the thesis of this text is that each WBA and CVS present efficient hedges in opposition to a number of basic dangers in the long run. Specifically,

- In the long run, endurance and pricing energy are the final word hedge in opposition to inflation. And each WBA and CVS have demonstrated loads of each due to their scale and the secular tailwind of our rising want for higher healthcare.

- Each WBA and CVS additionally present earnings yields which can be far above treasury charges or the projected treasury charges. They thus present traders with a secure cushion in opposition to future rates of interest uncertainties.

- Lastly, WBA’s present valuation encompasses a substantial low cost. And CVS encompasses a cheap valuation each in absolute phrases and particularly in relative phrases. In comparison with the general market, each present a hedge in opposition to market valuation dangers.