jetcityimage

W.W. Grainger (NYSE:GWW) has accomplished phenomenally properly since my first article in October 2022, delivering 67% complete returns versus 31% for the S&P 500. Let’s evaluate what occurred since then, what drove the expansion, and whether or not the inventory has remained attractively valued after the runup.

The funding thesis recap

Grainger is an industrial distributor with nearly all of its enterprise within the USA divided into:

- Excessive-tough Options (HTS): Targeted on mid to giant prospects with extremely complicated operations and processes

- Limitless Assortment (EA): A simple shopping for expertise for smaller and fewer complicated companies

- MonotaRO: A part of the Limitless Assortment phase, however working in Japan

We are able to see that Grainger solely has a 7% share in its largest phase (HTS), with the present addressable market solely round 12% of the full B2B provide market within the USA. This leaves a lot room for natural development by taking market share and increasing into new segments.

Whole addressable market (GWW Investor Day)

Grainger has an edge over its competitors attributable to its giant scale and concentrate on value-added buyer options. Scale is significant for distributors as a result of a big and dense community of branches means quicker and cheaper cargo, bettering the client expertise and working margins for Grainger. It additionally makes consolidation fascinating as a result of acquired branches improve the community and convey new buyer relationships and infrequently new SKUs (stock-keeping models) into the combination.

Buyer options are digital choices like a listing administration system, digital procurement assist or specialist consulting. This enhances the client expertise, makes Grainger a extra vital a part of the complicated processes of the client and locks them in.

Working outcomes

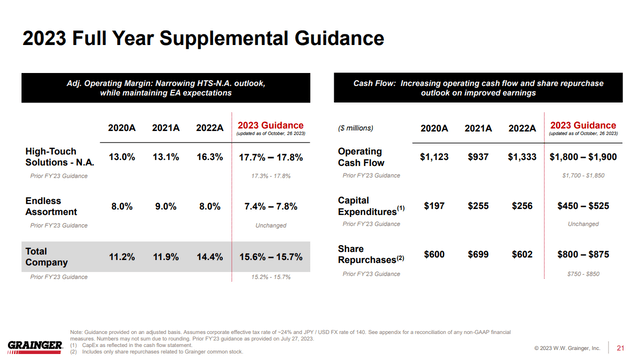

Whereas income had no surprises within the final 12 months (all 5 earnings since my earlier protection noticed ~1% distinction to analyst expectations), EPS stunned every quarter with 2-14%, exhibiting the sturdy working leverage Grainger managed to ship and with that earnings development. The corporate continues to spend a lot of its money stream on share repurchases and has considerably elevated capital expenditures to develop and assist its enterprise. I estimate that the enterprise spends $150 million on development capex, based mostly on the distinction between its capital expenditures and D&A bills (a good proxy for development capex).

GWW FY 23 steering (Q3 earnings)

E&R Industrial divestment

In December, Grainger divested its subsidiary E&R Industrial to Paradigm Fairness Companions, an LA-based PE agency. Whereas the corporate didn’t disclose many particulars concerning the transaction, in keeping with a number of sources like Datanyze, E&R Industrial had generated over $350 million in gross sales, representing round 2% of the corporate’s gross sales. I’d assume the paid a number of was decrease than the GWW Value/gross sales of two, and I’d guess the worth paid to be someplace round $500 million. Total, the divestment shouldn’t be materials to the funding case. Grainger has a historical past of divesting components of its companies.

Valuation

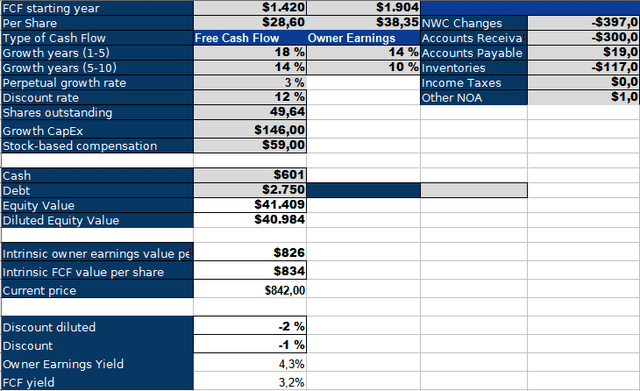

To worth Grainger, I once more use an inverse DCF mannequin. Since my preliminary protection, I made a number of modifications to my inverse DCF mannequin:

- I calculate FCF and Proprietor Earnings (FCF + development CapEx – SBC +/- modifications in NWC) and rely totally on the end result from Proprietor Earnings.

- I eliminated the shares depend discount from the calculation as a result of it double counts buybacks (the FCF used for buybacks is already included within the FCF quantity).

- I elevated the low cost charge for cyclical enterprise from 10% to 12-15% to account for the danger. As an industrial distributor Grainger depends on the financial system and is cyclical, therefore I exploit a 12% low cost charge.

GWW Inverse DCF Mannequin (Authors Mannequin)

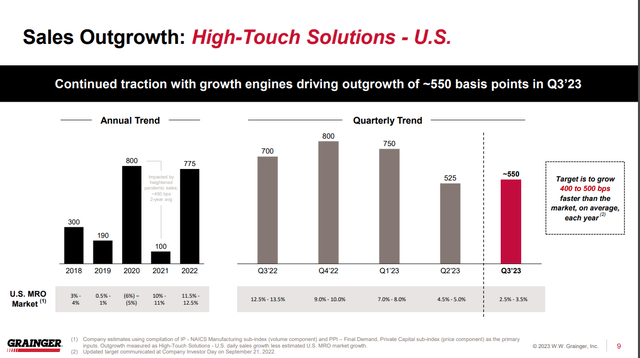

Based mostly on the present outcomes, Grainger could be required to develop by 14% for the subsequent 5 years, adopted by 10% for the next 5 years. I discover these development charges to be too excessive. Over the past 5 years, Grainger grew income by 8% yearly and EPS by 23%. I imagine income will proceed to develop round 6-9% attributable to incremental market share positive aspects, the market development according to inflation and community enlargement by way of capex and acquisitions. Grainger made it a goal to outgrow the general market by 400 to 500 bps a 12 months. I imagine they’ll obtain this purpose as a result of beforehand talked about components. Grainger managed to virtually double its internet earnings margin over the past 5 years and retired over 10% of the shares excellent. Revenue margins are actually at traditionally excessive ranges, considerably above ranges pre-pandemic, so I doubt that we’ll see vital additional enhancements. As a distribution enterprise, you possibly can solely develop margins to a sure extent. The pace of buybacks has additionally slowed as the corporate noticed quite a lot of a number of enlargement from 10 instances EBITDA to fifteen instances. This makes future buybacks much less efficient and lowers the influence on EPS.

Gross sales outgrowth in opposition to the market (Q3 Earnings)

Analysts share my considerations and anticipate the corporate to develop EPS within the mid to excessive single digits over the subsequent three years, with gross sales rising at 6% yearly. Grainger seems to be costly on the present stage, and I’ve to downgrade to a maintain. We have to keep in mind that I exploit a better low cost charge for my mannequin in comparison with the earlier evaluation, so buyers with a better danger tolerance may nonetheless discover Grainger enticing at these ranges.