z1b

I urged traders in main net-lease REIT W. P. Carey Inc. (WPC) to capitalize on its valuation dislocation in early November 2023. Again then, WPC bought off because of the implied uncertainties of its Internet Lease Workplace Properties (NLOP) spin-off. Consequently, WPC revisited the $50 degree (final re-tested in Could 2020), doubtless gorgeous weak holders into anticipating that the worst may nonetheless be over the horizon.

Nevertheless, by the point I offered my replace, astute value motion traders would have realized that WPC had been consolidating constructively at that degree for over 4 to 5 weeks. In different phrases, I assessed dip patrons helped WPC type a base earlier than staging a surging run from its early November lows, as weak holders offloaded their shares on the worst doable time.

With WPC recovering greater than 35% (adjusted for dividends) from its early October 2023 low via final week’s excessive, it is well timed for us to reassess whether or not traders ought to think about permitting the current optimism to chill off first. Think about that WPC continues to be down greater than 12% over the previous 12 months on a complete return foundation. Taking a 5Y and 10Y view, WPC posted a complete return CAGR of 5.4% and seven%, respectively. In different phrases, you possibly can have outperformed considerably over its long-term averages by profiting from its peak pessimism alternative laid out on a platter three months in the past. After such a exceptional restoration, allow us to revisit what has modified since early November that has bolstered such an enormous revaluation in WPC.

Recall that the Fed highlighted three potential price cuts in 2024. Nevertheless, in case you waited for the Fed’s sign (in mid-December) to take action earlier than choosing up the items in WPC’s battering, you’ll have missed out on the meat of the current transfer. Subsequently, whereas Fed Chair Jerome Powell and his FOMC colleagues doubtless performed a component, traders who accurately anticipated the transfer benefited extra considerably.

For REIT traders, I imagine it is clear why the Fed’s transfer issues. Sure, they haven’t reduce but, however the market is not going to attend until it cuts earlier than shifting to re-rating WPC. Think about WPC’s valuation priced in such steep pessimism in October 2023 that its AFFO per share a number of fell to 10.1x, effectively under its 10Y common of 13.9x. Subsequently, these dip-buyers capitalized on a extremely enticing valuation, anticipating a extra dovish Fed (shifting forward) as they moved so as to add publicity. That ought to be how WPC traders think about its bullish thesis, as it is a essentially robust and well-diversified REIT.

Because it curtailed its workplace publicity to 16% of its annualized base hire or ABR, it is anticipated to bolster W. P. Carey’s valuation tailwinds because it seems to be to reinvest. As well as, the corporate offered a current funding replace, highlighting a full-year funding quantity of $1.3B. It features a cadence of $320M within the fourth quarter, indicating the REIT’s skill to capitalize on enticing cap charges (weighted common: 7.7%) to spice up its portfolio. W. P. Carey additionally initiatives $180M in closures in January 2024, suggesting that the funding momentum is anticipated to hold on.

I imagine WPC traders are acquainted with the high-quality traits introduced by the REIT. It is rated BBB+ (steady) by S&P, specializing in single tenants and offering “steady and predictable money flows.” Given its current workplace portfolio spinoff, it has additionally allowed W. P. Carey to enhance its debt profile, serving to to keep up an adjusted EBITDA leverage ratio within the mid-to-high 5 ranges. With the Fed’s price cuts doubtlessly actualizing this 12 months, the market has doubtless re-priced its value of capital, bolstering its skill to maintain its improved AFFO payout ratio. Whereas I nonetheless see the potential for a lowered development profile in its same-store NOI as inflation charges peaked, it was doubtless priced in when WPC hit peak pessimism in October.

With WPC’s AFFO per share a number of crossing above the 14.2x degree just lately, it has additionally absolutely normalized in opposition to its 10Y common. In different phrases, I assessed that traders who missed shopping for three months in the past ought to think about ready for an additional extra enticing dip-buying alternative.

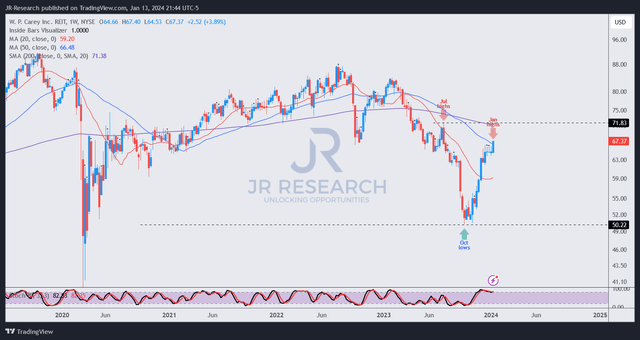

WPC value chart (weekly) (TradingView)

I gleaned that WPC’s resurgence may nonetheless have extra upside potential, reaching the $72 zone earlier than consolidating. Nevertheless, the chance/reward profile is far much less enticing than the one I assessed in early November. Moreover, such sharp momentum spikes may very well be extra susceptible to intense profit-taking as dip patrons reallocate their publicity to guard sharp features.

Consequently, it may additionally spur increased potential draw back volatility, presenting extra enticing alternatives for traders trying so as to add extra publicity. Consequently, I encourage traders to not chase the current surge in the event that they haven’t added. As an alternative, they’ll think about assessing potential consolidation zones inside the $56 to $59 degree so as to add extra publicity, partaking within the medium-term restoration in WPC.

Score: Downgraded to Maintain.

Vital observe: Traders are reminded to do their due diligence and never depend on the data offered as monetary recommendation. Please at all times apply unbiased pondering and observe that the ranking isn’t supposed to time a selected entry/exit on the level of writing until in any other case specified.

I Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a essential hole in our view? Noticed one thing necessary that we did not? Agree or disagree? Remark under with the intention of serving to everybody locally to study higher!