Zolak/iStock via Getty Images

Company Background

VY Global Growth is a blank check company that came public on October 6, 2020. The offering was underwritten by Morgan Stanley and Deutsche Bank.

Mission Statement:

“We are a newly formed blank check company that intends to partner with a technology business that will benefit from our global expertise to define the future of its industry. We believe our investing and operating experience, together with our deep network of founder relationships, will enable us to identify a wide range of attractive potential business combinations”

Source: Prospectus

The management team is composed of several well-seasoned veterans in the technology space.

Alexander Tamas serves as the Chairman and Chairman of the Board of Directors. Mr. Tamas worked in the technology mergers and acquisitions group at Goldman Sachs (GS) before joining DST in 2008. At DST, he led and sourced technology investments in Facebook (META), Airbnb (ABNB), Spotify (SPOT), Twitter (TWTR), JD.com (JD), Alibaba (BABA), Xiaomi (OTCPK:XIACF) and Zalando (OTC:ZLDSF). After DST, Mr. Tamas founded Vy Capital, which is a technology investment venture capital firm. Mr. Tamas is also the founder of the data science company, Synaptic.

John Hering serves as the Chief Executive Officer and sits on the board of directors. Mr. Hering is also a founding Partner at Vy Capital. He has spent his entire career as a technology founder, entrepreneur, and investor. He co-founded Lookout, a leading global cybersecurity company. Lookout is backed by over $350 million in venture capital from investors including Andreessen Horowitz, BlackRock, T. Rowe Price (TROW), Goldman Sachs (GS), Morgan Stanley (MS), and Qualcomm (QCOM). Mr. Hering is a prolific technologist and has co-authored 43 patents, primarily in the fields of Cybersecurity, cloud, and mobile technologies.

Source: Summarized from Prospectus

Two of VYGG’s board members are also very high-profile names in the tech industry. Steve Huffman, the co-founder and CEO of Reddit, and Justin Kan, best known as the co-founder of Twitch, will both have active roles on the board of directors. Mr. Kan was also a partner at Y-Combinator, which has helped launch over 2,000 technology start-ups including Stripe (STRIP), Airbnb, Cruise Automation, DoorDash (DASH), Coinbase (COIN), Instacart (ICART), PagerDuty (PD), Dropbox (DBX), Twitch, and Reddit.

As of the time of this writing, the company has not yet identified a business combination.

Opportunity

As is the case with most SPACs, VYGG has 24 months to complete a business combination. The deadline for VYGG is October 6, 2022. If the company fails to identify a target prior to that date, then operations will cease and the company will be wound down. If the company does announce a business combination, then public shareholders will have an opportunity to redeem their shares at a price anticipated to be $10.00 per share.

In either scenario, an investor who purchases shares at today’s price of $9.87 should have the ability to redeem those shares for $10.00, on or shortly after October 6th. The annualized rate of return for that scenario is 4.68%.

In addition, owners of VYGG hold a free call option on any appreciation above $10.00. In the event that VYGG announces a favorable business combination which causes the stock price to rise above $10.00, investors who sell, will achieve an annualized return greater than 4.68%.

While many SPACs offer the same opportunity, VYGG in my opinion has one of the best chances of announcing a deal that excites the market. There have been rumors in the past that VYGG will engage in taking Reddit public. Although that is an unlikely scenario, even a small probability of the event adds significant value to the optionality embedded in VYGG. Apart from the Reddit rumors, the background of the management team does provide some optimism that a high-profile target could be identified.

Risks/Reward

Most blank check companies are structured in a similar fashion. One such similarity is that upon the IPO, the company deposits $10.00 per share into a trust account. That money is expected to be returned to shareholders who elect to redeem their shares either upon the completion of a business combination or in the event that a combination does not occur within 24 months.

In VYGG’s case, $575mm was deposited in a U.S.-based trust account maintained by Continental Stock Transfer and Trust Company, acting as trustee. Funds held in the trust account are invested only in U.S. government treasury bills with a maturity of one hundred and eighty-five (185) days or less or in money market funds which invest only in direct U.S. government obligations.

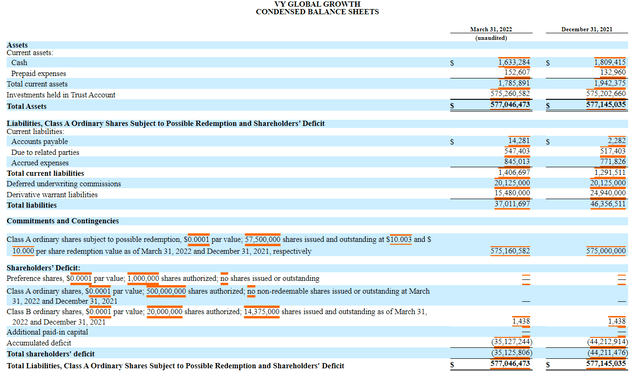

The most recent 10-Q for the quarter ending March 31st shows investments held in the trust account of $575,260,582. Which equates to $10.004 per share.

Balance Sheet (10-Q)

The main risk is that the company fails to return $10.00 per share to public shareholders. It would be remiss not to highlight the section of the prospectus titled risk factors which states the following on page 44:

If third parties bring claims against us, the proceeds held in the trust account could be reduced and the per-share redemption amount received by shareholders may be less than $10.00 per public share.

For the sake of brevity, I did not embed the full text from the prospectus, but readers should closely examine the risk factors from the link provided above, prior to investing in VYGG.

A Few Vital Points to Consider

It is important to keep the price sensitivity of this trade in mind due to the short-term nature of the investment. For every one-cent change in the price paid for VYGG, the annualized rate of return will be impacted by roughly 36 basis points. I have provided a table below for illustrative purposes.

| Stock Price | Days To Termination | Implied Annualized Yield To Termination |

| 9.85 | 102 | 5.41% |

| 9.86 | 102 | 5.05% |

| 9.87 | 102 | 4.68% |

| 9.88 | 102 | 4.32% |

| 9.89 | 102 | 3.96% |

| 9.90 | 102 | 3.60% |

| 9.91 | 102 | 3.24% |

| 9.92 | 102 | 2.87% |

| 9.93 | 102 | 2.51% |

| 9.94 | 102 | 2.15% |

| 9.95 | 102 | 1.79% |

| 9.96 | 102 | 1.43% |

| 9.97 | 102 | 1.08% |

| 9.98 | 102 | 0.72% |

| 9.99 | 102 | 0.36% |

| 10.00 | 102 | 0.00% |

Lastly, and most importantly, is that investors are required to follow the announcements from VYGG on the SEC website. Shareholders must tender their shares on or before the cut-off date that will be announced at some point prior to October. The majority of SPACs suffer severe declines after the redemption cut-off date, so make sure that you provide tender instructions to your broker well in advance of the deadline. Also, check to make sure that your broker does not charge any fees associated with the redemption.