Sjo

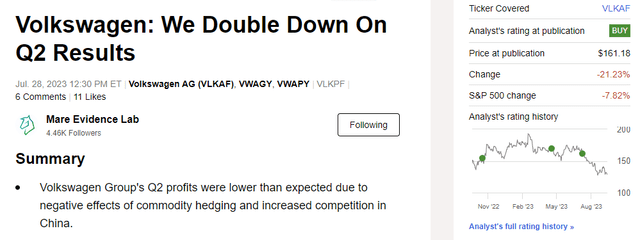

Right here on the Lab, we proceed to imagine that Volkswagen (OTCPK:VLKAF)(OTCPK:VWAGY) is ‘The Most Discounted Auto Inventory‘. Regardless of our double-down investments following the H1 outcomes and Mare Ev. Lab supportive sum-of-the-part valuation (Fig 1), the firm’s inventory worth additional declined (Fig 2). We’re extremely disenchanted, and at the moment, slightly than trying on the financials, we deal with the newest MACRO adjustments and new strategic developments throughout the firm. Given the stock growth and resilient expectations in 2024, we notice valuation anomalies on the present market cap (P911 fairness stake at €60 billion > VW market cap at €58 billion). Our inner crew continues to chubby the corporate, and we’re nonetheless assured that Volkswagen presents a pretty entry level on the present valuation.

Previous SOTP Valuation

Fig 1

Mare Previous Evaluation

Fig 2

EU helps

Final week, the European Fee introduced an investigation into Chinese language electrical automobile imports. Right here on the Lab, we anticipate that is essential for the sector. Reporting Ursula von der Leyen phrases: “The worldwide markets are actually flooded with cheaper Chinese language electrical automobiles. And their worth is saved artificially low by enormous state subsidies.” In our danger part paragraphs, Chinese language-made electrical automobiles signify probably the most vital danger for European automobile producers. Based on Allianz Commerce, until authorities authorities intervene, this may cost a little nearly €7 billion per 12 months when it comes to misplaced earnings between now and 2030. In 2022, three of the EU’s best-selling electrical autos have been imported from China. Chinese language automobile manufacturers recorded whole gross sales of 147,000 models in Europe, a market share of round 2.25% (it was 0.19% in 2019). Nevertheless, trying solely at whole electrical autos, the market share of battery-powered automobiles went from 0.5% in 2019 to eight.2%, because of the sale of 86,000 BEVs. Specifically, Saic Motor’s model (MG) recorded whole gross sales (ICE and electrical) of 104,000 automobiles, nearly doubling in comparison with the earlier 12 months, surpassing Mazda and Honda. To oppose this growth, the EU President reported that “too usually our corporations are excluded from overseas markets or are topic to predatory practices and are sometimes weakened by rivals who profit from vital state help.” Strengthening European competitiveness and supporting companies in Europe is now a high precedence. Von der Leyen determined to depend on Mario Draghi (former Italian Prime Minister and the ECB). We view Draghi’s appointment positively and imagine he’ll help European auto competitiveness. Following this information, we’d forecast greater duties on automobiles imported from China to guard EU automobile producers. The present European customary fee on automobile imports is at an advantageous 10% vs. an import US obligation at 27.5%. To raised assess the present surroundings, we also needs to report that European automobile producers pay tariffs between 15% and 25% to have the ability to export automobiles to China. Subsequently, a Chinese language retaliation appears unfair contemplating this reality.

Volkswagen Newest Replace

Final week, Volkswagen disclosed the Trinity challenge, which had already been postponed a number of instances. The economic facility chosen was the Zwickau plant, which might be devoted to electrical automobiles. As well as, the German newspaper Handelsblatt revealed the hiring of Sanjay Lal for Cariad. Sanjay is a former supervisor at Tesla (TSLA), Cisco (CSCO), and Google (GOOG) (GOOGL). Cariad is betting on the newcomer to get rid of the continued difficulties and delays which have slowed the launch of recent and essential fashions. Sanjay Lal lately developed a brand new software program platform for Rivian (RIVN) and will begin in November. Final week, the supervisory board allotted manufacturing plans till 2028, establishing its industrial websites to make sure worthwhile use of manufacturing capability and obtain the anticipated financial ends in the approaching years. By establishing the longer term manufacturing community in Germany, Volkswagen goals to attain probably the most environment friendly mannequin allocation and concurrently improve productiveness, two crucial features outlined on the capital market day. What’s vital to emphasise is that Volkswagen is now extra open to administration adjustments and exterior cooperation. Discussing the power of the corporate to vary triggers skepticism amongst traders; nevertheless, we should always recall Blume’s monitor document in Porsche. The corporate wants to vary, and there’s a have to make troublesome choices corresponding to value discount and decrease headcount. Change in administration’s perspective from insularity towards shared funding with cooperation and partnerships will repay. Volkswagen’s competitiveness is in danger, and the CEO is conscious of that.

Why are we nonetheless supportive?

After a considerable build-up in 2022, inventories elevated marginally in 2023 H1 as supply bottlenecks have been launched. In gentle of this, auto corporations have, on common, roughly 2.5 months of gross sales, which is an optimum degree for the business. Right here on the Lab, we forecast a major discount in inventories beginning in H2. Subsequently, we count on a reversal impact in 2024 working capital impact with a lift in Volkswagen’s money on the steadiness sheet. Confirming an absolute worth of EBIT at €24.9 billion for the following 12 months with a gaggle core working revenue margin of seven.7%, we’re elevating FCF growth to €15 billion. Subsequently, even when we’re not chasing a dividend yield (which we imagine might be confirmed and the corporate is yielding at 8%), Volkswagen trades at an FCF yield of virtually 25%. On a present P/E of three.5x, we predict Wall Avenue isn’t pricing the corporate with its long-term potential, and we reaffirmed our earlier valuation. Volkswagen’s final two years have been harsh, from no uplift in P911’s IPO valuation, disappointing EV shares, and dropping Chinese language management. In a nutshell, we will say that “what may go improper on the firm has gone improper.” Having mentioned that, Volkswagen’s market valuation isn’t justified contemplating its high quality portfolio. MACRO help from the European Union and visual change in administration, we’re nonetheless assured in VW’s future inventory worth appreciation.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.