grinvalds

Jerkiness is not as respectable because it was once, not even in L.A. Which is why they needed to construct Vegas. ― Ross Macdonald

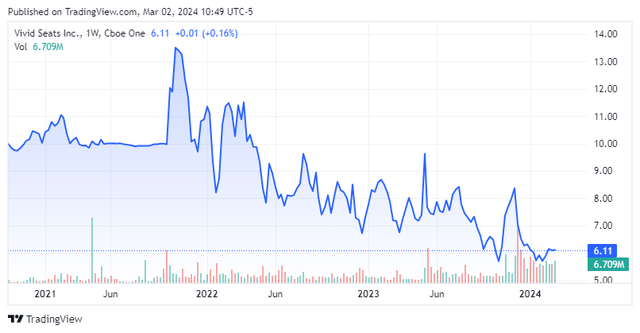

Shares of on-line ticket trade Vivid Seats Inc. (NASDAQ:SEAT) touched an all-time intraday low of $5.54 on February 2, 2024 as personal fairness overhang menaces. The shares have bounced again some 10% since. The corporate’s acquisitions of Vegas.com and Wavedash expanded its complete addressable market by greater than 50% in 2023 and can bolster income and Adj. EBITDA in 2024. With 76.2 million shares of personal fairness overhang remaining however previously bloated valuation metrics now much less so, this busted IPO merited a deeper dive. An evaluation/suggestion follows beneath.

Looking for Alpha

Firm Overview

Vivid Seats Inc. is a Chicago primarily based on-line ticket market, coordinating buyer funds and ticket supply by way of its web site and app. It additionally supplies a loyalty program, ticket insurance coverage, and fantasy sports activities choices. Vivid was fashioned in 2001 and went public when it merged into particular goal acquisition firm (SPAC) Horizon Acquisition Company in 2021 with its first commerce transacted at $13.14 per share. The inventory presently trades for simply over six bucks a share, equating to a market cap of just below $1.3 billion.

The corporate is capitalized by two lessons of inventory. The 133.7 million publicly traded Class A shares bestow financial curiosity and one vote per share. The 76.2 million privately held Class B shares are predominantly owned by personal fairness pursuits, particularly Vista Fairness Companions and GTCR. They bestow no financial curiosity, one vote per share, and convertibility into Class A shares.

Enterprise Mannequin

Vivid splits its actions between company (Market) and principal (Resale).

Market supplies a platform for ticket patrons and sellers to transact, with the corporate receiving 10% of the gross order worth (GOV) from the vendor, in addition to service and supply charges from the client. Along with these income streams, Vivid sells purchaser insurance coverage by way of a third-party supplier, generates proceeds from its platform as a personal label providing, and produces extra contribution to its prime line by way of each day fantasy sports activities choices. This section generated contribution margin of $166.4 million on income of $430.1 million throughout the first 9 months of 2023 (YTD23), up 20% and 16% from YTD22 (respectively), consisting primarily of live performance (56%), sports activities (33%), and theatre (11%) tickets gross sales. [Contribution margin is defined as revenue minus cost of revenue, as well as marketing and selling expenses.]

Resale is predominantly Vivid buying tickets to promote on secondary ticket marketplaces, together with its personal. It accounted for YTD23 contribution margin of $20.4 million on income of $84.5 million, representing will increase of 36% and 31% over YTD22, respectively.

These segments are buttressed by what administration depicts as essentially the most beneficiant loyalty program within the area, which drives repeat enterprise. Launched in 2019, this providing – that includes a purchase 10 tickets get one free promotion – was an try and drive model consciousness, which was beneath 10% and the bottom amongst the massive 5 ticket brokers when the corporate went public in 2021. The method has proven tooth, with repeat patrons orders as a share of complete rising from 47% in 2018 to 56% in 2022.

Development By means of Acquisition

Along with leveraging gross sales and advertising to develop its model organically, Vivid has engaged in a number of transactions since going public to broaden its complete addressable market, a very powerful of which was its acquisition of Vegas.com in November 2023. The supplier of entry to exhibits, motels, trip packages, excursions, points of interest, eating, and nightlife in Sin Metropolis acquired a consideration of $243.8 million, comprised of $153.6 in money and ~15.6 million shares of SEAT. In return, Vivid acquired an entrée right into a $6 billion complete addressable market [TAM], basically its personal oasis throughout the $20 billion North American alternative (2023). When mixed with its $74.3 million buy of main Japanese on-line ticket market Wavedash in September 2023, Vivid grew its TAM by greater than 50% to ~$21 billion in FY23.

November Firm Presentation

Market

That TAM growth will assist the corporate compete in opposition to the likes of StubHub, Reside Nation’s (LYV) Ticketmaster, and Seat Geek in a worldwide market estimated to achieve $63 billion in 2024. To place Vivid’s market upside into perspective, it offered the 100 millionth ticket of its existence (since 2001) in January of 2022. Reside Nation, by way of Ticketmaster, different associated web sites and apps, stores, and name facilities offered 550 million tickets in 2022.

Share Worth Efficiency

Having survived by way of the pandemic when nobody was attending live shows or sporting occasions, Vivid went public because the world started returning to stadiums and theatres, but in addition simply previous to rates of interest surging to market re-valuation ranges. After producing Adj. EBITDA of unfavorable $80.2 million on income of $35.1 million in FY20, the corporate rebounded to provide FY21 Adj. EBITDA of optimistic $109.9 million on income of $443.0 million. Nonetheless, its opening commerce at $13.14 valued Vivid at an EV/FY21 Adj. EBITDA of 23.3. The market was nonetheless okay with administration’s preliminary FY22 projection of Adj. EBITDA of $112.5 million on income of $530 million, which the corporate barely surpassed with Adj. EBITDA of $113.3 million on income of $600.3 million.

Nonetheless, as a part of its IPO, Vivid acquired a $225 million PIPE funding from third-party buyers together with DraftKings (DKNG), who had an choice to promote its shares at $9.77 one 12 months after the closing of the Horizon SPAC merger. As markets are wont to do, that dynamic, vital overhang from personal fairness, and elevated valuations stored shares of SEAT in a slender buying and selling vary between $7 and $9 from June 2022 and August 2023. And though Vivid has been worthwhile since going public, incomes $0.36 a share (GAAP) in FY22 and $0.43 a share (GAAP) in YTD23, with an preliminary FY23 Adj. EBITDA forecast of $112.5 million (that has since been raised to $139 million to mirror its two acquisitions and barely higher than anticipated enterprise), it was nonetheless costly on EV/Adj. EBITDA foundation given its middling progress prospects. As such, with personal fairness trying to exit, would-be patrons have been ready for ‘promoting shareholders’ secondaries as alternatives to make investments at considerably depressed costs.

The most recent such prevalence transpired in December 2023, when personal fairness issues offered 23.575 million shares at $6.50 per. Nonetheless, the belief that one other 76.2 million shares remains to be on the market sooner or later sooner or later has made it difficult for the market to get enthusiastic about funding in Vivid. It also needs to be famous that the principals in Vegas.com have filed to promote greater than half of the shares (7.8 million) they acquired as consideration on its deal. As such, Vivid’s inventory touched an all-time intraday low of $5.54 a share on February 2, 2024.

Q3’23 Financials

Even an early and optimistic FY24 outlook courtesy of its contemporaneous acquisition of Vegas.com on its Q3’23 monetary report of November 7, 2023 did little to alter sentiment. The corporate posted web earnings of $0.07 a share (GAAP) and Adj. EBITDA of $33.4 million on income of $188.1 million versus $0.09 a share (GAAP) and Adj. EBITDA of $28.3 million on income of $156.8 million in Q3’22, representing a 15% decline (in $ worth) and features of 18% and 20%, respectively. Additionally, market gross order worth (GOV) of $998.9 million was up 28% from $781.8 million within the prior 12 months interval.

November Firm Presentation

With the announcement of the acquisition of Vegas.com, administration took the added measure of offering an preliminary FY24 outlook that included Adj. EBITDA of $175 million on income of $825 million bolstered by market GOV of $4.35 billion. Vegas.com’s contribution to the top-line outlook will likely be someplace within the neighborhood of $82.5 million to $100 million. All forecasts are primarily based on vary midpoints.

November Firm Presentation

Stability Sheet & Analyst Commentary

The money portion of the Vegas.com deal got here from Vivid’s sturdy steadiness sheet, which held $105 million in opposition to debt of $274 million for web leverage of 1.2 post-acquisition (at YE23). Moreover, Vivid has entry to $100 million on an undrawn credit score facility. The corporate repurchased $40 million of inventory in 2022 after which purchased 2 million shares as a part of the December 2023 promoting shareholder secondary providing. Vivid doesn’t pay a dividend.

November Firm Presentation

Regardless of the personal fairness overhang, the Road is combined on the corporate’s future, that includes three purchase and outperform rankings in opposition to two maintain rankings issued to date in 2024. On common, they count on the corporate to earn $0.46 a share (GAAP) on income of $698.6 million in FY23, adopted by $0.42 a share (GAAP) on income of $822.4 million in FY24, reflecting the onboarding of Vegas.com.

Verdict

It’s troublesome to choose a backside in a inventory that simply created a brand new all-time low, however the decline in share worth coupled with the acquisition of Vegas.com has made Vivid engaging on an EV/Adj. EBITDA foundation for the primary time in its considerably transient public firm historical past, buying and selling at just below 11 on FY23E Adj. EBITDA and eight.5 on FY24E Adj. EBITDA. Moreover, its worth to FY24E gross sales is presently 1.55, and its PE on FY24E GAAP EPS is simply 14.5 – each affordable given its future prospects. Non-public fairness overhang remains to be a priority as is the economic system, however with strong money era and its finest valuation metrics since going public, this busted IPO is price a small ‘watch merchandise’ place if an investor is keen to attend out the personal fairness overhang. Fourth quarter outcomes must be out later subsequent week as properly. Sooner or later later this 12 months, we’ll probably circle again on this story.

Las Vegas is the savage coronary heart of the American Dream. ― Hunter S. Thompson