Vladyslav Horoshevych

Thesis

Verra Mobility Company (NASDAQ:VRRM) is a number one supplier of sensible mobility know-how options. I assign a maintain to VRRM inventory. Though VRRM is a superb enterprise with a sticky buyer base, potential international growth, and secular tailwinds, the corporate additionally carries a number of dangers. For instance, 51.8% of the corporate’s income comes from 4 totally different clients, three of whom function in the identical business (rental automotive businesses), so if one thing have been to go flawed there, VRRM may probably undergo. One other threat is regulation. Plus, the present value of $17.76 a share is just not that engaging to me. I’ll clarify every of my thesis’s key factors within the following sections.

Overview

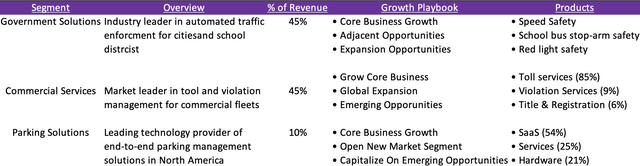

Verra Mobility Company gives sensible mobility know-how options all through the US, Australia, Europe, and Canada. The corporate operates in three segments: authorities options, business providers, and parking options.

Made by the creator utilizing the corporate’s presentation

International Enlargement

Administration has mentioned a number of instances that certainly one of its major progress methods is to develop globally since 91% of the corporate’s income comes from the U.S. Actually, in Q1 23, the corporate landed a brand new partnership that can permit them to supply their providers in 4 European international locations. That is what the CEO mentioned within the Q1-23 earnings name.

I am happy to announce that we lately entered right into a partnership with Telepath for rental automotive tolling in Italy. This partnership successfully permits Verra Mobility to supply our toll administration options in Italy for our rental automotive companions and permits for interoperability throughout Italy, Spain, France, and Portugal.

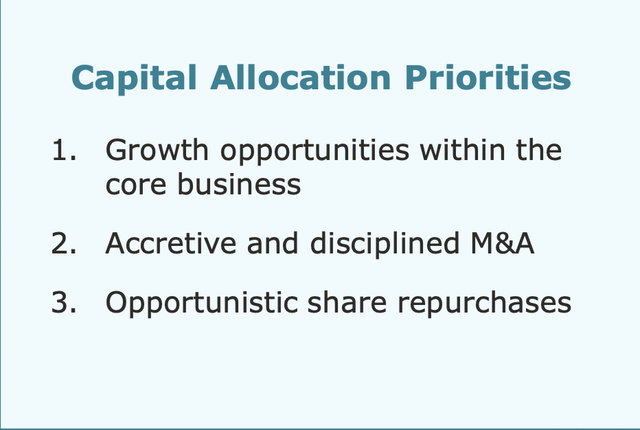

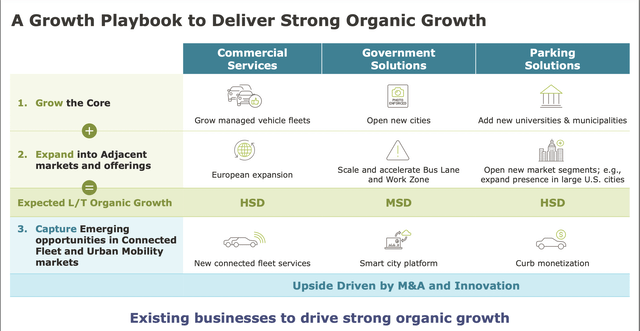

I count on the corporate to maintain increasing in two kinds. Both partnerships or acquisitions. In 2021, VRRM acquired T2S Programs to offer beginning to a brand new phase now often called parking options (this phase now makes up 10% of the corporate’s income). VRRM additionally acquired Redflex in June 2021 to develop its authorities options phase in Australia. VRRM has allotted roughly $1.2 billion in direction of M&A within the final 5 years. It’s clear that M&A offers are an essential a part of VRRM’s enterprise, and I do not count on that to alter because the firm highlighted in its 2022 investor day convention that M&As are nonetheless a precedence. Europe generally is a large marketplace for the business phase since there isn’t a equal product to VRRM but.

Firm’s Presentation Firm’s Presentation

Secular Tailwinds

VRRM has many tailwinds to help its enterprise, each long-term and short-term. I will solely give attention to two: journey and the Infrastructure Funding and Jobs Act. Journey performs an essential position in VRRM’s enterprise. Business providers, which make up 45% of the corporate’s complete income, work with rental automotive firms to supply them with toll providers, violation processes, and title and registration. The extra folks journey, the extra automobiles they hire. Provided that VRRM is almost a monopoly on this phase, the corporate has partnerships with three of the largest rental automotive businesses within the U.S. As demand for automotive leases will get again to pre-covid ranges following journey, VRRM stands to make more cash as they’ve the chance to supply merchandise to extra automobiles. Journey has returned to the 2019 pre-covid stage as of Q1 23. This doesn’t suggest that it’s going to keep that manner, however it’s wanting promising. That is what the CEO needed to say about touring in the course of the Q1 23 investor name.

TSA throughput attain 100% of pre-pandemic 2019 quantity, driving a rise in adopted rental agreements. We’re additionally skilled robust adoption charges from renters for all-inclusive tolling product choices…The most important U.S. airways are all reporting robust bookings via the second quarter and the outlook from our rental automotive companions stays robust as nicely. Actually, whereas leisure journey seems to have returned to pre-COVID ranges

Hertz CEO had this to say within the This autumn-22 earnings name

Home leisure volumes throughout the business have made progress in direction of pre-pandemic ranges inside our enterprise, and we see regular enchancment in company volumes.

The Infrastructure Funding and Jobs Act is a $1 trillion invoice to assist construct America. Beneath this new act, states can use as much as 10% of the $15.8 billion in complete freeway security cash out there. Security cameras, crimson lights, and different merchandise that promote freeway security VRRM can profit from this since they’re one of many main suppliers of street security cameras within the U.S.

Sticky Buyer Base

VRRM had a 94% recurring income fee within the trailing twelve months, up by 5% from Q1 2022. This mainly implies that companies are depending on VRRM merchandise and are keen to maintain paying for them. I imagine that one ought to hold an in depth eye on this metric as a result of a sticky buyer base tends to help profitability in instances of financial hardship. A excessive stage of recurring income is sweet when one is attempting to foretell future money flows.

Dangers

Income focus is without doubt one of the dangers I wish to cowl in the case of VRRM. Town of New York made 17.8% of VRRM’s income in Q1 23, 34% of Verra Mobility Company’s income comes from three totally different firms: Avis Price range Group (12.7%), Enterprise Holding (10.1%), and Hertz Company (11.2%). These three firms all function in the identical business (rental automotive businesses), which is very influenced by financial traits similar to journey and shopper spending. In 2020, the VRRM business providers phase suffered a ~34% income decline attributable to COVID, and certainly one of their largest clients, Hertz, filed for chapter. Provided that 4 clients compose 51.8% of VRRM’s income, For me, that could be a severe threat that one has to contemplate. If solely one of many 4 clients determined to not renew a contract with VRRM for causes similar to getting higher phrases from a competitor or constructing and utilizing their very own providers, that would make the corporate go from worthwhile to unprofitable. Administration is addressing this threat as they develop globally and enter into new partnerships. The income focus of the 4 clients talked about above was ~56% in 2022; it has dropped by 4.2% since. I believe it is price mentioning that VRRM did obtain a three-year contract renewal from New York Metropolis in February 2022. This contract gives for the growth of 100 further red-light cameras and 150 bus lane cameras, and so forth.

One other threat is regulation. This may be loopy since VRRM’s aim is to advertise street and faculty security via their merchandise, however some states have made it clear that pace picture enforcement applications and pace cameras are an excessive amount of surveillance to deal with. Texas handed a invoice prohibiting red-light picture enforcement applications throughout the state in 2019. Florida Gov. Ron DeSantis additionally had one thing to say concerning the cash that was given to states to make use of for freeway security.

“They’re spending $15 billion on pace cameras to have the ability to catch folks dashing. I imply, I’m sorry. I don’t need that. That’s bringing us much more surveillance,” the Republican mentioned. “Like we want extra surveillance in our society proper now”

These rules can impression VRRM’s income because the much less demand there may be for dashing cameras, the much less cash VRRM can stand to make.

VRRM additionally had $1.2 billion in debt as of Q1 23. I will not speak an excessive amount of about debt as a threat as a result of the corporate has applied an aggressive debt compensation program. Internet leverage is presently at 3.2x, down from 3.8x in Q1 2022. The corporate did give steering that web leverage could be 3.0x by the top of 2023. I imagine that if the corporate retains paying off the debt as they’ve, then it should not be a lot of an issue.

Valuation

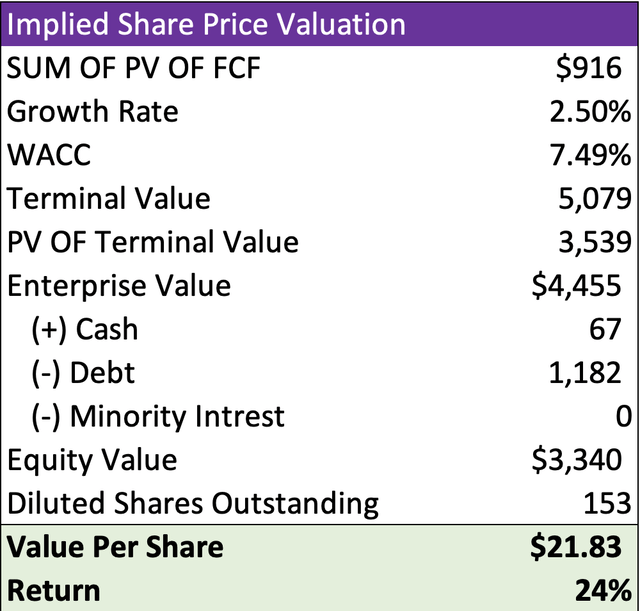

VRRM is presently buying and selling at an EV/EBITDA ratio of 12.12x, beneath its 5-year common of 14.14x. It has a free money circulation yield of seven%. To judge the corporate, I used a DCF mannequin. I forecast the corporate’s funds 5 years into the long run. For my 2023 income estimate, I made a decision to comply with the corporate’s steering of $780–$800 million (my 2023 estimate is $793 million). Why did I resolve to comply with the corporate’s steering? Effectively, I checked VRRM’s earlier yr’s income steering, and it was correct. As for the opposite 4 years (2024–2027), my assumptions have been that the corporate would develop at a compound annual progress fee of 5% as a result of the business VRRM operates in would not provide a number of natural progress except they land large authorities contracts. Utilizing these assumptions, I used to be in a position to forecast the corporate’s future money circulation, which I discounted again into the long run utilizing a 7.49% low cost fee. Provided that, I get an fairness worth of $3.34 billion, or $21.83 per share (24% upside).

Created by the creator

Why not a Purchase?

A few of you may be questioning: if there’s a 24% upside, why assign a maintain on VRRM and never a purchase? Given the dangers related to the corporate and the present value. I imagine that it isn’t price it for me to purchase into the inventory for a possible 24% upside, contemplating the dangers. I believe that there are higher alternatives for capital to be deployed as a way to maximize returns. Nonetheless, I’ll hold VRRM on my watchlist if the value drops from $17 to $14–15. Possibly I’ll rethink my ranking, however I assign a maintain for now.

Conclusion

The underside line is that VRRM has a stable enterprise supported by a sticky buyer base, market management, and secular tailwinds. A return on fairness of 33.4% (sector median 13.83%) and a 41% EBITDA margin (sector median 13.23%). I count on the corporate to maintain increasing and diversifying its enterprise. Contemplating the corporate’s dangers, I might say that the present value of $17.76 a share is without doubt one of the major causes I assign VRRM a maintain. As I mentioned earlier than, I might be keeping track of VRRM, and maybe if the value have been to fall to the $15 vary and nothing dangerous occurred to the enterprise, I might rethink my ranking. Apart from that, I’ll go away you with a quote, as all the time.

“The inventory market is crammed with people who know the value of all the things, however the worth of nothing.” — Phillip Fisher