Yesterday, was a day with loads of surprising occasions. The Norwegian Norges and the British BOE have displaced traders by stunning to the upside (50 bps hikes as a substitute of the anticipated 25); the Turkish CBRT has achieved the identical however closely to the draw back (650 bps to a 15% fee as a substitute of the anticipated 21% – and the TRY has traded down nearly 4% each towards the USD and the EUR).

A minimum of the Swiss SNB was extra appropriate for the faint-hearted: +25 bps to 1.75%, as anticipated. This brings the full quantity of fee hikes for the reason that starting of the cycle to 200 bps, nicely beneath the ECB (400 bps) or the FED (500 bps).

Just a few extra indications got here from the press convention following the announcement of the choice: inflation stays above the SNB’s inflation goal of between 0 and a couple of% – though it has fallen sharply. Headline quantity is regular at 2.2% (down from 3.4) and core sits at 1.9%: regardless of what could look like end result, the SNB remains to be involved in regards to the second spherical results and has revised up its inflation forecasts for the following few years, now anticipated to stay at 2.2% in 2024 as nicely.

This will sign rising considerations in regards to the long-term outlook for inflation or perhaps an try and sound hawkish: in any case, this second speculation has by some means been confirmed by President Jordan’s statements, which appear to trace to a brand new hike in September.

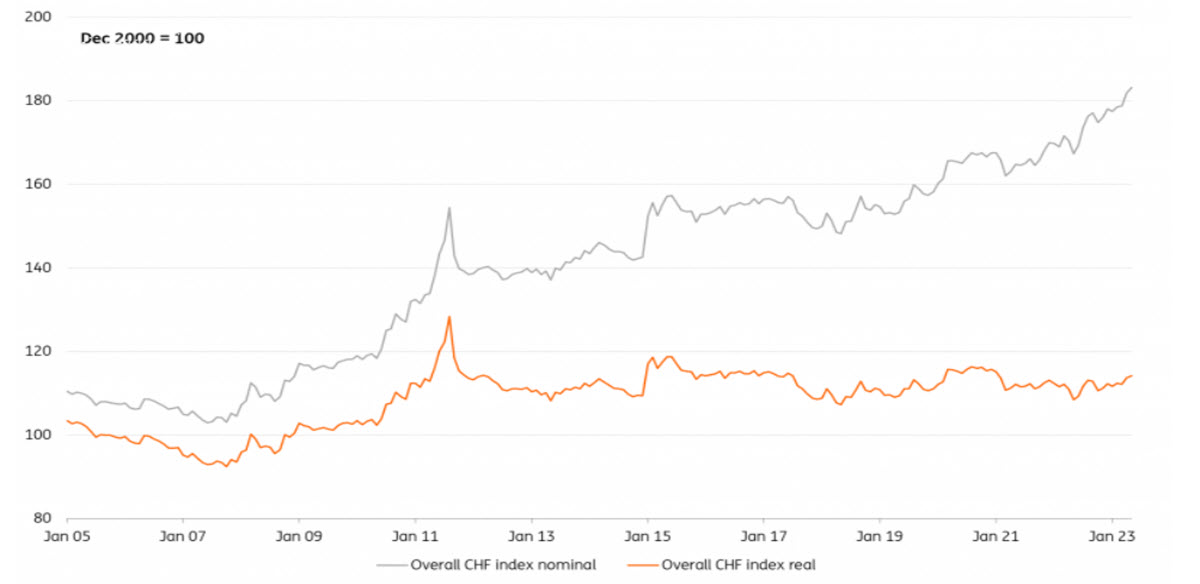

CHF actual and nominal appreciation, Index

The SNB has admitted that it has extensively bought its FX reserves in current months in order to maintain the actual Swiss franc secure to combat inflation (”Within the present atmosphere, the main focus is on promoting international foreign money”): really it has managed to get a 2% nominal appreciation of the trade-weighted Swiss franc over the past quarter, one thing it would in all probability not need to proceed to do because the inflation differential with different economies ought to slim.

Lastly, GDP development: it was robust in Q1 however is anticipated to stay modest till the top of the 12 months, settling near +1%.

TECHINCAL ANALYSIS

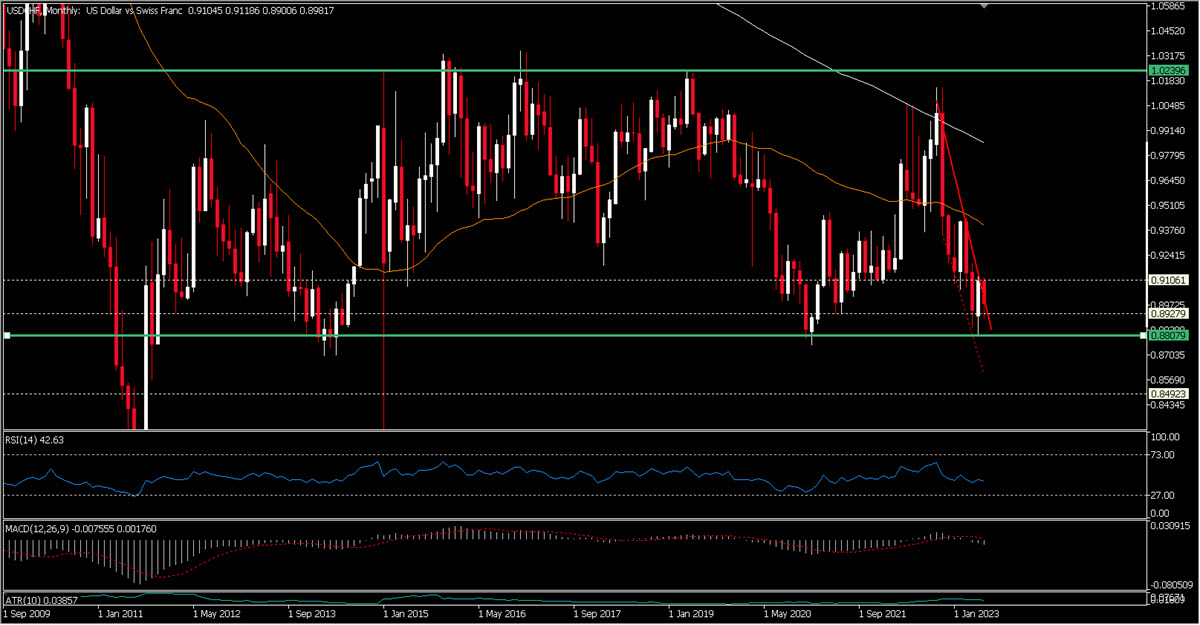

USDCHF, Month-to-month

In mild of all this, we consider that the time of a steadily descending USDCHF, because it has been since November 2022, is coming to an finish. The world of 0.88, examined in Could, has been an vital help zone since 2011 and has nearly at all times established a long-term low. The bearish pattern since November 2022 appears to have been damaged just a few weeks in the past and is being retested nowadays – proper right here within the 0.89 space. If this holds, we’d even have rising lows on the each day chart and the highs had been already barely retouched upwards at 0.9147, precisely when the downtrend was damaged on 31 Could 2023. RSI is optimistic and so is the MACD. Above the MA50 (0.8975) there’s additional positivity with an inexpensive goal within the 0.91 space. It’s clearly not inconceivable to see new weak point main the value in direction of 0.89 and even to retest 0.8830, however this might not change our long-term view that doesn’t exclude seeing USDCHF near 0.92 inside just a few weeks.

USDCHF, Every day

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a common advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or ought to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.