South African Rand Greenback Forecast:

- USD/ZAR pauses at historic resistance – systemic dangers stay excessive with FOMC on faucet.

- US Greenback recovers in opposition to the Rand regardless of a possible banking disaster.

- South African Rand faces further stress as issues over Monday’s nationwide shutdown mount.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to E-newsletter

USD/ZAR get well as fee expectations and fears of a banking disaster drive sentiment

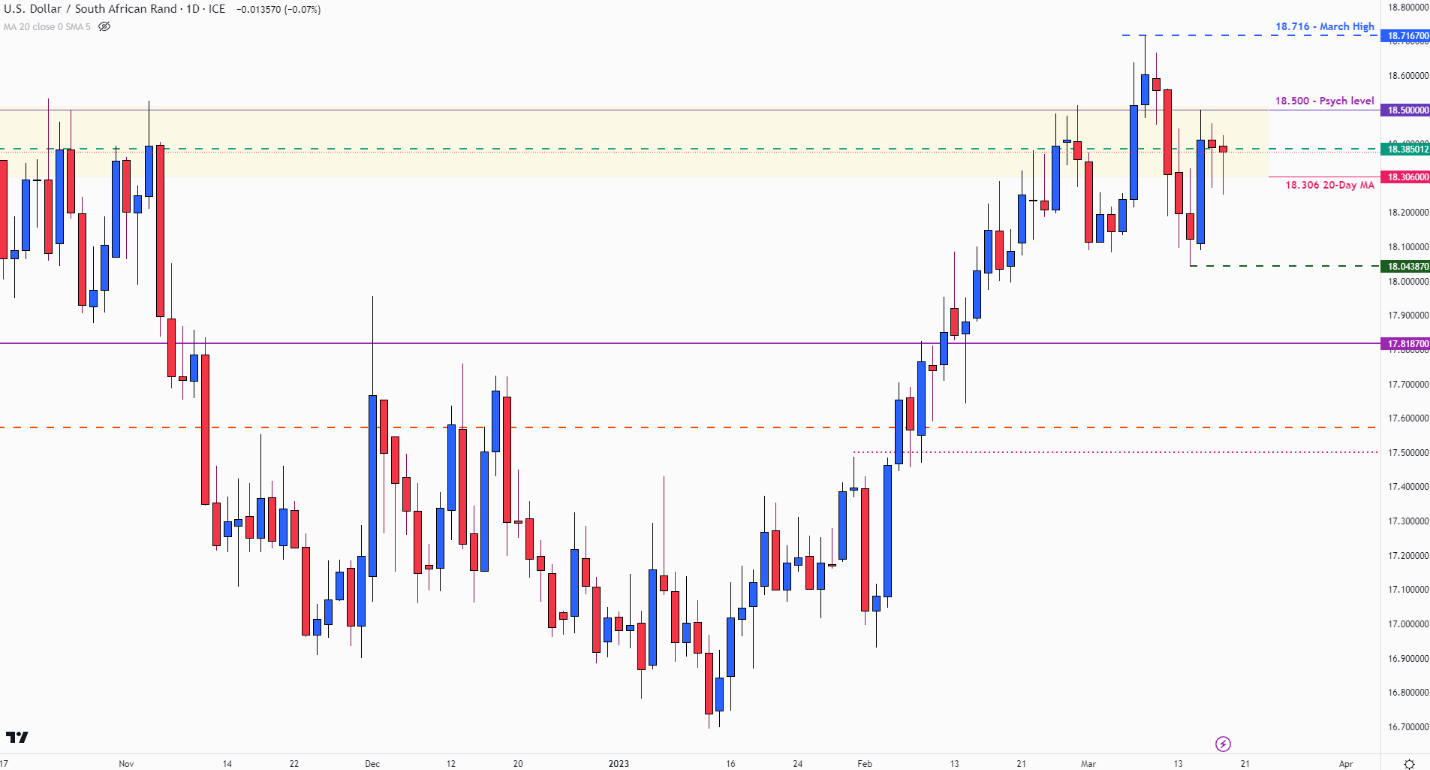

It’s been a difficult week for world markets and for USD/ZAR which is at present buying and selling round a key stage of resistance at 18.385.

As doubts over the soundness of the monetary system drove fee expectations decrease, USD/ZAR slumped earlier than regaining confidence. For the US Greenback, the Federal Reserve has continued to hike rates of interest at an aggressive tempo, in an effort to tame inflation. This has made the buck engaging to buyers, weighing closely on EM (rising market currencies).

Go to DailyFX Training to be taught in regards to the relationship between rates of interest and FX

With the failure of SVB (Silicon Valley Financial institution) elevating issues over additional contagion, US authorities stepped in by guaranteeing deposits. Though the injection of liquidity helped ease fears, it has additionally eradicated the chance (probability) of a 50-basis level fee hike.

In line with the FedWatch software, analysts are actually pricing in a 0.25% enhance with some predicting that charges will stay unchanged.

Supply: CME FedWatch Device

Beneficial by Tammy Da Costa

Buying and selling Foreign exchange Information: The Technique

As market contributors anticipate Fed Chair Jerome Powell to take a extra dovish tone on the upcoming FOMC, South Africa continues to wrestle with their very own political and financial constraints.

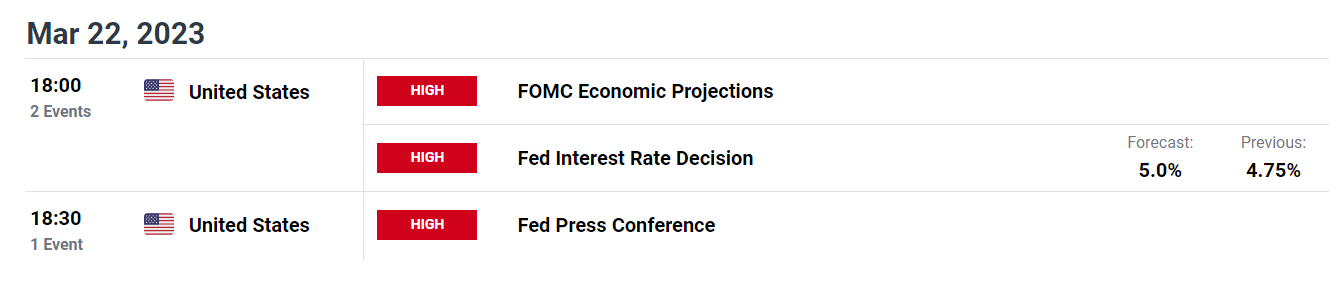

DailyFX Financial Calendar

South African residents warned about protests – will this be a repeat of the July 2021 unrest?

Since 2008, South Africa has been coping with loadshedding (rolling blackouts). With corruption and poor upkeep liable for the ability disaster, the nation’s electrical energy disaster has worsened, inflicting companies and households to search out further sources of vitality. As energy utility, Eskom, receives huge quantities within the type of authorities bailouts, the present state of affairs has positioned an extra burden on the decrease and center class.

With no authorities assist, labor unions and staff are protesting, demanding larger wages. In the meantime, with a nationwide shutdown anticipated to happen on Monday, there’s a chance that unrest may lead to looting and violence. In July 2021, related unrests added to the nation’s weak economic system, inflicting Billions of Rands in harm to non-public and public property.

USD/ZAR Technical Evaluation

From a technical standpoint, USD/ZAR is at present testing a historic stage of resistance round 18.385. If the Greenback weakens, a transfer decrease brings the 20-day MA again into play, opening the door for a transfer towards the weekly low (18.044).

USD/ZAR (Greenback Rand) Each day Chart

Chart ready by Tammy Da Costa utilizing TradingView

Nonetheless, if tensions in SA rise and there are clear indicators of social unrest or a hawkish Fed, a break of resistance may drive worth motion to the subsequent psychological stage of 18.500 and towards the month-to-month excessive of 18.716.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and comply with Tammy on Twitter: @Tams707