USD/JPY OUTLOOK:

- USD/JPY jumps after U.S. PMI information surprises to the upside

- Robust financial exercise boosts Treasury yields throughout the curve, reviving expectations for “higher-for-longer” rates of interest

- S&P World Composite PMI clocks in at 53.5 versus 52.3 in March, an indication enterprise exercise could also be beginning to rebound

Beneficial by Diego Colman

Get Your Free JPY Forecast

Most Learn: Sterling Value Outlook – Indicators of Bullish Impetus Reverse Forward of a Busy Week

USD/JPY was shedding floor early Friday morning, however took a 180-degree flip and reversed sharply larger shortly after U.S. markets opened, supported by better-than-anticipated U.S. financial information. The chart under reveals how the pair jumped from 133.55 to 134.35 in a matter of minutes.

USD/JPY 5-MINUTE CHART

Supply: TradingView

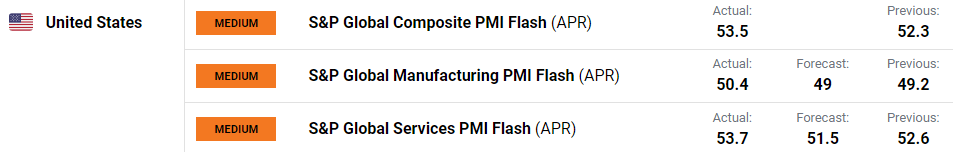

For context, S&P World Flash U.S. Composite PMI clocked in at 53.5 in April from 52.3 beforehand, with providers enterprise exercise surging to 53.7 from 52.6 and manufacturing manufacturing climbing to 50.4 from 49.2 one month in the past. Each sub-indices stunned to the upside.

US ECONOMIC CALENDAR

Supply: DailyFX

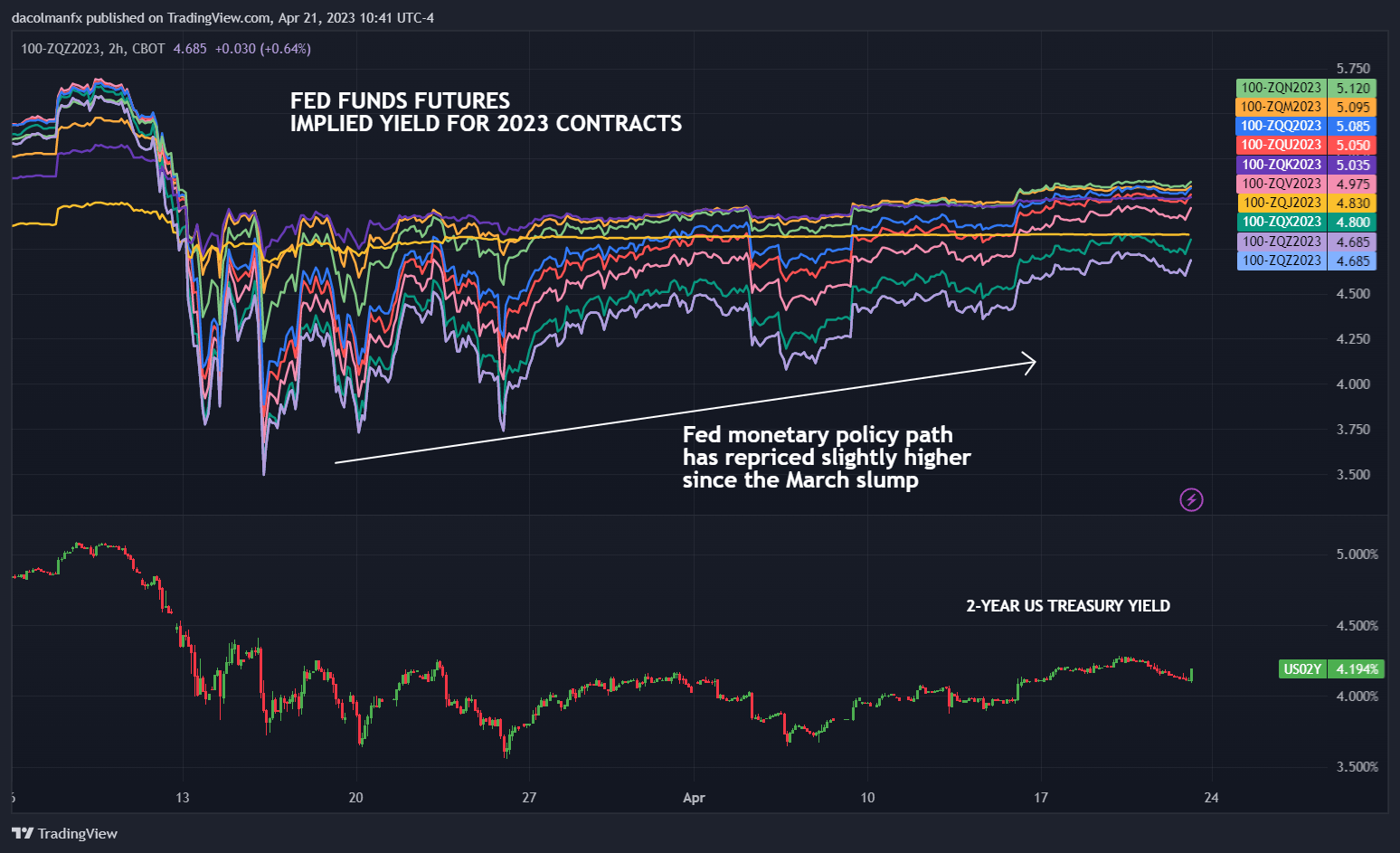

Resilient macro outcomes bolstered U.S. Treasury charges, particularly these on the entrance finish of the curve, as merchants repriced a little bit larger the FOMC financial coverage path, as mirrored within the chart under, which shows a number of 2023 Fed funds futures contracts with their respective implied yields trending larger.

Beneficial by Diego Colman

Get Your Free USD Forecast

2023 FED FUNDS FUTURES

Supply: TradingView

The robust efficiency of the U.S. financial system regardless of quite a few headwinds indicators that the nation could possibly keep away from a tough touchdown and that inflation will keep elevated for longer. This, in flip, may preclude the Fed from reducing charges too quickly. Whereas the outlook is fluid and topic to sudden adjustments, the celebs appear to be aligning for some U.S. greenback power, not less than within the close to time period.

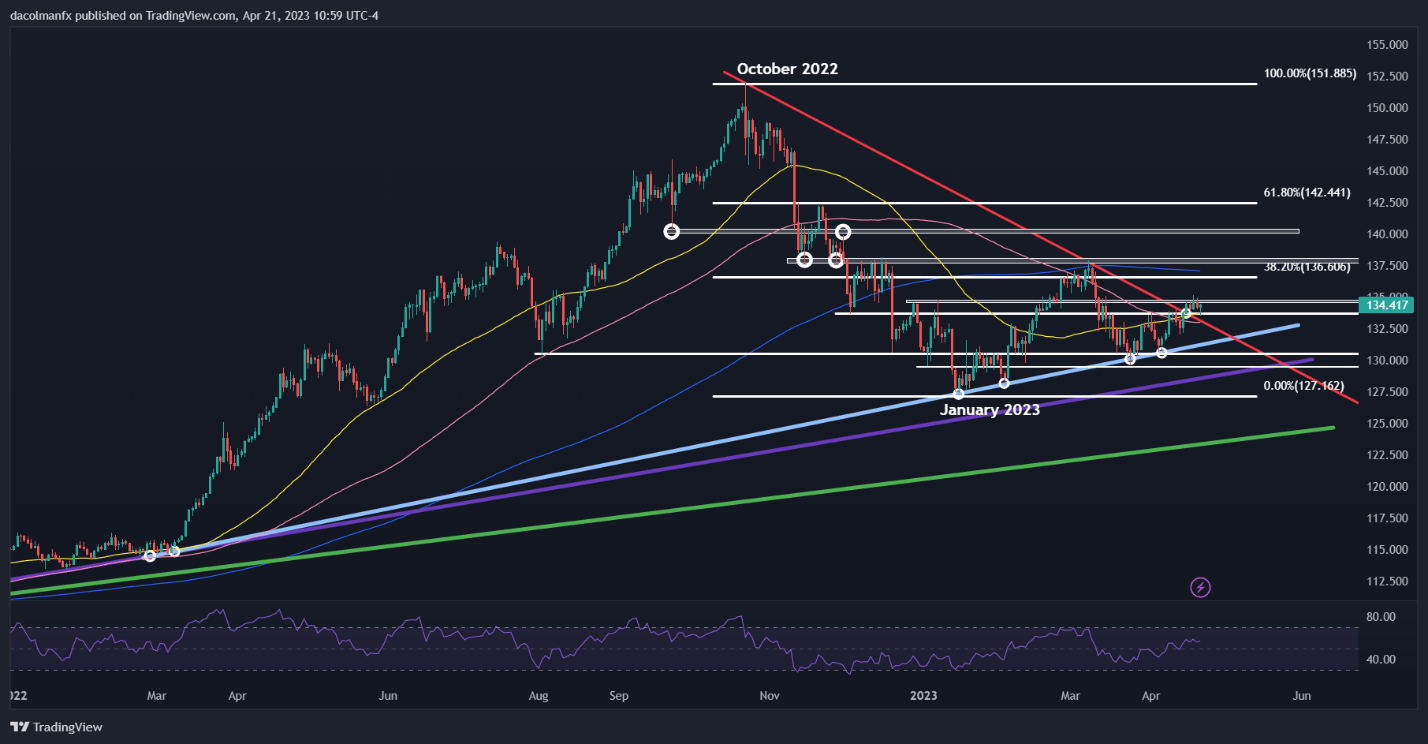

Within the present atmosphere, USD/JPY could have fewer obstacles to extending its rebound, with preliminary resistance seen at 134.75, adopted by 136.60, the 38.2% Fib retracement of the Oct 2022/Jan 2023 decline. In case of a pullback, preliminary help seems at 133.75/133.65, and 131.50 thereafter.

| Change in | Longs | Shorts | OI |

| Every day | 10% | -9% | -2% |

| Weekly | 2% | 4% | 3% |

USD/JPY TECHNICAL CHART

USD/JPY Chart Ready Utilizing TradingView