Given the actions of Donald Trump’s administration not too long ago, it wasn’t a shock once they introduced new tariffs on Japan and South Korea yesterday. The announcement stated {that a} 25% tariff will probably be positioned on Tokyo as a result of talks haven’t made sufficient progress.

Proper now, the foreign money change price is secure inside its normal vary. The market will doubtless look ahead to indicators of progress within the talks and any adjustments within the resolution, in addition to how the Financial institution of Japan will react. The financial institution’s leaders have typically stated they want extra time to see how the commerce struggle impacts Japan’s economic system, but when the tariffs stay, the Financial institution of Japan may have a difficult scenario to deal with.

Financial institution of Japan Price Determination Nears

The Financial institution of Japan has been following a cautious method this yr. At its final assembly, it determined to not change rates of interest, citing uncertainty about how potential tariffs may have an effect on the Japanese economic system. However this wait-and-see method can not proceed ceaselessly, particularly since inflation has stayed above the goal for a very long time. One clear signal of that is the sharp rise in rice costs, a key a part of the Japanese weight loss plan.

If the 25% tariffs stay in place, it will be dangerous information for BOJ Governor Ueda and his crew. On one hand, tariffs might push inflation even greater, making a stronger case for extra rate of interest hikes. However, these tariffs—particularly on vehicles—might harm Japan’s financial development, and better rates of interest would make issues worse.

This places the BOJ in a tricky spot the place it would quickly should make some tough selections if the US sticks to its plan.

Fed Awaits Extra Information

The US Federal Reserve can also be in a wait-and-see mode, holding off on extra cuts for now. Just like the Financial institution of Japan, it’s being cautious on account of uncertainty across the influence of tariffs.

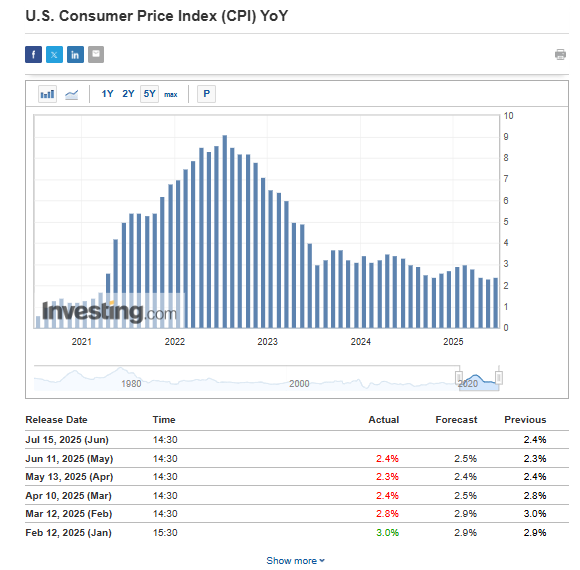

As of now, the following doubtless rate of interest reduce within the US is predicted in September, with a 57% likelihood of a 25-basis-point discount. The subsequent key information launch—centered on inflation—will come subsequent week. Though latest inflation readings have been decrease than anticipated, they’re nonetheless above the Fed’s goal.

USD/JPY Nears Vary Excessive—Breakout or Reversal Forward?

Since early July, the US greenback has proven some short-term weak spot. Nonetheless, this has not modified the broader development within the USD/JPY pair, which stays in a consolidation part. If the greenback continues to weaken, the following goal for consumers could be round 148 yen per greenback, close to the higher finish of the present vary.

Within the quick time period, merchants awaiting a attainable upward transfer ought to control help ranges round 145 and 144 yen per greenback. If the worth falls under the important thing help at 142 yen, that will counsel this upward situation is not doubtless.

****

You should definitely try InvestingPro to remain in sync with the market development and what it means on your buying and selling. Whether or not you’re a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now for as much as 50% off amid the summer time sale and immediately unlock entry to a number of market-beating options, together with:

- ProPicks AI: AI-selected inventory winners with confirmed monitor document.

- InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for one of the best shares primarily based on lots of of chosen filters, and standards.

- High Concepts: See what shares billionaire buyers similar to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclaimer: This text is written for informational functions solely. It isn’t meant to encourage the acquisition of property in any means, nor does it represent a solicitation, supply, suggestion or suggestion to speculate. I wish to remind you that each one property are evaluated from a number of views and are extremely dangerous, so any funding resolution and the related danger belongs to the investor. We additionally don’t present any funding advisory companies.