USD/CAD AND USD/JPY FORECAST:

- USD/CAD wavers after reaching a key technical resistance area, with bulls and bears combating for management of the market

- USD/JPY heads decrease and challenges trendline help as sellers eye a potential breakdown

- This text appears to be like at key technical ranges to keep watch over within the coming days

Most Learn: Gold and Silver Bid Greater, Authorities Bond Yields Fall on Recession Fears

USD/CAD TECHNICAL ANALYSIS

USD/CAD was largely flat on Wednesday regardless of broad U.S. greenback weak spot within the FX area, oscillating between small good points and losses close to the 1.3633 degree, a key resistance area. The shortage of course could also be as a consequence of market indecision following the pair’s sturdy rally in current days, which noticed the trade fee recognize by virtually 2.6% in lower than 10 buying and selling classes, so a pause is sensible from a technical standpoint.

In any case, with sentiment on fragile footing on the again of rising recession fears, high-beta currencies might underperform within the close to time period, making a adverse surroundings for the Canadian greenback, particularly if market turbulence intensifies. On this context, USD/CAD stays well-placed to increase its advance heading into subsequent month.

To have extra conviction within the bullish state of affairs, the pair should clear confluence resistance at 1.3645 quickly, a key technical barrier the place short-term trendline resistance aligns with the 61.8% Fibonacci retracement of the March/April pullback. If this ceiling is breached, consumers might turn into emboldened to launch an assault on 1.3700, adopted by the 2023 highs.

Conversely, if USD/CAD will get rejected from present ranges and bears regain management of value motion, the primary help to contemplate seems at 1.3580, which corresponds to the 50-day easy shifting common. If this flooring is taken out, the following draw back goal to keep watch over rests close to the psychological 1.3500 deal with.

| Change in | Longs | Shorts | OI |

| Each day | -13% | 16% | 4% |

| Weekly | -35% | 40% | 0% |

USD/CAD TECHNICAL CHART

USD/CAD Chart Ready Utilizing TradingView

USD/JPY TECHNICAL ANALYSIS

Whereas the U.S. greenback tends to understand towards high-beta currencies throughout risk-off episodes, this dynamic doesn’t incessantly happen towards the Japanese yen, which can be thought of a safe-haven asset. For that reason, USD/JPY tends to be extra delicate to rate of interest differentials between the US and Japan.

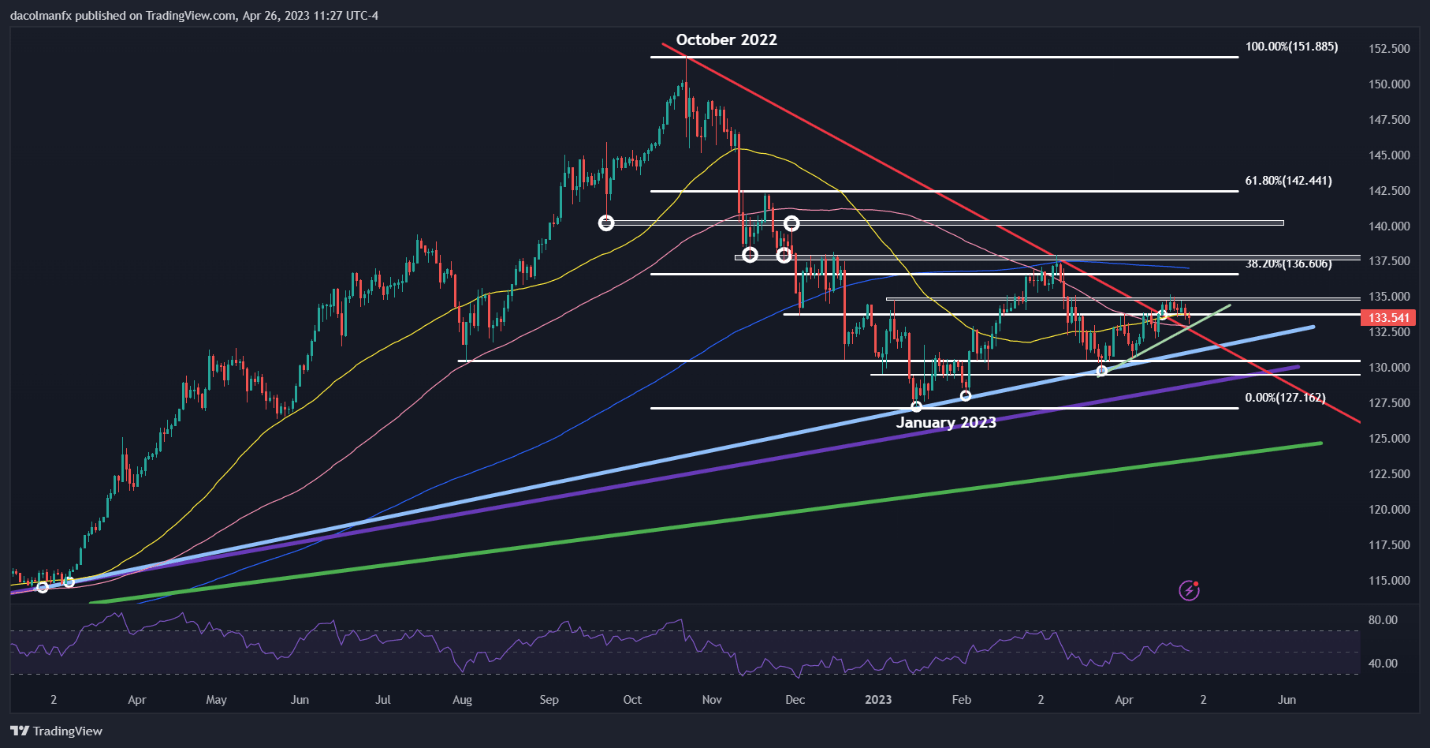

Turning our consideration to technical evaluation, USD/JPY has began to drag again in current days after failing to interrupt above resistance at 134.80, an indication that the bulls could also be bailing amid the exhaustion of upside momentum.

With the pair shifting in the direction of trendline help at 133.00, sellers could also be in a greater place to regain the higher hand in the event that they handle to push costs beneath that flooring. Ought to this state of affairs play out, USD/JPY might head sharply decrease, doubtlessly difficult the 131.00 degree in brief order.

Conversely, if USD/JPY resumes its rebound and fees larger, it might encounter resistance at 134.80, but when a breakout materializes this time, shopping for momentum might speed up, paving the best way for a rally in the direction of 136.60, the 38.2% Fibonacci retracement of the October 2022/January 2023 selloff.

| Change in | Longs | Shorts | OI |

| Each day | -5% | -3% | -4% |

| Weekly | -3% | -9% | -6% |

USD/JPY TECHNICAL CHART

USD/JPY Chart Ready Utilizing TradingView