USD/CAD PRICE, CHARTS AND ANALYSIS:

Really useful by Zain Vawda

Traits of Profitable Merchants

Learn Extra: Gold Falters as US Yields and the DXY Advance, $1900 at Danger

USDCAD has lastly damaged out of the current 5-day vary because the DXY advance gathers momentum. The Canadian Greenback had been on a little bit of a rally because of a pointy enhance in the newest inflation print coupled with a unprecedented rise in WTI Oil costs. There have been additionally feedback out right this moment from S&P who acknowledged that the financial outlook for Canada reveals indicators of sluggish development simply because the economic system seems set to battle resurgent inflation.

The current breakout on USDCAD has largely come about because the DXY finds its ft and continues its rally greater. The Dollar has largely been supported by the “greater for longer” narrative and the secure haven enchantment of the US Greenback. Not even a possible Authorities shutdown can dampen the temper in the mean time. The main contributor, nonetheless, appears to be the US Bond market because the perceived Authorities shutdown prompts market individuals into early revenue taking over carry commerce methods. US Yields nonetheless proceed to surge, holding at 2007 ranges.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to E-newsletter

The current developments round US Treasuries don’t bode properly for commodity currencies corresponding to Rising Market currencies and will additionally become a hindrance to the WTI linked CAD. WTI for its half has discovered some help right this moment persevering with its transfer greater and heading in the right direction for a hammer candle shut on the day by day timeframe.

WTI OIL Each day Chart

Supply: TradingView, Created by Zain Vawda

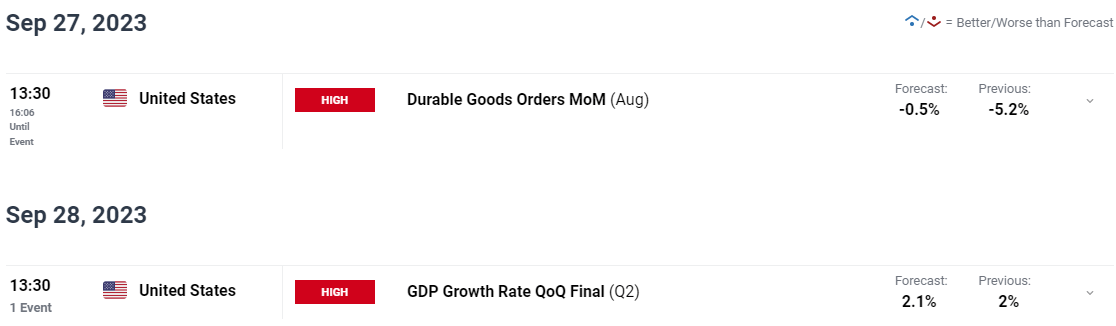

ECONOMIC CALENDAR AND EVENT RISK AHEAD

The following seven days carry little or no when it comes to Canadian information and danger occasions that are dominated by US information. There are a number of occasions on the docket in addition to a few Federal Reserve policymakers scheduled to talk. I will likely be paying shut consideration to the PCE information on Friday however even that may require a big miss or beat to have any materials impression on the US greenback.

For all market-moving financial releases and occasions, see the DailyFX Calendar

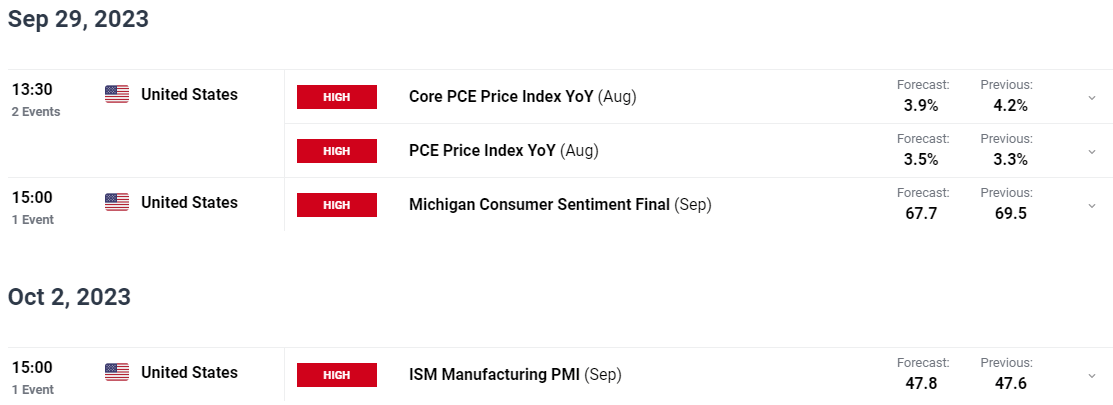

TECHNICAL ANALYSIS AND FINAL THOUGHTS

USDCAD

USDCAD ended final week with a dangling man candle, nonetheless the age-old adage that “wicks by no means lie” could also be taking part in itself out this week. Having continued its current consolidative value motion yesterday, we have now lastly had a breakout of the vary right this moment because the pair eyes a return to current highs.

Admittedly trying on the day by day timeframe there are various hurdles on the draw back with help supplied by each the 100 and 200-day MAs. A breach of those help areas could carry a retest of help across the 1.3250 deal with into play.

Wanting on the upside potential for the pair and rapid resistance rests at 1.3540 which is the 20-day MA whereas a transfer greater brings key resistance at 1.3650 into focus.

USD/CAD Each day Chart

Supply: TradingView, ready by Zain Vawda

IG CLIENT SENTIMENT

Looking on the IG consumer sentiment information and we are able to see that retail merchants are at present web SHORT with 57% of Merchants holding brief positions.

For Full Breakdown of the Each day and Weekly Modifications in Consumer Sentiment as properly Recommendations on Methods to use it, Get Your Free Information Beneath

| Change in | Longs | Shorts | OI |

| Each day | -3% | 14% | 6% |

| Weekly | -19% | 30% | 3% |

— Written by Zain Vawda for DailyFX.com

Contact and comply with Zain on Twitter: @zvawda