After world shares ex-US loved a uncommon if unimpressive win over American shares in 2022 — by shedding much less — the chances don’t look encouraging for a repeat run of outperformance in 2023, primarily based on a set of ETFs by Thursday’s shut (Nov. 9).

In 2022, Vanguard Whole Worldwide Shares Fund (NASDAQ:) (VXUS), which excludes US corporations, fell 16.1%. A painful loss, however SPDR ETF (ASX:), a proxy for US corporations, retreated much more through an 18.2% decline final 12 months.

The return unfold to this point in 2023 has widened however now favors US shares by a hefty diploma. SPY is up a robust 14.7% 12 months so far, far above the 5.1% advance for VXUS. Wanting on the regional elements of worldwide markets exhibits that solely Latin America shares () is outperforming the US (SPY) 12 months so far.

In any other case, the remainder of the sector is trailing, in some instances by a large diploma. Certainly, African shares () are within the pink by almost 17% to this point this 12 months.

Fairness Markets YTD Returns

The argument for proudly owning a worldwide portfolio of shares attracts on the view that worldwide diversification will repay ultimately. To make certain, there have been intervals when that’s true – however not currently. US shares (SPY) earned greater than 11% on an annualized foundation over the previous decade – greater than double the three.4% efficiency for VXUS, based on Morningstar.com.

The distinction is hanging, however some analysts warn in opposition to utilizing the rearview mirror to dominate choices about asset allocation in the case of the worldwide equities market. Growing estimates for anticipated return, in contrast, suggests a unique profile.

“When you’ve been 100% the US the final 15 years, drink some Champagne, pat your self on the again, however it’s in all probability the improper selection now,” says Meb Faber, chief government of Cambria Funding Administration.

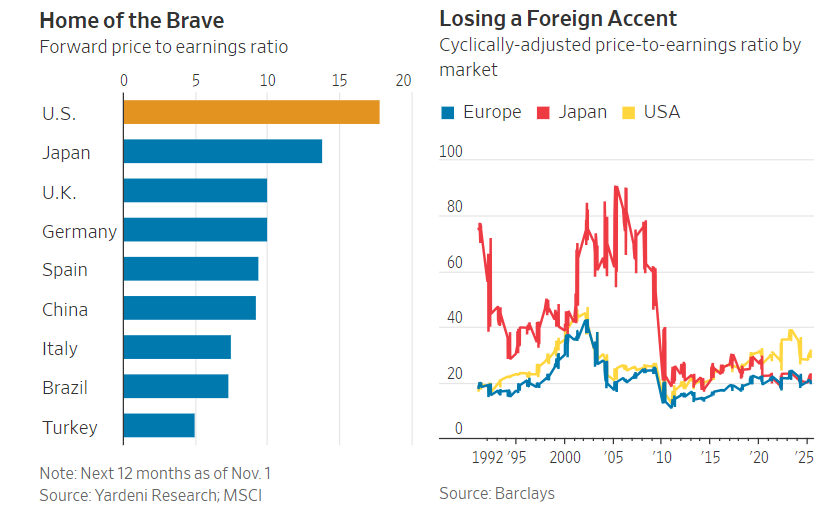

One motive for tilting towards international shares is decrease valuations relative to the US. As The Wall Avenue Journal factors out, the US has the best valuation vs. a number of key markets elsewhere.

Nobody is aware of if the decrease valuations in international shares will translate to greater efficiency vs. the US. Meantime, this a lot is obvious: 2023’s horse race is on observe to favor American shares by a large margin.