US Shares Evaluation (S&P 500, Nasdaq 100)

- ‘Smooth touchdown’ narrative returns as equities are set to rise in July

- S&P 500 nearing swing excessive – lower than 5% away from all-time-high

- Nasdaq eyes bullish continuation forward of Apple, Amazon earnings

- The evaluation on this article makes use of chart patterns and key help and resistance ranges. For extra info go to our complete schooling library

Advisable by Richard Snow

Get Your Free Equities Forecast

‘Smooth Touchdown’ Narrative Returns as Equities are Set to Rise in July

All three main US indices are on monitor to finish July within the inexperienced, with the Dow Jones incomes a point out after a formidable rise during the last two weeks. The outperformance within the index suggests buyers could also be shifting out of development shares in the direction of worth shares, because the Fed seems set to achieve peak charges over the approaching Fed conferences into 12 months finish.

Feedback right now from the Chicago Fed President Austan Goolsbee have been largely congratulatory of the Fed of their efforts to reign in inflation with out breaking the economic system. With unemployment close to historic lows and inflation making progress, US basic information seems to be to construct on the present scorching streak within the wake of the huge second quarter GDP beat. The providers sector is predicted to stay in enlargement with Friday’s non-farm payroll (NFP) print anticipated to see additional jobs added to the economic system regardless of the pattern of fewer additions.

This week, Apple and Amazon report earnings over the three-month interval from April by way of June. The 2 tech giants characterize 11.6% of all the index measured by market cap.

S&P 500 Nearing Swing Excessive – Much less Than 5% Away from All-Time Excessive

The S&P 500 opened barely larger to begin the week, eying the current swing excessive of 4609 and probably 4740. Currently, worth motion has struggled to rise with the identical diploma of momentum, oscillating between 4550 and 4609. The RSI seems on the verge of overbought territory on the each day chart however stays overbought on the weekly chart.

Within the occasion we see a transfer decrease from right here, 4550 stays probably the most rapid degree of help adopted by 4510. Hold an eye fixed out for US senior mortgage officer opinion survey information on banking circumstances which is tentatively scheduled for right now. If credit score circumstances have worsened materially because the March and Could bouts of panic, widespread concern may immediate a transfer decrease within the index.

S&P 500 (E-Mini Futures) Every day Chart Supply: TradingView, ready by Richard Snow

Tech Heavy Nasdaq Eyes Bullish Continuation Forward of Apple, Amazon Earnings

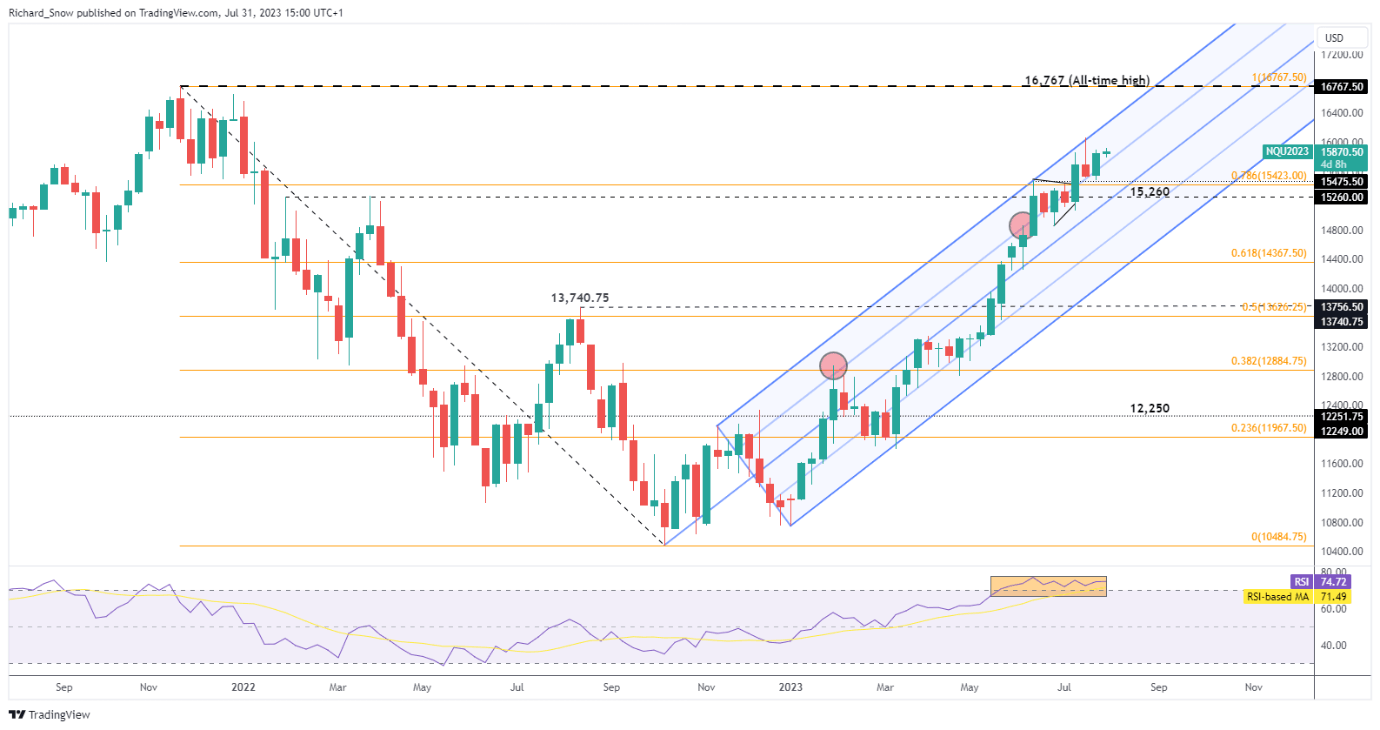

The Nasdaq continues its spectacular, sustained rise. Costs proceed to commerce neatly throughout the ascending pitchfork, touching trendline resistance twice within the final three weeks with out a main pullback. After every contact of resistance, costs cooled -providing higher entry factors for bullish continuation.

Since respecting the 78.6% Fibonacci retracement (as help) at 15,423, costs have continued larger, now eying the swing excessive of 16,062 forward of the all-time-high of 16,767. Help stays at 15,423, adopted by 15,260. The weekly chart stays oversold because the latter phases of Could with out fail. Nonetheless, better-than-expected US earnings can see the bull run proceed for a while but.

Nasdaq 100 Weekly Chart (E-Mini Futures)

Supply: TradingView, ready by Richard Snow

Advisable by Richard Snow

Get Your Free Prime Buying and selling Alternatives Forecast

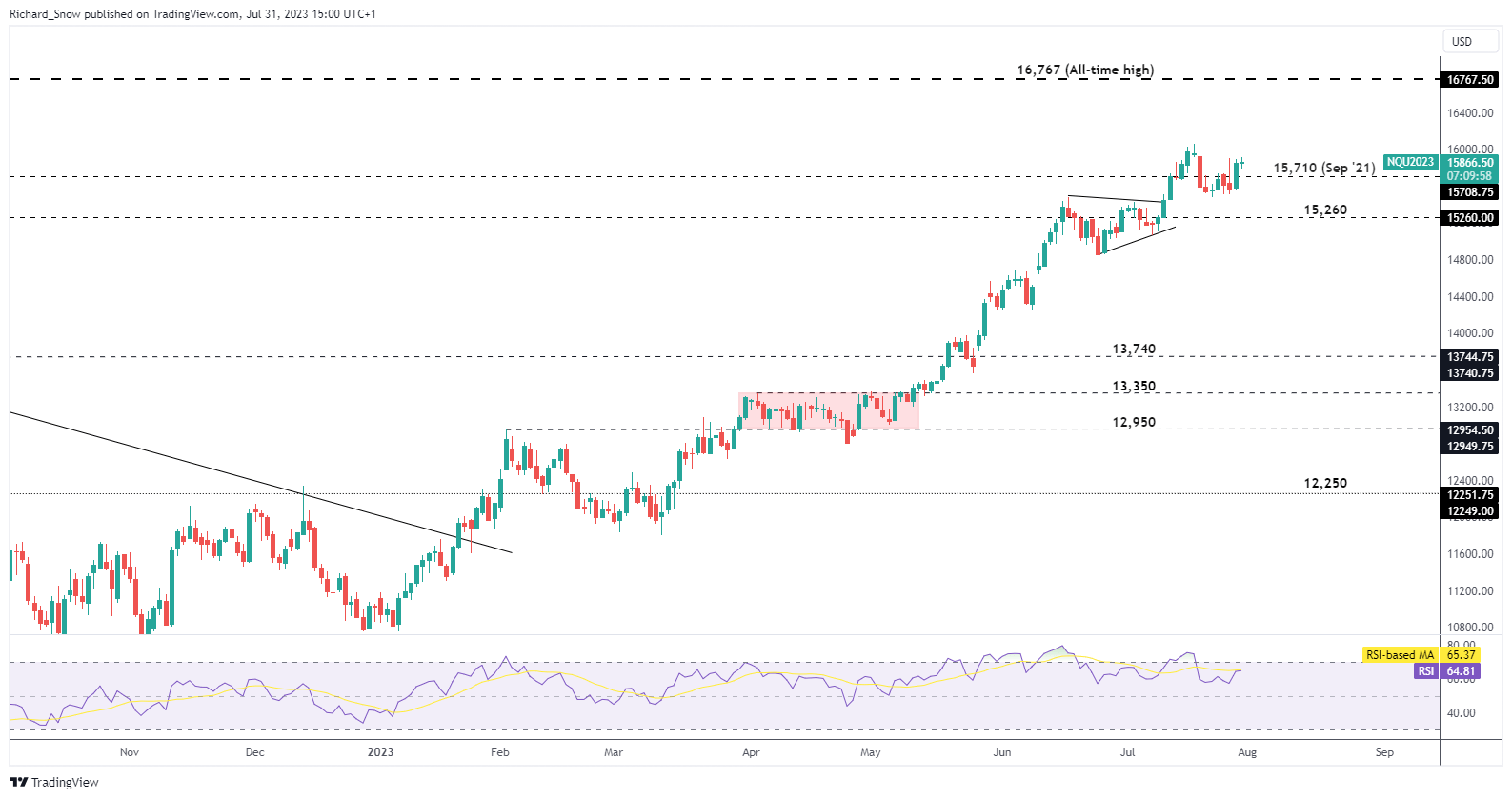

The each day chart helps to evaluate worth motion on a extra granular degree. Value motion has consolidated round elevated ranges in seek for the subsequent bullish catalyst, which may seem within the type of tech earnings, US providers PMI information and even NFP information.

Nasdaq 100 Every day Chart

Supply: TradingView, ready by Richard Snow

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to E-newsletter

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX