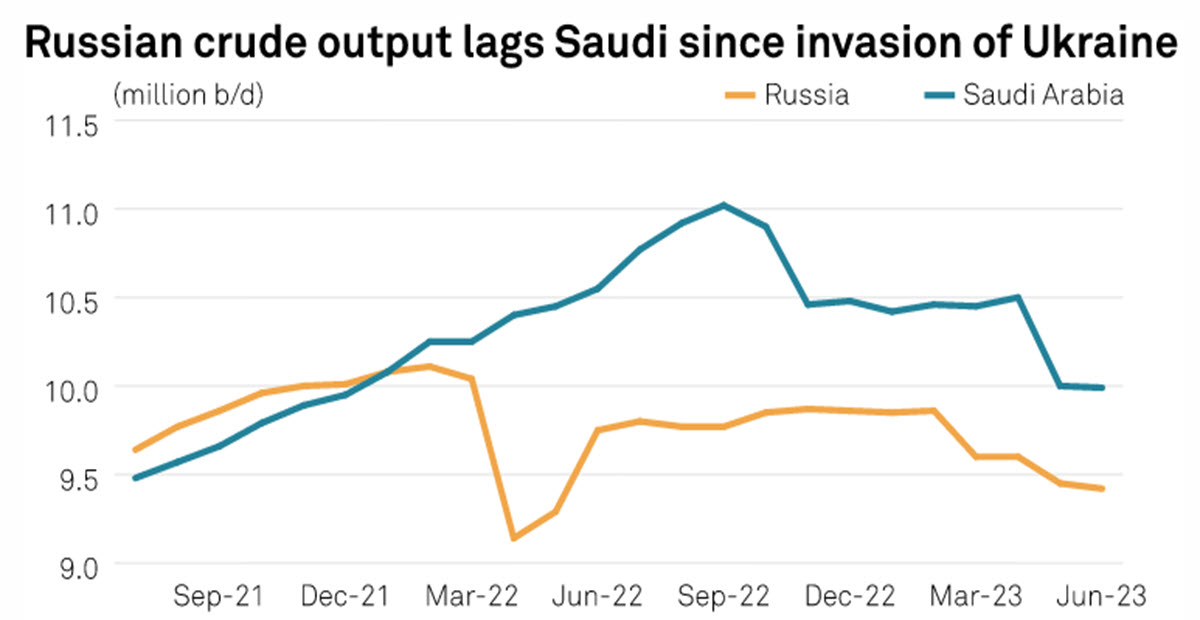

In July, OPEC’s crude manufacturing tumbled by essentially the most in three years (-900k) to a mean of 27.79 million bpd as Saudi Arabia applied a deeper cutback in a bid to shore up world markets and get extra income to help increasing authorities spending. Saudi Arabia pumped a mean of 9.15 million barrels a day in July; provides additionally fell in Nigeria, by 130,000 barrels a day to 1.26 million day by day and in Libya to 1.1 million a day, following a protest that halted its largest Oil Area, Sharara. Russia pumped 9.42 million bpd of crude in June, in contrast with 10.11 million bpd in February 2022 as a stability between its total output and better oil costs favoring the financing of its struggle in Ukraine.

The Joint Ministerial Monitoring Committee (JMMC), an OPEC+ ministerial panel, met final Friday in Wien and confirmed its pledge to strictly monitor the market circumstances: Saudi Arabia’s 1 million bpd minimize has been confirmed to be prolonged for an additional month to incorporate September, with an opportunity of being additional prolonged and even deepened; Russia will taper to 300k bpd.

All this, even though world Oil demand is formally anticipated to rise in H2 by 2.2 million bpd to succeed in 102.1 mbpd, an all-time report.

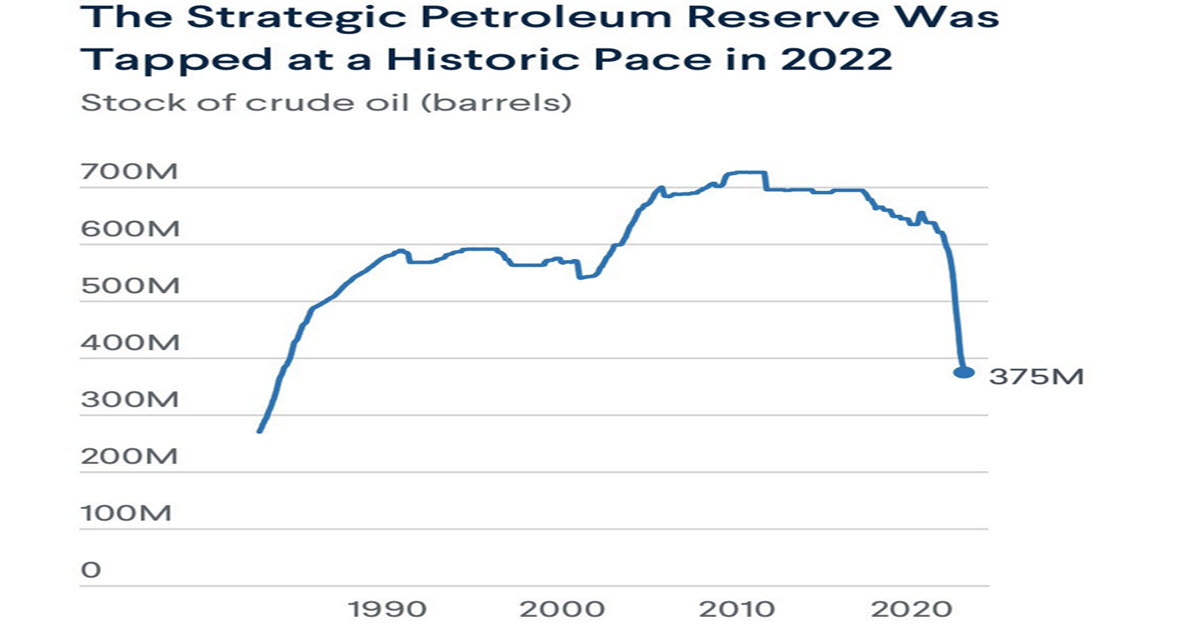

There’s one other fascinating side to this: the Biden Administration has had huge withdrawals from the Strategic Petroleum Reserve (SPR) with the intention of combating inflation. Larger oil costs have been a significant contributor to inflation which the Fed and US authorities have been combating for two years now. Information exhibits that extra extractions are nonetheless taking place. Over 221 million barrels have been withdrawn from the reserve in 2022 alone in response to inflation and geopolitical conflicts. The SPR now holds 346 million barrels of crude oil, its lowest degree since 1983. In October 2022, the Biden administration introduced its intent to refill the SPR. An announcement stated they plan to make purchases when oil costs are “at or under $67 to $72 per barrel.” Each single time oil costs have hit that degree this yr, OPEC took motion. On June ninth, the US refilled 6 million barrels of the SPR, nonetheless properly under the 250 million+ which were drained. On the time, oil costs have been proper round $70 which is within the value zone that the US desires to refill the SPR. Promptly thereafter, Saudi Arabia and Russia prolonged latest crude oil manufacturing cuts. That is the sixth time that OPEC has taken motion when oil costs hit the $67 to $72 zone this yr. Now, the US can not fill the reserve once more.

Technical Evaluation

USOil has superior steadily since 28 June and is presently up 23.11% ($82.62) from that day’s low of $67.03. It’s again to buying and selling within the big selection of Nov 2022 – Mar 2023 between about $83.50 and $73.25. It might make sense for it to consolidate on this value zone. The unfold towards UKOil has hit a low this yr, within the $3.40 space, indicating a desire for Northern Sea Seaborne Oil.

US Oil, UK Oil unfold

Ought to consolidation not happen and an additional extension of the rally occur, we don’t take into account it unimaginable to see the $93 space in early autumn. Technical indicators are excessive, constructive however not overbought.

US Oil, Every day

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a basic advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.