US Flash PMI, US Greenback, Russia, Ukraine, Inflation – Speaking Factors

- March Flash PMI 58.5 vs 56.3 est.

- USD comparatively unchanged beneath 99.00

S&P World revealed that its survey of enterprise exercise surged to an 8-month excessive on the again of strong demand for items and providers. The survey studying got here in at 58.5, surpassing the 55.9 studying from February. This additionally represents the very best print since July 2021. Readings above 50 symbolize development, whereas sub-50 prints point out a contraction of financial exercise. The sturdy print might be welcomed by policymakers, who’ve battled considerations currently {that a} recession could also be forward because the Fed appears to pivot away from pandemic-era coverage. Warning indicators have began to flash, with elements of the yield curve starting to invert. For extra on that, please click on right here.

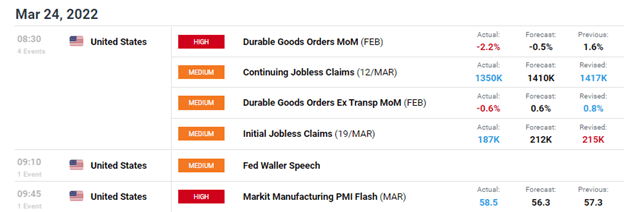

US Financial Calendar

Courtesy of the DailyFX Financial Calendar

The survey highlighted that corporations proceed to fret about persistent inflation, as labor and enter prices proceed to rise. Uncooked materials and power costs proceed to weigh on sentiment, whereas Covid lockdowns throughout China may doubtlessly exacerbate provide chain points. Expectations for the long run had been hampered by the continued Russia-Ukraine battle, which continues to weigh on international development forecasts. In response to the survey, companies proceed to fret about regular will increase to the price of dwelling, as households can have much less disposable earnings to place again into the financial system.

Following the discharge of the survey, the US Greenback Index (DXY) continued to tread water beneath the 99.00 threshold. The Greenback basket has been buoyed by Euro weak point, as EURUSD has traded decrease in 4 of the final 5 classes. Throughout Thursday’s session, worth has been propped up by assist round 99.70, which may see worth make a transfer for the 99.00 psychological stage. US Treasury yields stay elevated throughout the curve on Thursday, which may proceed to assist Buck firmness.

US Greenback Index (DXY) 1 Hour Chart

Chart created with TradingView

Assets for Foreign exchange Merchants

Whether or not you’re a new or skilled dealer, now we have a number of assets out there that will help you; indicator for monitoring dealer sentiment, quarterly buying and selling forecasts, analytical and academic webinars held each day, buying and selling guides that will help you enhance buying and selling efficiency, and one particularly for individuals who are new to foreign exchange.

— Written by Brendan Fagan, Intern

To contact Brendan, use the feedback part beneath or @BrendanFaganFX on Twitter