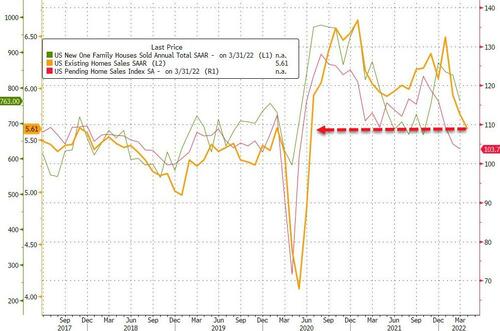

Soaring mortgage rates, plunging mortgage applications, housing starts and permits slumping, homebuilder sentiment hammered, and now labor market stress… it is no surprise that analysts expected another monthly drop in existing home sales in April. US existing home sales fell 2.4% MoM (worse than the 2.3% MoM drop expected), Worse still, this drop was from a revised-lower 3.0% MoM drop in March (from -2.7% MoM)

Source: Bloomberg

This is the 3rd straight monthly decline in existing home sales and the total SAAR is the lowest since June 2020…

First-time buyers accounted for 28% of sales last month, down from 30% in March, and underscoring the affordability challenges that have been pricing many Americans out of the market.

“Higher home prices and sharply higher mortgage rates have reduced buyer activity,” Lawrence Yun, NAR’s chief economist, said in a statement.

“It looks like more declines are imminent in the upcoming months, and we’ll likely return to the pre-pandemic home sales activity after the remarkable surge over the past two years.”

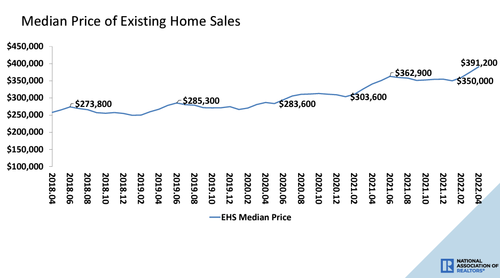

The median selling price rose 14.8% from a year earlier, to a record $391,200 in April, led by gains in the South.

Cash sales represented 26% of all transactions in April, down slightly from the prior month but still elevated. Investors, who typically buy in cash and are therefore less sensitive to mortgage rates, made up 17% of the market.

Yun also noted the rare state of the current marketplace.

“The market is quite unusual as sales are coming down, but listed homes are still selling swiftly, and home prices are much higher than a year ago,” said Yun.

“Moreover, an increasing number of buyers with short tenure expectations could opt for 5-year adjustable-rate mortgages, thereby assuring fixed payments over five years because of the rate reset,” he added.

“The cash buyers, not impacted by mortgage rate changes, remain elevated.”

The number of homes for sale climbed from March but was down 10.4% from a year ago. At the current pace it would take 2.2 months to sell all the homes on the market, up from 1.9 in the prior month. Realtors see anything below five months of supply as a sign of a tight market.

“Housing supply has started to improve, albeit at an extremely sluggish pace,” said Yun.

Sales dropped in the South and West from the prior month, though rose in the Northeast and Midwest.

For the eighth consecutive month, the South recorded the highest pace of price appreciation in comparison to the other three regions. Additionally, the South is the only region to report year-over-year double-digit price gains.

Judging by the surge in mortgage rates, this slump in existing home sales is far from over…

If the chart is correct, Deutsche Bank’s Jim Reid warns that “it will be a very painful few months ahead” for homeowners.

So, as Reid concludes rhetorically, will the Fed need to lift rates such that mortgages are far above levels most home buyers have grown accustomed to, ultimately slowing blistering price growth? Or will the cracks appear much sooner (spoiler alert: yes).

Is the housing crash starting?