It was a troublesome September for bond and inventory bulls. After reiterating advert nauseum, it seems that the FOMC’s “increased for longer” message has lastly gotten by. Typically central banks are principally in wait and see mode as they assess the various crosscurrents to find out whether or not further tightening is required. Uncertainties over the coverage course tied the markets in knots over Q3. Yields climbed over Q3, although a lot of the erosion got here in September, and largely after the FOMC’s hawkish dots.

As This fall begins, the Fed is confronted with one other robust alternative, maintain or hike. Q3 ended with a number of surprises, and particularly the advance indicators numbers that boosted the Q3 GDP outlook measurably to a 4.8% development fee from 3.7% beforehand. That may preserve the Fed, and particularly the hawks, on guard. The November 1 Fed fee hike remains to be on the desk assuming the numbers stay agency, in step with the upward revision to Q3 GDP estimate to a 4.8% fee of development from 3.7% earlier than Friday’s advance knowledge launch.

Actual sector knowledge has continued to shock on the excessive facet, whereas inflation has been cooling — will the energy within the economic system restrict additional progress on reaching the two% goal?

Nonetheless there may be one essential launch on faucet this week, tomorrow’s September nonfarm payrolls. The September nonfarm payroll report ought to mirror some cooling total however nonetheless a sturdy labor market. It’s projected with a 140k improve after beneficial properties of 187k in August, 157k in July, and 105k in June. The jobless fee ought to tick down to three.7% from 3.8% in August, versus a 54-year low for the two-digit fee of three.39% in April. Hours-worked are assumed to be flat after a 0.4% August rise, whereas the workweek slips to 34.3 from 34.4 in August.

Common hourly earnings are assumed to rise 0.4%, after a 0.2% acquire in August, whereas the y/y wage acquire ought to maintain at 4.3% for a second month, with a broader downtrend reflecting the persevering with return of lower-paid staff to the labor pool. Previous to the pandemic, development in hourly earnings was progressively climbing from the two% trough space between 2010 and 2014 to the three%+ space till the pandemic-induced spike.

Preliminary and persevering with claims tightened in September, whereas client confidence fell and producer sentiment improved barely however to a nonetheless depressed stage. The chance for payrolls every month is downward, each as a result of job development has outpaced the GDP path since 2021, and momentum for GDP development is probably going moderating.

USD: Taking a Break Forward of NFP

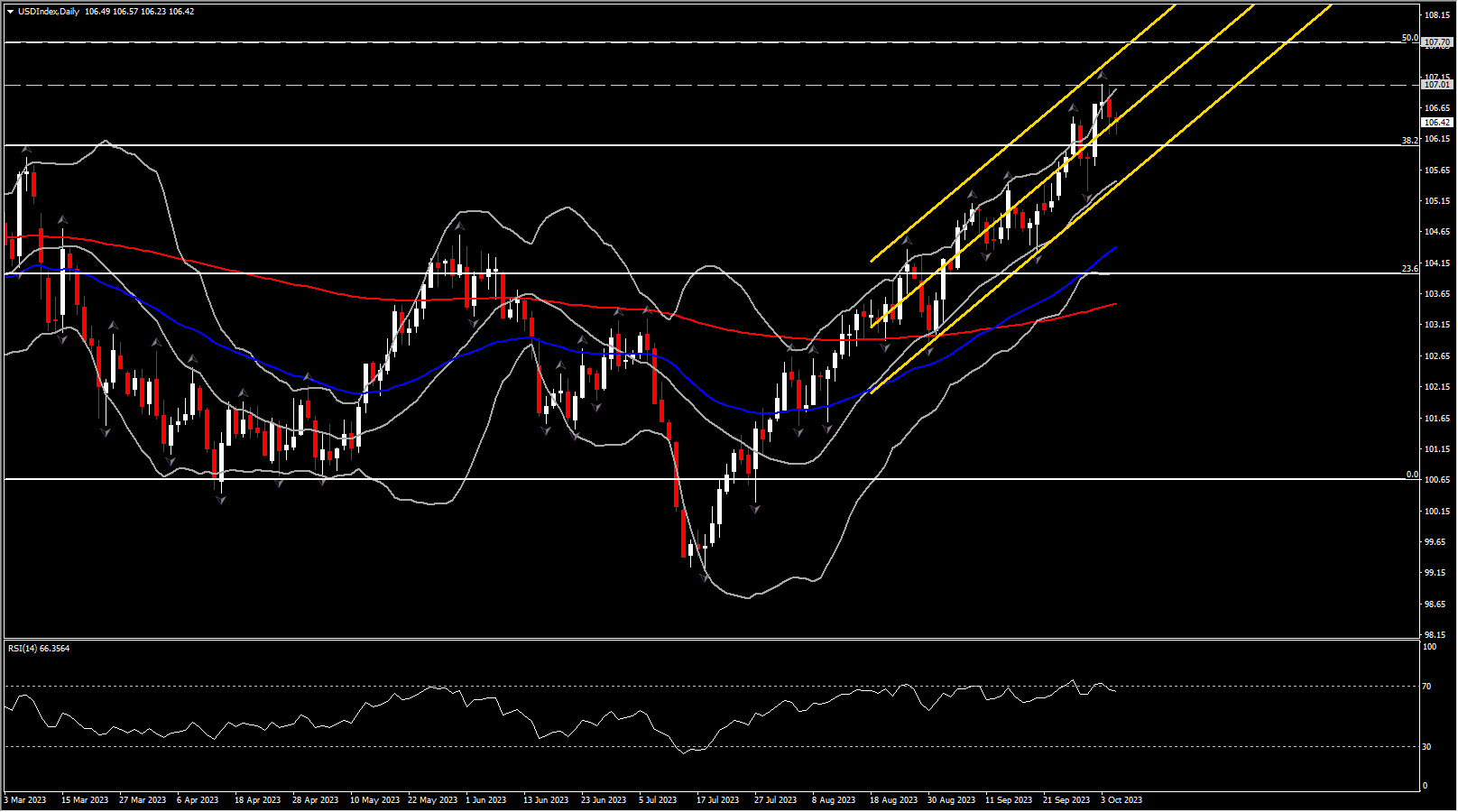

The USDIndex is barely down on the day and buying and selling at 106.20-106.60 as the main target shifts to tomorrow’s jobs report. The cautious buying and selling as we speak is anticipated to proceed particularly after the shocking market response yesterday submit ADP, given their restricted correlation with the precise payroll knowledge. In truth, there appears to be an illogical inverse correlation between weak ADP numbers and robust official payroll figures.

Bonds had pared losses forward of the ADP report and charges have prolonged decrease after the weaker than forecast ADP inspired dip shopping for and quick masking. Numerous the updraft in yields was a perform of a patrons’ strike.

At the moment the Dollar’s correction shouldn’t be attracting individuals since whatever the indicators of a slowing economic system, that are elevating beliefs for a sidelined FOMC, there may be nonetheless room for a extra hawkish pricing of the US yield curve, and the US greenback’s potential for upward motion stays important.

The USDIndex might stabilize round 106.50 as we speak, as markets assess whether or not jobless claims can proceed to shock on the draw back (which might be unfavourable for bonds and constructive for the Greenback). Moreover, a number of Federal Reserve audio system are scheduled to make remarks, most of whom are anticipated to specific hawkish views, offering additional help for potential fee hikes.

The upcoming important milestone for the USDIndex stays the spherical 107. A confirmed breakout of that stage might breach the 107.70 -108 vary if there’s a extra pronounced downturn within the US bond market.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or needs to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.