Shares completed the day decrease, following hotter-than-expected knowledge and a few commentary from Jay Powell that prompted merchants to on December and January price cuts. The market now sees the following price reduce not coming till March.

(BLOOMBERG)

The entire speak from the Fed audio system the previous few days appears to focus on them going slower and with the ability to take their time when heading to the impartial price.

The impartial price, after all, is only a fantasy quantity that’s talked about, however nobody has a clue the place it’s. Primarily based on the value motion of danger belongings, one would suppose that coverage is simple.

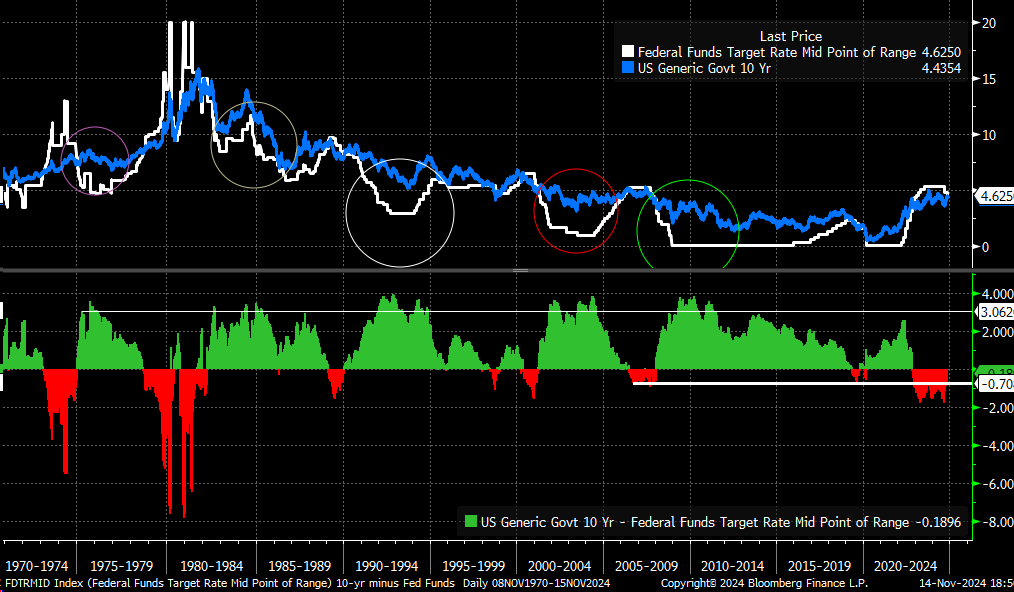

Nevertheless, based on Powell, the coverage is restrictive as a result of the has risen and the labor market has loosened. So, let’s say the Fed Funds impartial price is round 3 to three.5%.

This in all probability signifies that the price and yields nonetheless have a lot additional to climb from present ranges. If the 10-year price will get to 300 bps larger than Fed Funds, it should rise to a minimum of 6%.

Assuming inflation breakeven stays at 2 to 2.5%, the actual yield will likely be 3.5 to 4%. Whether or not they keep anchored, after all, is one other story.

To say that the inflation swap is on the cusp of constructing a giant transfer could also be an understatement at this level. However, a breakout may very well be of epic proportions, and extra importantly, it carries a lot which means behind it.

For now, the trail larger within the 10-year interval seems to be on monitor.

Within the meantime, the continues to soar. It was chillin’ most of yesterday, however as soon as Powell began talking and price cuts have been dialed again, the took off.

Simply take a look at the transfer within the 5-year foundation swap unfold. The funding value for {dollars} seems to be rising at a breakneck tempo.

So, for now, the greenback additionally finds itself extremely nicely positioned to interrupt out above the 107.25 degree. If the greenback breaks out right here the quantity of ache it’s about to inflect on the fairness market will likely be quite gorgeous.

So we wait.

Unique Put up