Market sentiment stays fragile this morning as stories proceed to reach that the US is planning strikes on Iran. This might be a serious escalation within the battle and will draw different allies into the combat.

The UK additionally held conferences on the doable implications of US strikes on Iran with the Iranians warning of great retaliation. This has saved total market sentiment on edge and this might proceed forward of the weekend.

Asian Market Wrap

MSCI’s regional inventory index dropped about 1%, with Hong Kong shares falling over 2%. U.S. inventory futures additionally dipped barely after the barely moved within the final session. The gained energy towards most main currencies.

U.S. Treasury markets are closed on Thursday because of a vacation. Traders had been already nervous after the Federal Reserve lowered its progress forecast for this 12 months and predicted greater inflation, highlighting how tariffs are making it more durable for the Fed to regulate its insurance policies.

Swiss Nationwide Financial institution (SNB) Slashes Charges to 0%

The Swiss Nationwide Financial institution () lowered its rate of interest to 0% in June 2025, as anticipated, marking the primary time charges have been at zero since 2022. This choice was made as a result of inflation is easing, and the worldwide economic system is slowing down. In Might, Swiss client costs dropped by 0.1%, the primary decline in 4 years, primarily because of cheaper tourism and oil costs. The SNB now predicts low inflation for the subsequent few years: 0.2% in 2025, 0.5% in 2026, and 0.7% in 2027.

Switzerland’s economic system grew strongly in early 2025, partly because of exports to the U.S. earlier than new tariffs took impact, however total progress is predicted to gradual. is forecast to develop by 1% to 1.5% in each 2025 and 2026. Nonetheless, rising international commerce tensions are creating uncertainty for Switzerland’s commerce future.

The transfer will little question be welcomed by the enterprise neighborhood, particularly these counting on exports. The had gained vital floor because of its haven attraction towards the Greenback and the in current months, which noticed the export neighborhood urge the Central financial institution to take motion.

The SNB vowed to not comply with the identical path as 2015 and fee cuts grew to become the one choice out there.

European Open

European shares dropped on Thursday, with the index falling 0.6% to 537.37 factors, hitting its lowest degree in over a month.

Buying and selling was quieter than traditional since U.S. markets had been closed for a vacation. rose as a result of ongoing battle, which helped vitality shares acquire 0.6%.

However, journey and leisure shares fell 1.5%, as greater oil costs damage the sector.

The Euro STOXX Volatility Index, a measure of market uncertainty, hit its highest degree since Might 23, rising to 23.78.

On the FX entrance, the US Greenback was stronger this morning, and that may very well be right down to safe-haven flows. Nonetheless, we’re seeing the Greenback retreat because the begin of the European session.

Forex Energy Steadiness

Supply: OANDA Labs

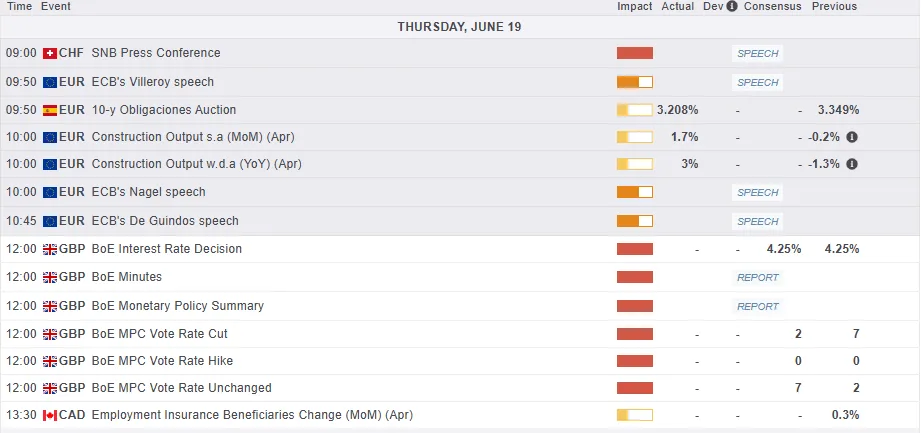

Financial Information Releases and Closing Ideas

Trying on the financial calendar, market individuals shall be watching a bunch of ECB policymakers who’re talking.

Later, the saved the rates of interest on maintain regardless of a big drop in providers inflation yesterday. The current rise in oil costs may additionally be a contributing issue of their choice later in the present day.

Market individuals worry an uptick in international inflation if oil costs stay elevated, and all of this may increasingly come to fruition earlier than we get the total results from tariffs.

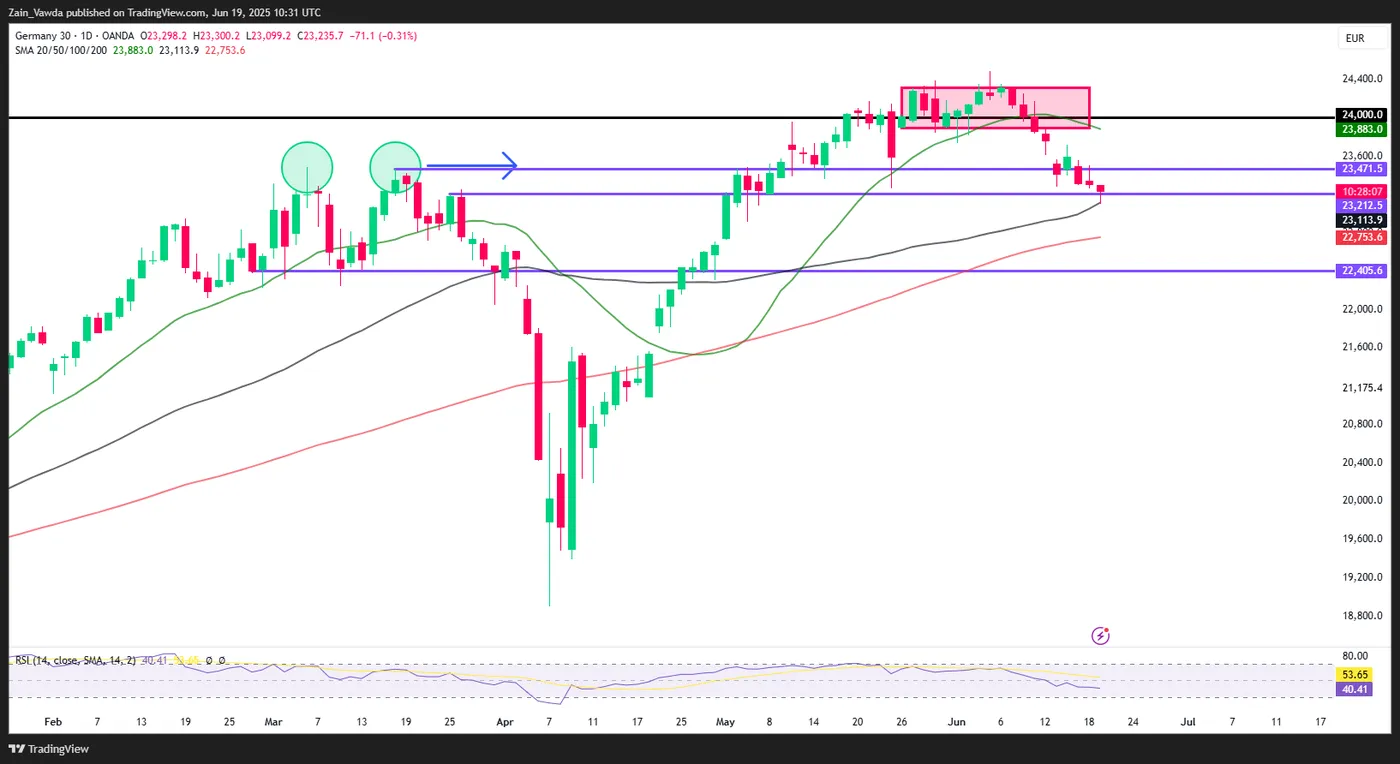

Chart of the Day – DAX Index

Supply: TradingView.com

Key Ranges to Look ahead to DAX Index:

Help

Resistance

Unique Publish