Most Learn: British Pound Outlook & Market Sentiment – GBP/USD, GBP/JPY, EUR/GBP

The U.S. greenback surged on Thursday after a subdued efficiency in current days, boosted by hovering U.S. Treasury yields following higher-than-anticipated February’s PPI numbers, launched on the heels of Tuesday’s sizzling CPI report.

Labor market information, displaying that the variety of People making use of for jobless advantages stayed at traditionally low ranges final week, additional solidified the buck’s beneficial properties by bolstering confidence within the nation’s financial prospects.

Introduced beneath are key financial releases from right this moment’s session.

Supply: DailyFX Financial Calendar

Though the Fed has indicated that it could possible be applicable to take away coverage restriction this 12 months, stagnating progress on disinflation, juxtaposed with the financial system’s resilience, may scale back the scope of incoming fee cuts and maybe delay the beginning of the easing cycle, at present projected for June.

We’ll know extra concerning the FOMC’s financial coverage outlook subsequent week when policymakers collect for his or her March assembly and launch up to date macro projections (SEP), together with the dot-plot – a diagram that maps out Fed officers’ estimates of how borrowing prices are more likely to evolve over numerous years.

With upside inflation dangers beginning to materialize, merchants shouldn’t be shocked if the central financial institution indicators fewer fee reductions for 2024 in comparison with three months in the past. This state of affairs may maintain bond yields biased upwards within the close to time period, reinforcing the buck’s bullish comeback.

Wish to know the place EUR/USD is headed over the approaching months? Discover all of the insights out there in our quarterly forecast. Request your complimentary information right this moment!

Really useful by Diego Colman

Get Your Free EUR Forecast

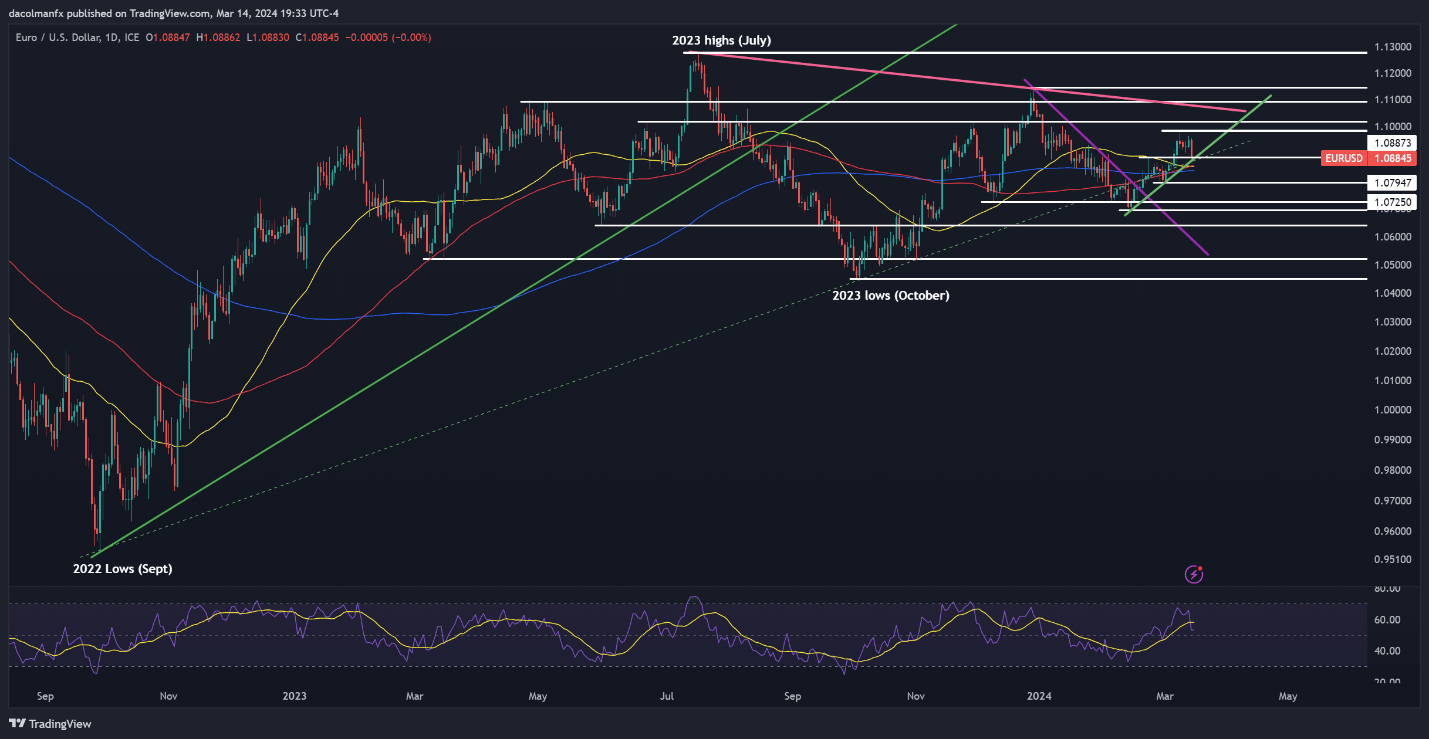

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD fell sharply on Thursday, however managed to carry above confluence help round 1.0875. Bulls should shield this technical ground tooth and nail; failure to take action may end in a pullback in direction of 1.0850, adopted by 1.0790. On additional weak point, all eyes can be on 1.0725.

Alternatively, if consumers set off a bullish reversal and costs rebound off present ranges, resistance is situated at 1.0980 and 1.1020 thereafter. Above these thresholds, the main target can be on 1.1075, a key ceiling created by a medium-term descending trendline.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Utilizing TradingView

Questioning concerning the yen‘s outlook – will it weaken or get well within the close to time period? Uncover all the small print in our quarterly forecast. Do not miss out – request your complimentary information right this moment!

Really useful by Diego Colman

Get Your Free JPY Forecast

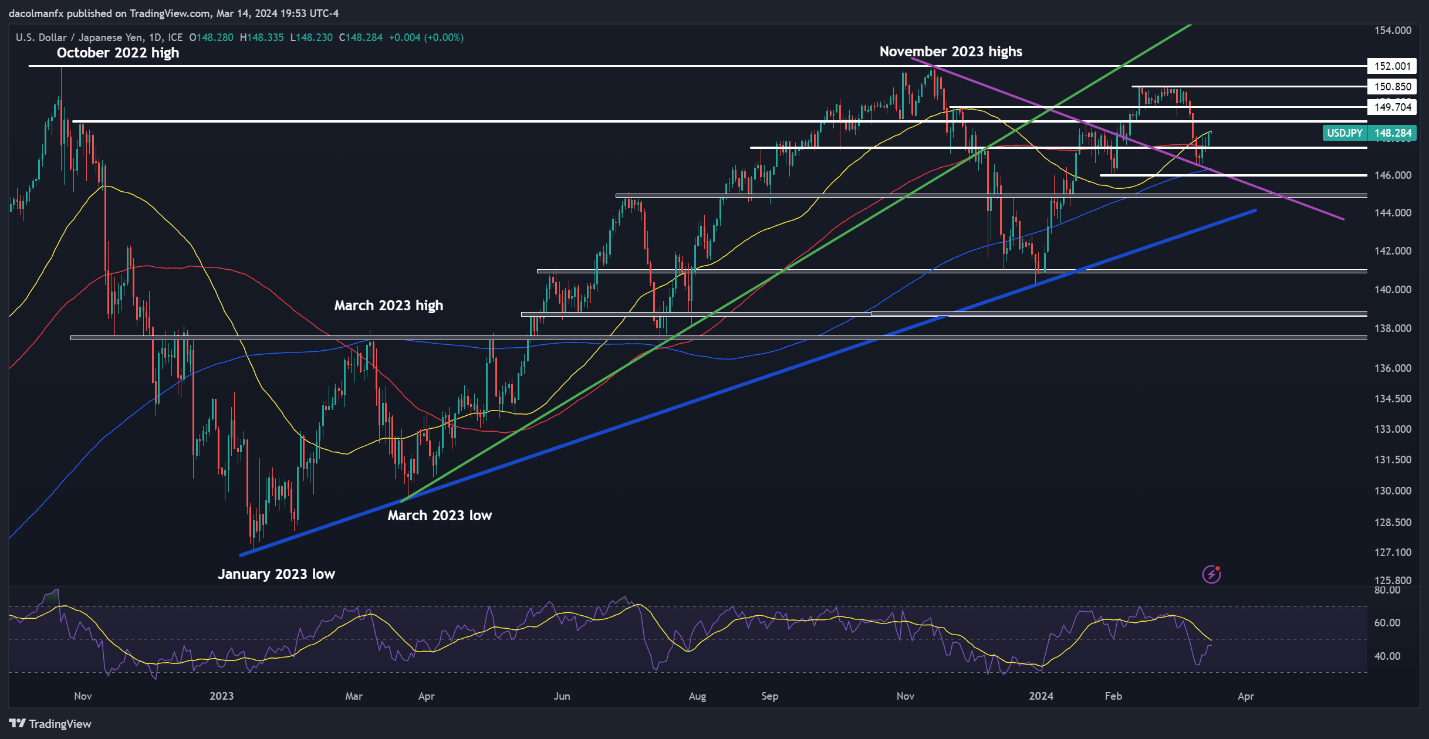

USD/JPY FORECAST – TECHNICAL ANALYSIS

USD/JPY prolonged its rebound on Thursday, coming inside placing distance from reclaiming its 50-day easy shifting common at 148.40. The market response right here can be key, with a breakout presumably fueling an advance in direction of 148.90, adopted by 149.70.

Conversely, if renewed promoting stress emerges and drives the change fee decrease, help looms at 147.50. Under this ground, market focus will shift in direction of the 200-day easy shifting common, situated close to 146.40, and subsequently in direction of February’s swing lows within the neighborhood of 146.00.

USD/JPY PRICE ACTION CHART

USD/JPY Chart Created Utilizing TradingView

Serious about studying how retail positioning can supply clues about GBP/USD’s directional bias? Our sentiment information accommodates invaluable insights into market psychology as a pattern indicator. Obtain it now!

| Change in | Longs | Shorts | OI |

| Each day | 17% | -18% | -3% |

| Weekly | 63% | -31% | -1% |

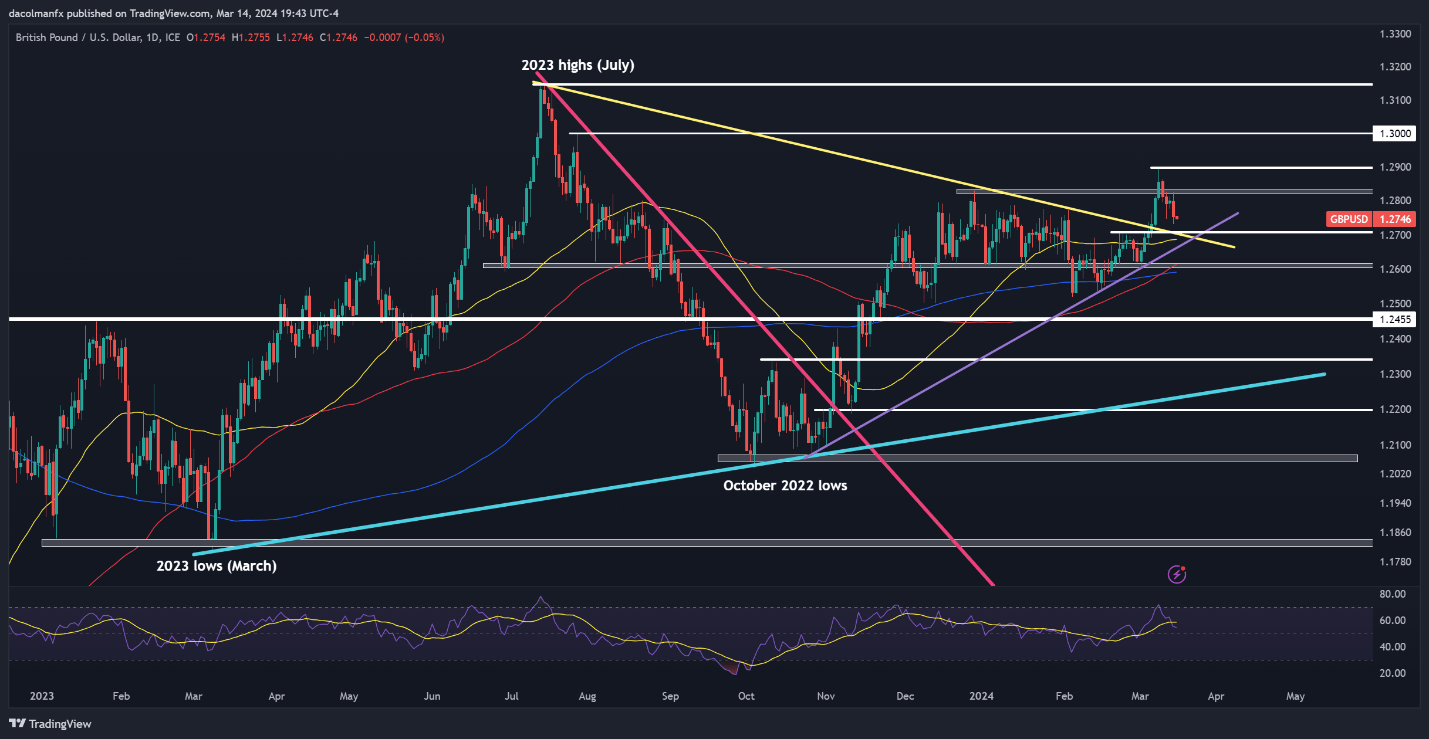

GBP/USD FORECAST – TECHNICAL ANALYSIS

GBP/USD continued to lose floor on Thursday, steadily approaching an essential help zone close to 1.2700. This space ought to present stability in case of additional losses, however a breakdown is more likely to spark a retracement towards trendline help at 1.2665. Transferring decrease, consideration can be on the 1.2600 deal with.

Alternatively, if sentiment improves and cable mounts a turnaround, preliminary resistance seems at 1.2830, adopted by 1.2895. Breaking by means of this barrier would possibly pose a problem for the bullish camp, though a profitable breach may result in a rally towards the psychological 1.3000 mark.

GBP/USD PRICE ACTION CHART

GBP/USD Chart Created Utilizing TradingView