- Trump dampens threat urge for food, cites unilateral tariff plan

- Greenback and equities endure as buyers additionally query US-China progress

- British pound below strain after one other set of sentimental UK knowledge

- Gold and oil give again in a single day beneficial properties

Greenback Slips on Tender CPI and Tariff Discuss

It looks like Groundhog Day, because the is as soon as once more shedding floor throughout the board. has climbed above 1.1500, whereas has shortly erased final week’s rally, confirming the greenback’s incapability to withstand the prevailing market traits. Equally, US fairness indices skilled losses in Wednesday’s session, although they continue to be in optimistic territory on a weekly foundation.

Notably, yesterday’s session started positively for threat belongings. The conclusion of the London spherical of the US-China negotiations created some goodwill, supporting threat urge for food and holding Euro/Greenback rangebound. Nonetheless, the sentiment shifted after the tender report, combined commentary in regards to the US-China talks and Trump’s renewed tariff rhetoric.

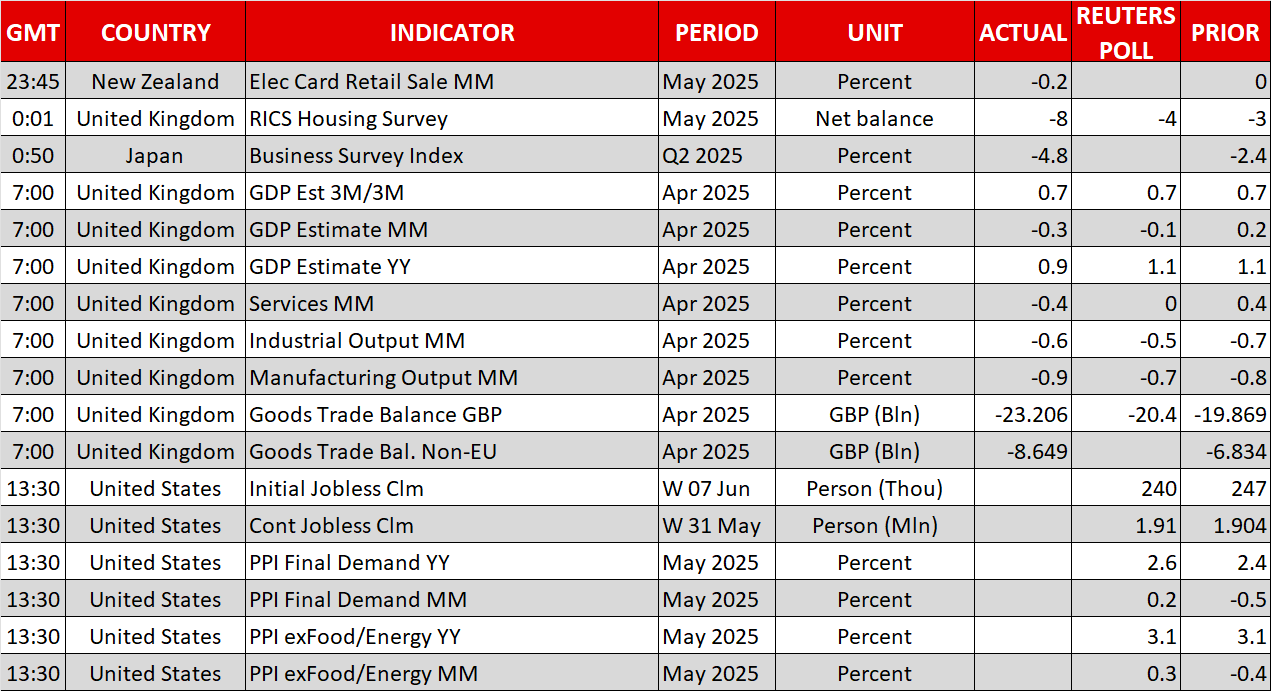

The US CPI report for Might produced a draw back shock, permitting the market to spice up its expectations for 2025 – it’s presently totally pricing in 50bps of easing – and kicking off the greenback’s underperformance. The Might report will probably be launched at present, and one other tender report may help marginal expectations of a barely extra dovish tone at subsequent week’s Fed assembly.

When 30% Tariffs Are Really 55% Efficient Tariffs

The decisive blow to threat belongings, although, got here from US President Trump and his prime Secretaries. Regardless of celebrating the progress made within the US-China talks, Trump introduced that the US will keep an ‘efficient’ 55% tariff on Chinese language imports, whereas US exports to China will probably be topic to only a 10% tariff. Curiously, China has already accepted uncommon earth exports to the US however imposed a six-month restrict, primarily stopping in need of giving the US a carte blanche. On the floor, there was progress within the negotiations, however in actuality, each markets and corporates want a complete and definitive settlement, not half-measures.

To make issues worse, Trump acknowledged he’ll set unilateral tariff charges inside two weeks, including strain on non-compliant international locations. Negotiations with Japan, South Korea and India are progressing — with the July 8 deadline doubtlessly being pushed again to permit time for agreements — making the EU the almost certainly candidate for additional commerce restrictions. Canada might be finest positioned to keep away from a brand new spherical of tariffs, as there are sturdy indications {that a} commerce deal is imminent.

Pound Is Below Strain

The UK, which secured an early commerce cope with the US, is watching its foreign money endure as soon as once more towards the euro. Following Tuesday’s weak labour market report, at present’s month-to-month report and industrial manufacturing knowledge have been disappointing, additional including strain on the Labour authorities to amend its fiscal plan of great tax will increase and stronger borrowing. Coupled with the market’s frustration in regards to the ONS’ constant failure to ship correct knowledge, a dovish BoE assembly subsequent week seems more and more doubtless.

Gold and Oil Retreat After a Sturdy Rally

In the meantime, the general market sentiment has boosted each and in a single day, with the previous climbing to $3,370 and oil rising to the very best stage since early April, when Trump introduced his notorious reciprocal tariffs. The principle perpetrator for these strikes has been reviews that Israel is making ready to strike Iran’s nuclear services. Placing apart the truth that such an motion would fully negate any likelihood of an settlement between the US and Iran, it may additionally immediate Iran to reply, doubtlessly beginning a brand new wave of violence.

Nonetheless, regardless of the escalation seen within the Ukraine-Russia battle, the place either side seem unwilling to barter a ceasefire or a everlasting pause, each commodities are giving again their beneficial properties at present. Nonetheless, gold and oil are more likely to stay supported, whatever the greenback’s efficiency.