US Greenback (DXY), USD/JPY, and Gold Newest

- US greenback weakens additional forward of key Fed chair speech

- USD/JPY appears to be like technically weak

- Gold consolidating Friday’s report excessive.

This 12 months’s Jackson Gap Symposium – “Reassessing the Effectiveness and Transmission of Financial Coverage” – shall be held on August 22-24 with Fed chair Jerome Powell’s keynote speech on Friday as the principle attraction. Merchants count on chair Powell to sign that the Federal Reserve will begin reducing rates of interest in September with monetary markets at the moment pricing in practically 100 foundation factors of fee cuts by the top of this 12 months. With solely three FOMC conferences left this 12 months, and with the Fed usually shifting in 25 foundation level clips, one 50 foundation level fee reduce is trying probably if market predictions show to be right.

Advisable by Nick Cawley

Get Your Free USD Forecast

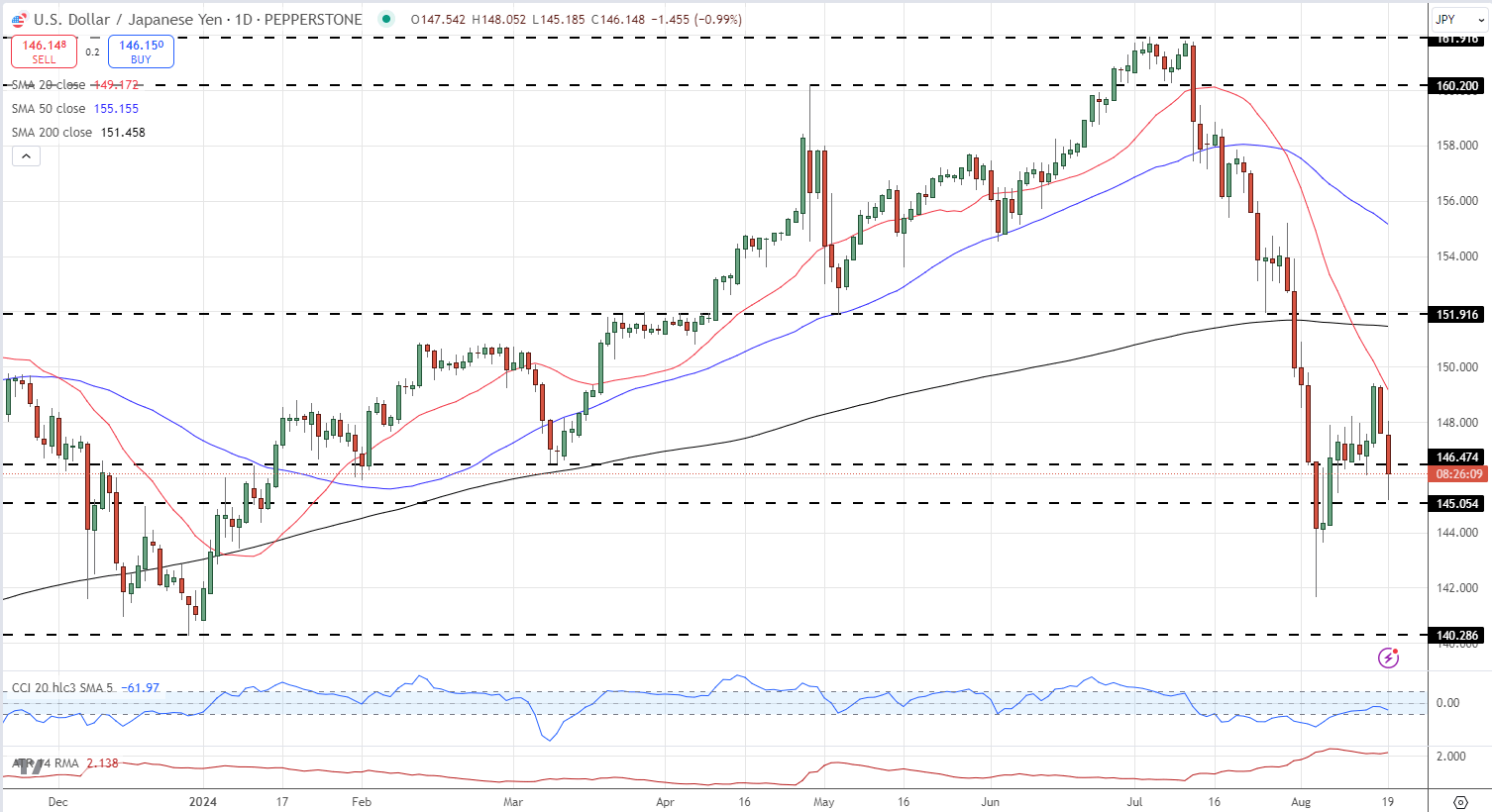

USD/JPY has been on a rollercoaster experience during the last month, shedding 20 massive figures in three weeks after the BoJ hiked charges for the second time this 12 months. The pair then rallied by practically 10 massive figures on a bout of US greenback energy earlier than dropping final Friday, and at present, on a weaker US greenback. The subsequent space of USD/JPY resistance is seen between 151.45 (200-day sma) and a previous degree of horizontal resistance turned assist at slightly below 152.00. A renewed sell-off will probably deliver 140.28 into focus.

USD/JPY Each day Worth Chart

Chart through TradingView

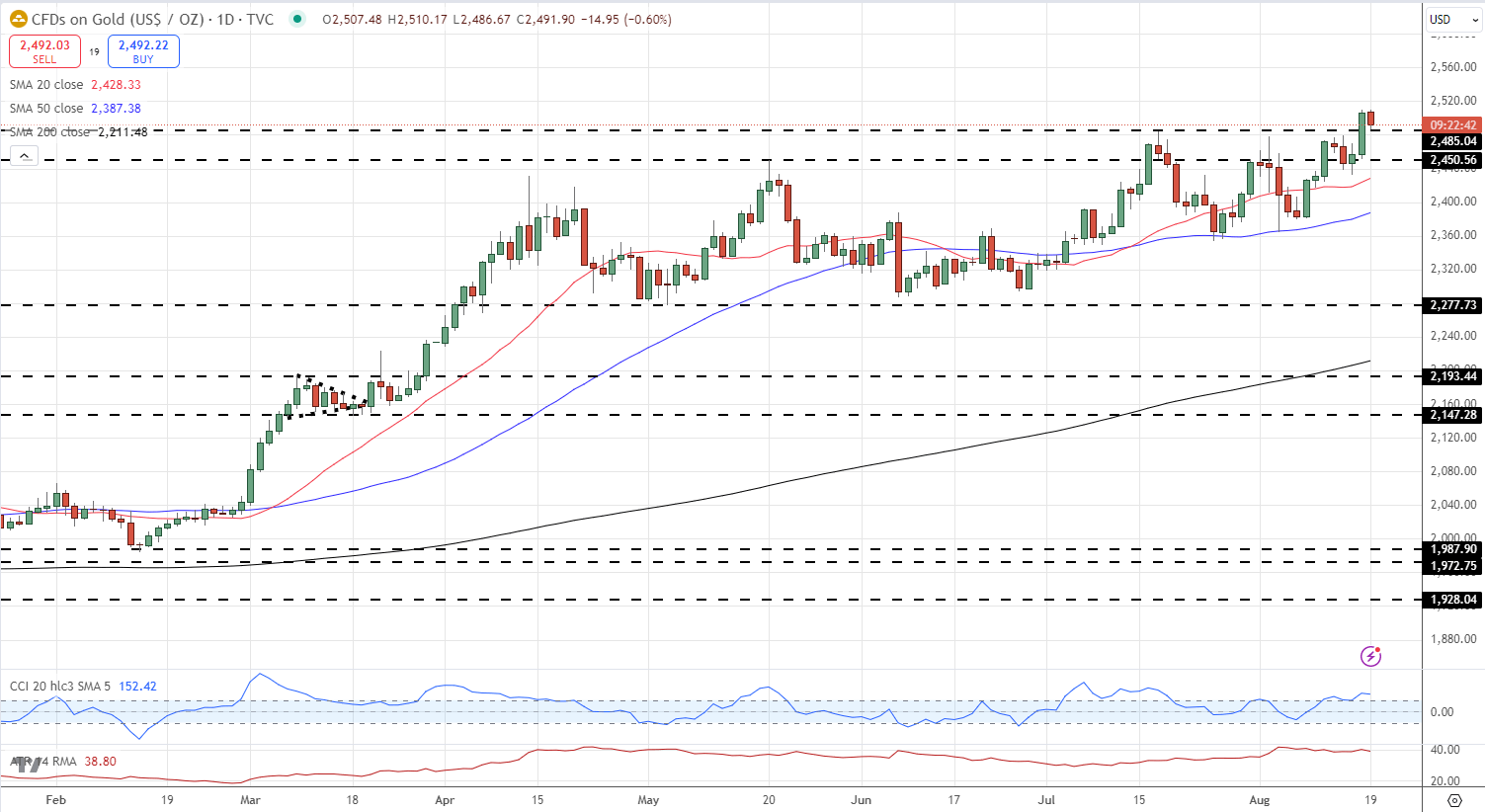

Gold lastly broke via a cussed space of resistance and posted a contemporary all-time excessive on Friday. Expectations of decrease rates of interest and fears that the scenario within the Center East may escalate at any time have given a robust, underlying bid. Assist is seen at $2,485/oz. forward of $2,450/oz. whereas gold continues its value discovery on the upside.

Gold Each day Worth Chart

Chart through TradingView

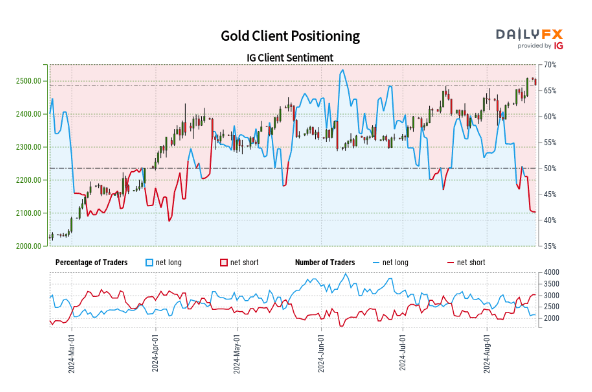

Retail dealer information reveals 43.65% of merchants are net-long with the ratio of merchants brief to lengthy at 1.29 to 1.The variety of merchants net-long is 11.99% increased than yesterday and 13.24% decrease than final week, whereas the variety of merchants net-short is 5.76% increased than yesterday and 30.77% increased than final week.

We sometimes take a contrarian view to crowd sentiment, and the very fact merchants are net-short suggests gold costs could proceed to rise. Positioning is much less net-short than yesterday however extra net-short from final week. The mixture of present sentiment and up to date adjustments provides us an extra blended gold buying and selling bias.

| Change in | Longs | Shorts | OI |

| Each day | 16% | -1% | 6% |

| Weekly | -4% | 17% | 6% |