Most Learn: Fed Sticks to Dovish Coverage Roadmap; Setups on Gold, EUR/USD, Nasdaq 100

Too typically, merchants get caught up within the herd mentality, shopping for when costs are rising quickly and promoting in a panic when the market takes a flip to the draw back. Contrarian indicators, like IG consumer sentiment, supply a unique perspective. By gauging whether or not positioning and the general temper are excessively bullish or bearish, these instruments can trace at potential reversals and turning factors. The bottom line is to search for alternatives to zig when everybody else is zagging.

In fact, contrarian indicators are strongest when used as a part of a well-rounded buying and selling strategy. Relying solely on sentiment information is unwise. As a substitute, mix these indicators with elementary and technical evaluation to achieve a complete market understanding. This manner, you may simply spot engaging setups/alternatives others overlook. Now, let’s use IG consumer sentiment information to research three key U.S. greenback pairs: USD/JPY, USD/CAD and USD/CHF.

Questioning concerning the U.S. greenback’s prospects? Achieve readability with our newest forecast. Obtain a free copy now!

Advisable by Diego Colman

Get Your Free USD Forecast

USD/JPY FORECAST – MARKET SENTIMENT

IG consumer information paints an image of maximum pessimism in the direction of the USD/JPY. A staggering 86.79% of merchants are betting towards the U.S. greenback, with a short-to-long ratio of 6.57 to 1. The one-sided positioning has widened not too long ago, with web shorts rising 7.55% since yesterday and a considerable 47.12% increased than final week.

Our typical technique entails taking a contrarian view of crowd sentiment. On this case, the acute bearish bets on USD/JPY implies a possible for extra positive factors, even after the newest upswing. Contrarian approaches hinge on the concept that the bulk may be improper, particularly during times of sturdy market emotion.

Excited by understanding how FX retail positioning might affect USD/CAD worth actions? Uncover key insights in our sentiment information. Obtain it now!

| Change in | Longs | Shorts | OI |

| Day by day | -22% | 29% | -2% |

| Weekly | -3% | -20% | -12% |

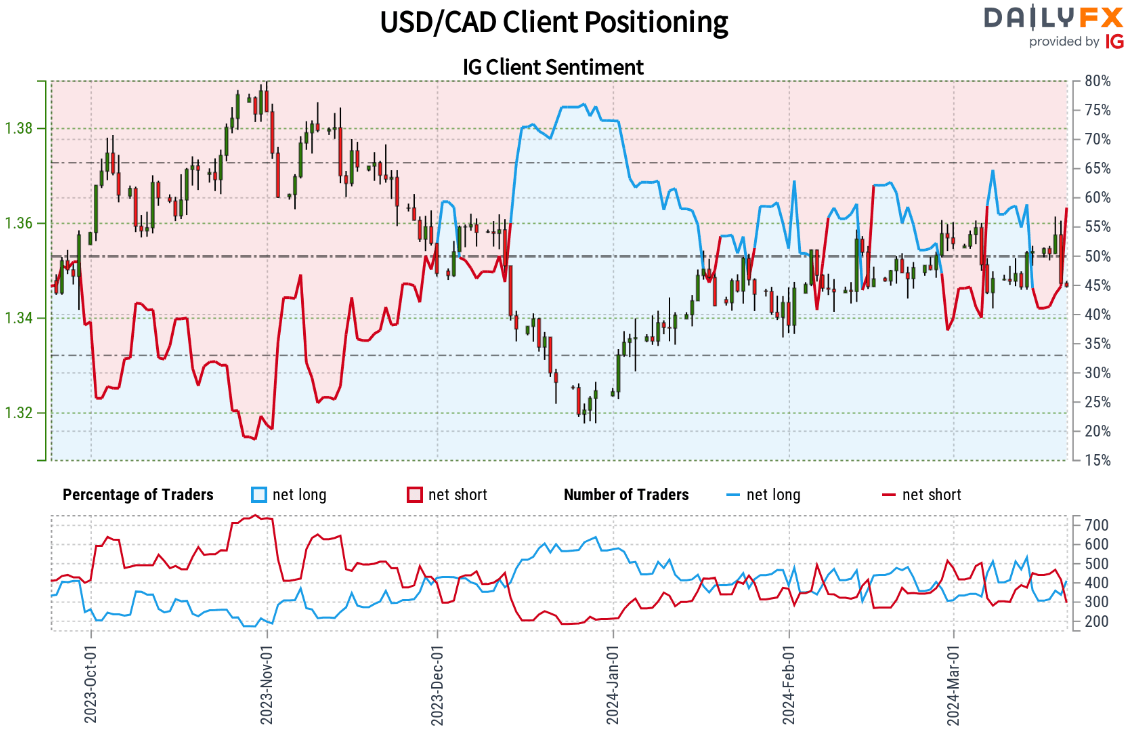

USD/CAD FORECAST – MARKET SENTIMENT

IG consumer information reveals sturdy optimism surrounding the USD/CAD. Nearly 61% of merchants maintain bullish positions on the pair, making a long-to-short ratio of 1.56 to 1. Optimistic sentiment in the direction of the U.S. greenback has intensified not too long ago, with net-longs up 35.17% from yesterday, although reasonably decrease than final week’s prevailing ranges.

Our contrarian strategy raises a crimson flag concerning the pair’s bias. When a major majority leans a method, it could possibly create imbalances and unsustainable situations, making a reversal extra seemingly. This might imply hassle forward for USD/CAD. In fact, sentiment is only one device amongst many. Savvy merchants at all times combine sentiment information with tech and elementary evaluation to craft well-informed choices.

Disheartened by buying and selling losses? Empower your self and refine your technique with our information, “Traits of Profitable Merchants.” Achieve entry to essential suggestions that will help you keep away from frequent pitfalls and dear errors.

Advisable by Diego Colman

Traits of Profitable Merchants

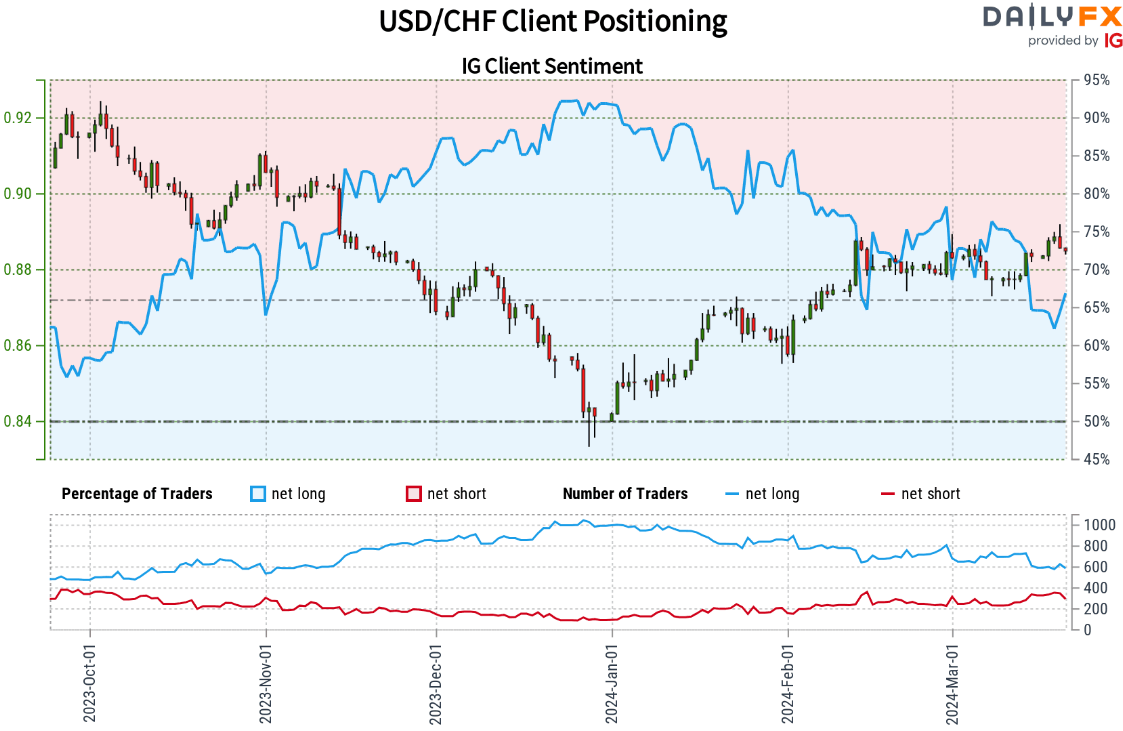

USD/CHF FORECAST – MARKET SENTIMENT

IG sentiment information reveals a robust bullish bias in the direction of the USD/CHF. As of Thursday morning, a large 70.44% of retail purchasers maintain lengthy positions, leading to a long-to-short ratio of two.38 to 1. Nevertheless, this bullish tilt has decreased barely, with net-long positions down 3.75% from yesterday and 18.14% from final week.

Our contrarian technique suggests warning relating to this heavy bullish sentiment. A major majority leaning a method can sign a possible pullback within the USD/CHF. In fact, market sentiment is only one issue to contemplate. Astute merchants perceive {that a} complete strategy, together with technical and elementary evaluation, is essential for knowledgeable decision-making.