US DOLLAR FORECAST

- The U.S. greenback, as measured by the DXY index, sinks to its lowest stage in 5 months, with skinny liquidity situations doubtless amplifying the selloff

- Rising expectations that the Fed will considerably ease its stance in 2024 have been the principle driver of the dollar’s retreat in latest weeks

- This text affords an evaluation of the U.S. greenback’s technical and basic outlook, analyzing important value thresholds that would act as assist or resistance within the coming buying and selling classes

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to E-newsletter

Most Learn: US Greenback in Dangerous Waters, Technical Setups on EUR/USD, GBP/USD, Gold

The U.S. greenback, as measured by the DXY index, plunged to its weakest level in 5 months on Wednesday (DXY: -0.55% to 100.98), pressured by a considerable drop in Treasury charges, with the 2-year yield sinking beneath 4.26%, its lowest stage since late Could.

Whereas market strikes had been doubtless amplified by skinny liquidity situations, attribute of this time of yr, wagers that the Federal Reserve will reduce charges materially in 2024 have been the first bearish driver for the dollar in latest weeks.

The Fed’s pivot at its December FOMC assembly has bolstered ongoing market traits. For context, the central financial institution embraced a dovish stance at its final gathering, indicating that talks about decreasing borrowing prices have begun, probably as a part of a technique to prioritize progress over inflation.

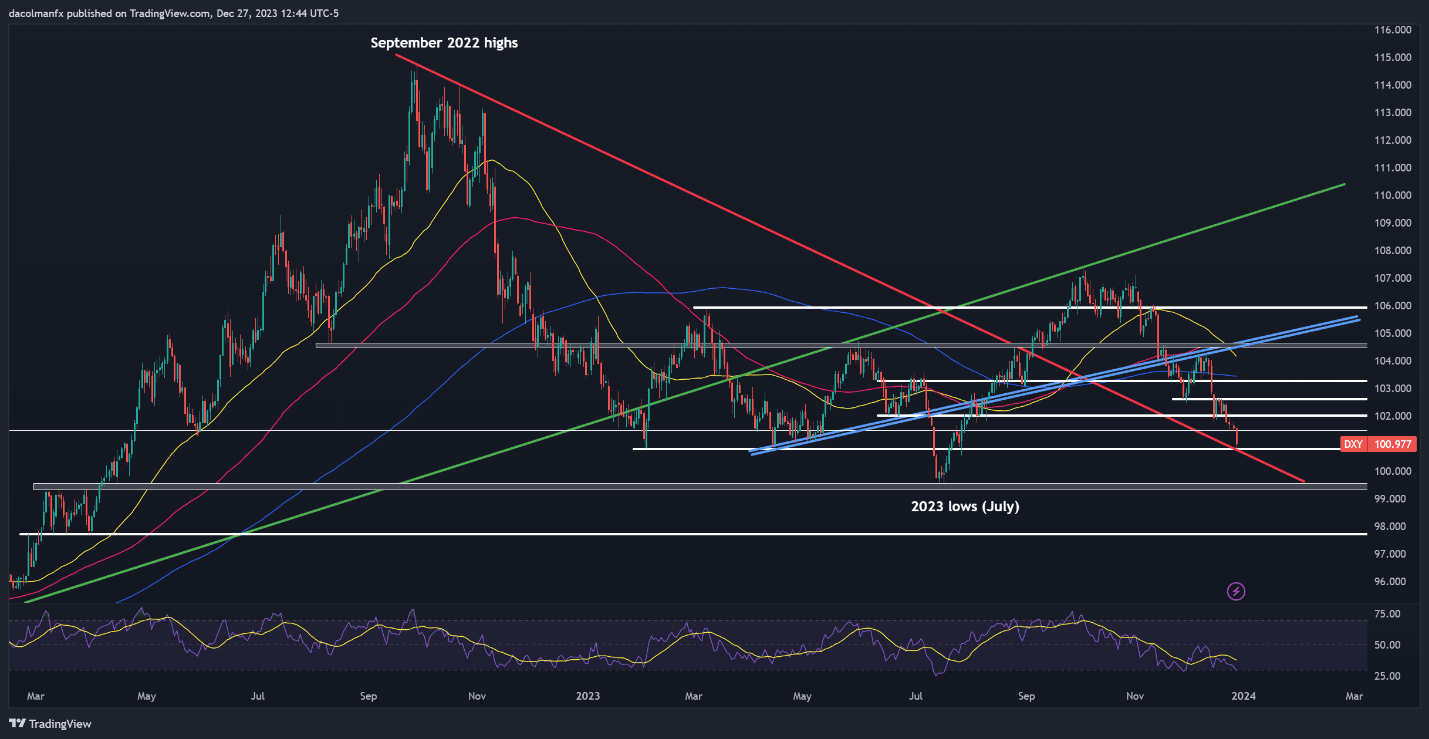

The chart beneath exhibits how the DXY index has been falling for some time, simply as easing expectations for the upcoming yr have trended increased in a significant method.

For a complete evaluation of the U.S. greenback’s prospects, get a replica of our free quarterly outlook now!

Really useful by Diego Colman

Get Your Free USD Forecast

Supply: TradingView

From a technical standpoint, the U.S. greenback broke beneath 101.50 and sank towards assist at 100.75 on Wednesday. Bulls should defend this space in any respect prices to curb downward stress; failure to take action may lead to a pullback towards the 2023 lows close to 99.60. On additional weak point, the main target shifts to 94.75.

Conversely, if consumers return in power and spark a bullish bounce off present ranges, overhead resistance looms at 101.50, adopted by 102.00. Contemplating the prevailing sentiment, breaching this hurdle might be a formidable activity for the bulls. Nevertheless, if surpassed, consideration will flip to 102.60 and 103.30 thereafter.

If you’re discouraged by buying and selling losses, why not take a proactively constructive step in the direction of enchancment? Obtain our information, “Traits of Profitable Merchants,” and entry invaluable insights to help you in avoiding widespread buying and selling errors.

Really useful by Diego Colman

Traits of Profitable Merchants

US DOLLAR INDEX (DXY) CHART

US Greenback Index (DXY) Chart Ready Utilizing TradingView