US Greenback and Gold Evaluation and Charts

- US greenback index hits a five-month excessive.

- Gold eyes $2,400/oz. and better.

Now you can obtain our model new Q2 US Greenback Technical and Basic Forecasts at no cost:

Really helpful by Nick Cawley

Get Your Free USD Forecast

For all main central financial institution assembly dates, see the DailyFX Central Financial institution Calendar

US greenback energy is seen throughout a variety of FX pairs in early European commerce because the US greenback index breaks by means of outdated resistance ranges with ease. This transfer is being helped by renewed Euro weak spot after yesterday’s ECB assembly ramped up expectations for a June rate of interest reduce. With the US seemingly pushing a charge in the reduction of in direction of later this yr, the yield differential between the 2 currencies will slender, forcing EUR/USD decrease.

For all financial knowledge releases and occasions see the DailyFX Financial Calendar

The US greenback index is a measure of the worth of the US greenback relative to a basket of foreign currency. The index is designed to supply a reference level for the energy or weak spot of the US greenback. It’s calculated by evaluating the greenback’s worth to 6 main world currencies: the euro (57.6%), Japanese yen (13.6%), British pound (11.9%), Canadian greenback (9.1%), Swedish krona (4.2%), and Swiss franc (3.6%). The index has a base worth of 100, with values above 100 indicating a stronger greenback and values beneath 100 signalling a weaker greenback in comparison with the basket of currencies.

US Greenback Index Every day Chart

Really helpful by Nick Cawley

The best way to Commerce Gold

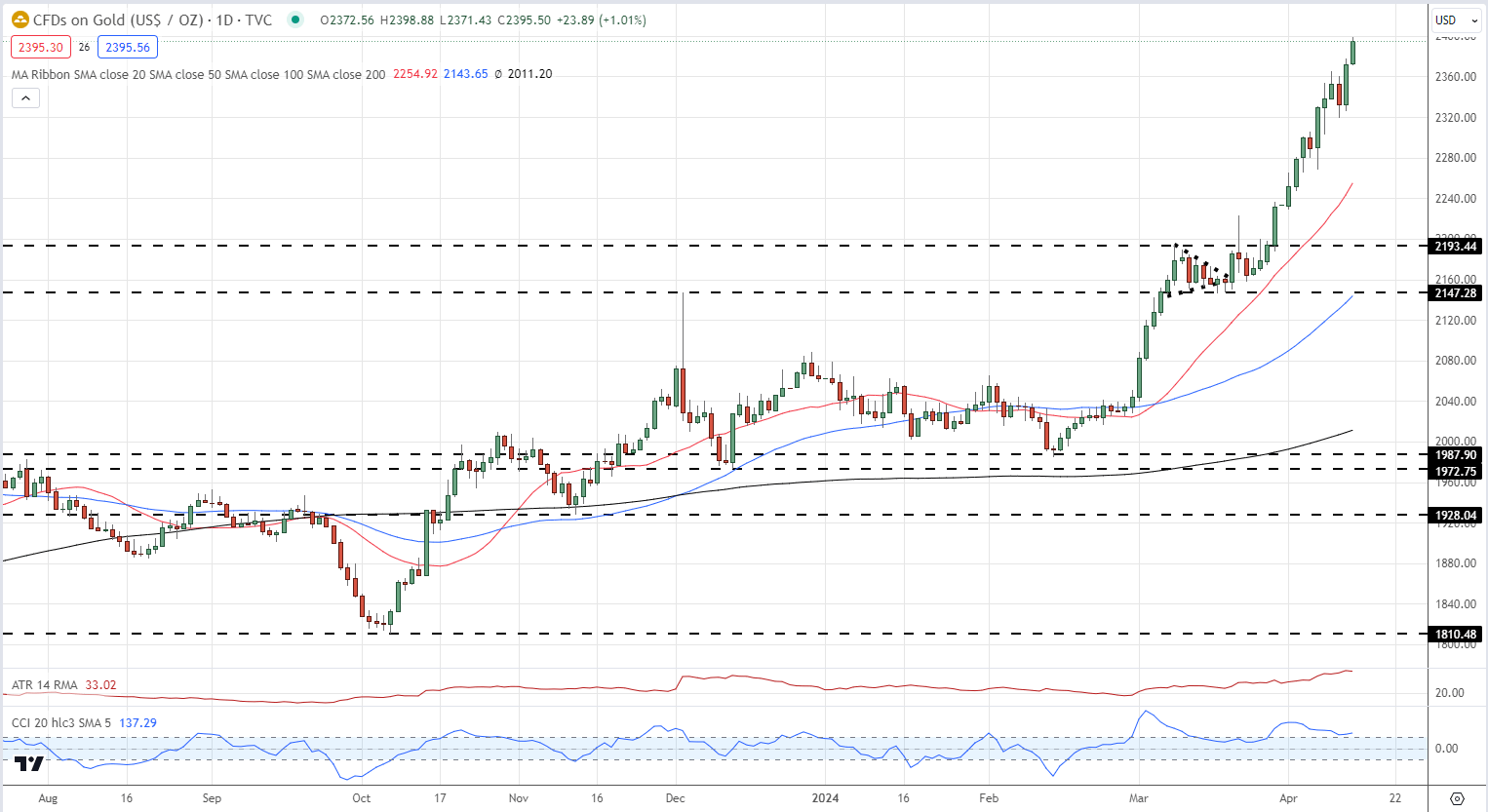

Gold carries on transferring larger regardless of the US greenback’s ongoing rally. Gold usually weakens in instances of US greenback energy, however this correlation has damaged over the previous weeks as a robust security bid, pushed by growing tensions within the Center East, has pushed gold into record-high territory. Gold is testing $2,400/oz. and a confirmed break larger would see $2,500/oz. as the subsequent degree of resistance.

Gold Every day Worth Chart

All Charts by way of TradingView

Retail Sentiment knowledge exhibits 46.76% of merchants are net-long with the ratio of merchants quick to lengthy at 1.14 to 1.The variety of merchants net-long is 2.56% larger than yesterday and a couple of.60% larger than final week, whereas the variety of merchants net-short is 5.47% larger than yesterday and 0.55% larger than final week.

We sometimes take a contrarian view to crowd sentiment, and the very fact merchants are net-short suggests Gold costs might proceed to rise.

| Change in | Longs | Shorts | OI |

| Every day | -10% | -13% | -11% |

| Weekly | 11% | -17% | -6% |

What are your views on the US Greenback and Gold – bullish or bearish?? You’ll be able to tell us by way of the shape on the finish of this piece or contact the creator by way of Twitter @nickcawley1.